The United Arab Emirates (UAE) is a very attractive prospect for expats. From the lack of income tax to its glamorous lifestyle, there are many benefits to living here. However, one aspect of life that doesn’t always get mentioned is retirement plans in the UAE for expats.

People tend to think of it as a country in which you enjoy life now, not later. Easy accessibility to retirement funds compared to in the UK makes it hard to resist temptation. And stories of pension mis-selling scandals also put expats off UAE retirement plans.

In this article, we’ll explore key points including:

- While the UAE is appealing for its lifestyle and tax benefits, the pension scheme for expats often gets overlooked, highlighting the need for effective retirement planning.

- Reforms and schemes like the Golden Pension aim to enhance retirement savings for expats, supplementing traditional end-of-service benefits.

- Expats can use international pension transfers and voluntary schemes for better flexibility and investment opportunities.

UAE Pension Scheme for Expats: What You Need to Know

In recent years, the UAE has undertaken economic, social and legal reforms in order to:

- Strengthen the country’s business environment and reputation

- Increase foreign direct investment

- Attract a skilled workforce

- Give incentives to companies that could then set up, or expand, in the UAE.

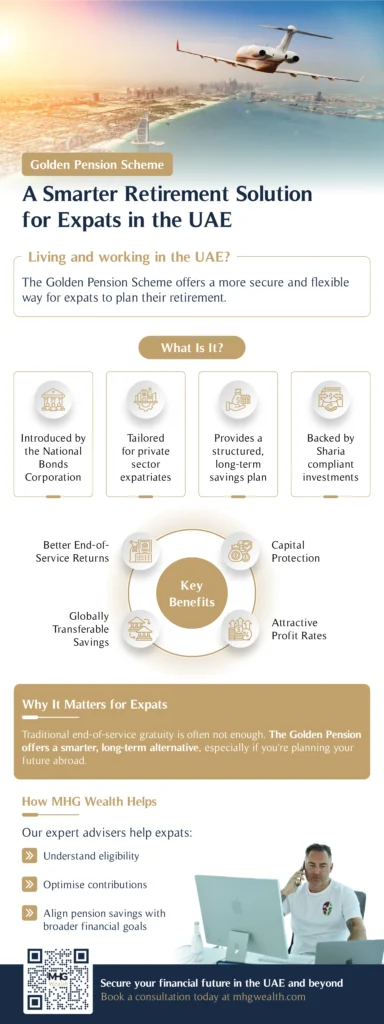

The Golden Pension Scheme (also known as the golden scheme) is the latest addition to the UAE retirement plan landscape. Before we explore this, we’ll run through the existing options expats have for retirement savings in the UAE.

End-of-service gratuity benefits

These benefits are mandated by the government for employees. End-of-service gratuity is given if you’re an employee in the UAE and leave the company, provided you’ve worked there for at least a year.

However, you’ll likely need more than this to comfortably retire on. To help, the government unveiled a new addition, called the Voluntary Alternative End-of-Service Benefits Scheme.

This latest initiative is optional and allows registered employees to invest their end-of-service gratuity benefits into investment funds that have been approved by the Ministry of Human Resources and Emiratisation (MOHRE) and the Securities and Commodities Authority (SCA).

National Bonds

National Bonds Corporation PJSC (NBC) is a savings and investment company owned by the Investment Corporation of Dubai (ICD). NBC offers Sharia-compliant investments and savings, to individuals as well as corporations and encourages UAE residents to save through a variety of options including:

- Savings schemes

- Investment plans

- Retirement schemes

International Pension Transfer Options for Expats in the UAE

For many UK, EU and global professionals living in the Emirates, managing pensions from overseas can be just as important as building new savings locally. Expats in the UAE can explore international pension transfer options such as QROPS (Qualifying Recognised Overseas Pension Schemes), SIPPs (Self-Invested Personal Pensions) and other retirement structures.

These can provide better portability, access to a wider range of investments and in some cases, favourable tax treatment depending on your home country’s rules.

Understanding the implications for both your pension in the UAE for expats and your overseas pension is key to creating a flexible, long-term retirement plan in the UAE for expats.

Voluntary Pension Scheme Options in the UAE

Beyond traditional UAE pension schemes and employer gratuity, expats can access voluntary savings solutions designed to boost retirement security.

These include the MoHRE Voluntary Savings Plan, the Golden Pension Scheme UAE offered by National Bonds, and the DEWS (DIFC Employee Workplace Savings) plan for those working in Dubai’s financial district.

Contribution rates, investment options and withdrawal rules vary, but these schemes can be a strong addition to your Dubai retirement plan or private pension strategy, especially for professionals seeking the best pension scheme for expats with higher flexibility than standard employer benefits.

The Golden Pension Scheme in UAE

What is the UAE’s Golden Pension Scheme?

The Golden Pension Scheme was introduced in 2022 and is offered by the UAE government through the NBC to provide an additional UAE pension scheme for expats.

This pension is intended to help employees bridge the gap in their retirement savings, plus support employers in funding their end-of-service financial commitments.

How does the Golden Pension Scheme work?

- Employers – can register by either investing their employees’ accumulated end of service benefits as a lump sum, or, invest a portion.

- Employees – expats can contribute to the gold scheme, monthly.

Who is eligible for the UAE’s Golden Pension Scheme?

All expats employed in the UAE private sector have the chance to future-proof their retirement finances.

What are the benefits of the UAE Golden Pension Scheme

For employers

- Improved employee retention: Offering a structured retirement plan in the UAE for expats makes your company more attractive to skilled workers and reduces turnover.

- Predictable gratuity liability: Employers can plan for end-of-service benefits without sudden cash flow shocks, as contributions are made gradually into a dedicated pension fund in the UAE.

- Reduced operational strain: No need to dip into operational capital for gratuity payouts. Funds are already allocated and grow over time.

- Enhanced employer brand: Being seen as a company that invests in staff’s long-term security boosts reputation and competitiveness in recruitment.

- Compliance and structure: Provides a clear, compliant framework for end-of-service benefits, aligning with evolving UAE employment and pension regulations.

For employees

- Financial security at retirement: Contributions accumulate into a growing pension fund, helping secure a stable income after leaving employment or retiring in the UAE.

- Affordable monthly contributions: Plans are designed to be accessible, even for employees at early or mid-career stages.

- Competitive profit rates: Funds are invested in professionally managed portfolios, often delivering better returns than traditional savings accounts.

- Transparency in profit calculation: Employees can track how their pension in the UAE is performing and see exactly how profits are calculated.

- Portability for expats: Funds can often be transferred or withdrawn when leaving the UAE, making it flexible for the mobile expat lifestyle.

- Tax advantages: In most cases, benefits are paid out tax-free in the UAE, with no local deductions on contributions or withdrawals (home country rules may still apply).

- Peace of mind: Knowing that both the employer and employee are contributing to a structured pension scheme creates long-term financial confidence.

UAE Golden Pension Scheme for expats compared to traditional UK pension schemes

Although promoted as a UAE pension for expats, this scheme actually works more like a long-term savings plan. It helps employees accrue wealth towards their end-of-service gratuity, rather than the traditional defined benefit schemes or defined contributions of UK pension plans.

Is a retirement visa needed to gain a golden pension in the UAE?

No, a retirement visa isn’t needed to gain a golden pension in the UAE. Although both are designed to improve financial security for expats, the visa is a separate initiative, offered to people who are at least 55-years-old and able to fulfil specific financial criteria.

Retirement planning for expats in the UAE

Having a retirement plan in the UAE is of vital importance. To live in such a beautiful, glamorous country and enjoy the lifestyle on offer in your golden years, you need to ensure you have enough resources in advance. By planning for retirement, you can:

- Maintain your financial independence

- Reduce stress and uncertainty

- Know that cover expenses such as healthcare costs

- Leave a legacy for your family

Alternatives to Traditional Pensions

For expats in the UAE, planning for retirement requires exploring options beyond traditional pensions, as such schemes aren’t generally available to non-citizens. Fortunately, there are several alternatives to help you secure your financial future while living abroad. Let’s delve into these options, highlighting their benefits and practical applications.

Stocks, Bonds, and Mutual Funds

Investing in stocks, bonds and mutual funds is a great way to grow your wealth for retirement. They offer flexibility, accessibility and diversification, catering to different risk tolerances and financial goals.

- Stocks: Ideal for long-term growth, stocks allow you to invest in companies worldwide. While they carry higher risks, they also offer the potential for significant returns, making them a key component of a well-balanced portfolio.

- Bonds: Bonds provide stability and consistent income. Options such as government bonds or corporate bonds can be tailored to suit conservative investors seeking lower-risk returns.

- Mutual funds: Managed by professionals, mutual funds pool resources from multiple investors to create a diversified portfolio. This option is especially appealing for expats who prefer a hands-off approach but still want exposure to global markets.

These investment options are a solid foundation to any retirement strategy and will build wealth steadily while managing risks.

Read our guide on alternative investments vs traditional investments to learn about how the two compare and which is the best option for you.

Consistent Savings Strategies

Saving consistently is another essential strategy for expats planning their retirement. While it may seem straightforward, the key to success lies in leveraging the right tools and maintaining disciplined contributions.

- Monthly Savings Accounts: These accounts encourage regular deposits, allowing you to build a significant nest egg over time. Many UAE banks offer competitive interest rates and tailored plans for expats.

- Sharia-Compliant Savings: For those seeking investments aligned with Islamic principles, Sharia-compliant accounts offer ethical, secure savings options. These accounts avoid interest and invest in approved activities.

- End-of-Service Benefits: Instead of immediately spending your end-of-service gratuity, consider reinvesting it in long-term savings or low-risk plans to grow your retirement fund effectively.

By adopting consistent savings strategies, expats can harness the power of compounding interest to grow their funds steadily.

For insights into effective savings methods, check out our article: Saving vs. Investing.

Looking Beyond the UAE? Discover how a second passport through investment can enhance your retirement and tax planning.

Tax Implications of UAE Pension Schemes for Expats

The UAE’s tax-free environment is one of the biggest attractions for expats planning retirement in the region. However, while pension funds in the UAE are not taxed locally, your home country may still apply taxes to withdrawals or ongoing growth, depending on your tax residency status.

The UK-UAE Double Taxation Agreement and similar treaties for other countries can prevent being taxed twice, but it’s essential to seek advice on your personal circumstances.

Whether you hold a Golden Pension, a Dubai pension fund or an international pension scheme in the UAE, understanding the tax rules will help optimise your retirement plan for expats in the UAE and avoid unpleasant surprises.

Step-by-Step: How to Set Up Your Pension in the UAE

Setting up a pension plan in the UAE is easier if you follow a clear process.

- Assess your current retirement savings. Include overseas pensions, gratuity and investments.

- Research available options, from Golden Pension schemes to pension schemes for expats in the UAE like DEWS or international transfers.

- Compare contribution requirements and flexibility for each plan.

- Check tax implications based on your residency and home country rules.

- Choose your provider and complete documentation.

- Set up contributions and automate where possible to stay consistent.

- Review annually to adjust for career changes, salary increases or changing goals.

Following these steps will give you a strong foundation for your retirement in the UAE, ensuring you build a pension fund that works across borders.

UAE Pension Options for Expats: Comparison Table

Below is a side-by-side look at the main pension schemes in the UAE available to expats, including Golden Pension, end-of-service gratuity, DEWS and international pension transfer schemes.

| Pension scheme | Eligibility | Contribution rates | Flexibility | Portability | Tax considerations | Best for |

| Golden Pension Scheme UAE | Expats & residents via National Bonds | Flexible, self-funded | High | Medium | No UAE tax; check home-country rules | Long-term personal savings |

| End-of-Service Gratuity | All employees meeting tenure requirements | Employer-funded | Low | None (cash lump sum) | No UAE tax | Short-term work stints |

| DEWS Plan (DIFC) | DIFC employees | Employer + employee contributions | Medium | Medium | No UAE tax | Structured workplace savings |

| QROPS / SIPPs (International) | Expats with overseas pensions | Varies by jurisdiction | High | High | Depends on home country | Global mobility and higher investment choice |

Key Takeaways

- The Golden Pension Scheme helps both employers and employees through improved retention, predictable liabilities and financial security post-retirement.

- Options such as stocks, bonds, mutual funds and consistent savings strategies provide additional paths to boost retirement funds.

- The UAE’s tax-free environment is advantageous, but understanding home country tax implications is crucial for optimising retirement plans.

- Establishing a pension plan involves evaluating current savings, exploring available options and understanding tax and contribution implications.

MHG Wealth’s retirement planning service

Planning can be time-consuming and confusing. MHG Wealth are here to help with your retirement plans in UAE.

We’ll assign you an expert expat wealth management advisor, who will assess your financial situation and estimate what you need in the future. From there, we’ll implement a thorough plan to ensure you get to enjoy the lifestyle you deserve when you retire.

If you’re looking for a UAE pension scheme for expats, MHG Wealth are the experts in retirement planning. Call today to set the ball rolling on your financial future.

UAE Pension Schemes for Expats FAQS:

Do expats get a pension in the UAE?

No, expats in the UAE are not eligible for the mandatory national pension scheme, which is exclusively available to Emirati citizens. However, expats can explore other retirement savings options such as the Golden Pension Scheme, end-of-service benefits, and alternative investments like mutual funds or bonds.

Who is eligible for a pension in the UAE?

The UAE pension system is limited to Emirati nationals working in the public and private sectors. Employers contribute to this scheme on behalf of their Emirati employees. Expats, however, can benefit from end-of-service gratuities and voluntary savings plans to prepare for retirement.

How much is the UAE pension?

The UAE pension for Emirati nationals is calculated based on the individual’s salary and years of service, with a maximum contribution period of 35 years. For expats, the end-of-service gratuity serves as a retirement benefit, which depends on the length of employment and basic salary.

What is the Golden Pension Scheme in the UAE?

The Golden Pension Scheme is a voluntary initiative designed to help expats save for retirement by contributing to investment funds approved by the UAE’s Ministry of Human Resources and Emiratisation (MOHRE). Employers and employees can both contribute, and the scheme offers competitive profit rates with a focus on transparency and growth.

What is the retirement age in UAE for expats?

For most expats, the standard retirement age in the UAE is 60 years old, though employers can extend contracts up to 65 with approval. Certain sectors may allow work beyond 65 if justified. While this is the employment age, it doesn’t stop expats from planning or drawing on pensions earlier through international schemes or private retirement plans.

Which pension plan is best for expats in UAE?

The best pension plan depends on your goals, income, and whether you plan to retire in the UAE or abroad. Options include:

-

Golden Pension Plan – a government-linked savings and investment platform.

-

End-of-Service Gratuity – the traditional lump-sum benefit from employers.

-

Voluntary savings schemes (e.g. DEWS in DIFC) – structured, regulated workplace schemes.

-

International pension solutions (such as SIPPs or QROPS) – useful for UK and EU expats looking for portability.

For many expats, a mix of local and international options works best, ensuring both flexibility and tax efficiency.

Is the Golden Pension Plan better than gratuity?

The Golden Pension Plan can be more attractive than gratuity for long-term savers because funds are invested, potentially growing beyond a fixed lump sum. Gratuity is a one-off payment calculated on your final salary and years of service, offering no growth potential.

However, gratuity is guaranteed by law, while Golden Pension returns depend on investment performance. For expats, the better option often comes down to risk appetite and whether they want steady protection or the chance of higher returns.