We’ve all heard how beneficial it is to invest in tax-free Dubai, that investment options in UAE can yield better returns simply because there is little or no tax to pay. But why is Dubai tax-free? What kinds of investments are best? What kind of wealth management strategies do you need to get the most benefit?

We’re taking a short survey of the tax-free investment options available in Dubai, and what you need to do to tap into one of the most exciting economies on the planet!

So why is Dubai a tax-free economy?

Dubai’s tax-free status is a deliberate economic policy. There is no personal income tax and corporate tax is much less than other markets. This strategy has been specifically designed to attract foreign investment and bring global corporations in to do business there.

The Dubai government generates revenue through other means – customs duties, property taxes, and fees for various services. Given the extraordinary growth achieved in the last few decades – it works pretty well. It has also created a very stable economy – so it’s a very favourable environment for long and short-term investments.

Dubai’s tax-free status offers a unique opportunity to significantly boost your savings. But it is not all plain sailing – there are some important things to consider before you start.

How to maximise your savings in Dubai

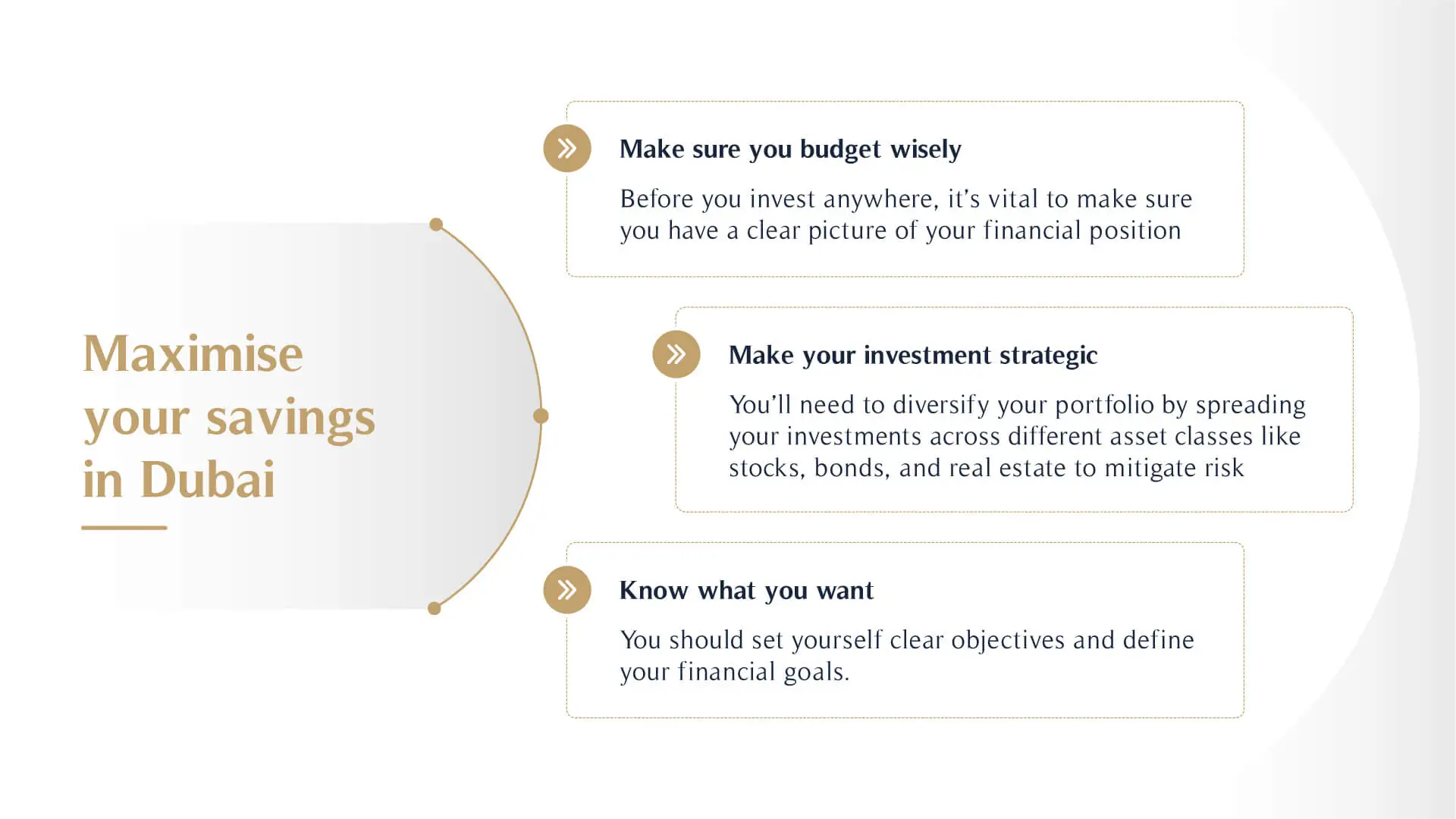

Here are three strategies to make the most of your savings:

Make sure you budget wisely

Before you invest anywhere, it’s vital to make sure you have a clear picture of your financial position. You should track your spending and monitor your expenses, differentiate between the essential expenses and more discretionary spending. Then you can create a budget so you can allocate funds for investment. Learn more about how you can save money in Dubai with our helpful guide.

Make your investment strategic

You’ll need to diversify your portfolio by spreading your investments across different asset classes like stocks, bonds, and real estate to mitigate risk. You might consider a blend of long and short-term investments, retirement plans or mutual funds.

There are some more tax-efficient investment options. You may want to look at investment vehicles that offer further tax benefits, like Islamic finance products or certain UAE retirement plans.

Know what you want

You should set yourself clear objectives, and define your financial goals. That could be buying your dream property, starting a business, or funding your children’s education

It’s always best to create separate savings accounts where you can allocate funds for each of your financial goals.

Typical Dubai investment opportunities

There are many ways to invest in Dubai and the UAE, read our guide on the how to get a better understanding on how to get started. Three most common opportunities in Dubai include:

Real Estate

With a thriving property market, buying an apartment in Dubai can be a lucrative investment. You’ll need to do some research and consider the best property investments in Dubai for the best long and short-returns. The property markets in Dubai It’s can be complex and does not always work like other markets.

Stocks and Mutual Funds

Invest in the stock market or mutual funds to diversify your portfolio. Dubai Investment Properties offer a range of options to explore.

Sharia-compliant investments

As a member of the UAE, Dubai is also home to a range of Shariah-compliant investments. This means the investments adhere to Islamic principles and can offer some good returns. In particular, they prohibit interest (riba), gambling (maysir), and investments in certain industries (haram).

However, with the right advice, you can invest in some popular investment options in Dubai:

- Sukuk: These are Islamic bonds that offer a return based on asset ownership rather than interest.

- Murabaha: This is a sale-purchase contract where the seller sells an asset to the buyer at a markup, allowing the buyer to pay in instalments.

- Ijarah: A lease contract where the owner leases an asset to the renter for a fee.

- Mudarabah: A profit-sharing partnership where one party provides capital and the other manages the investment.

- Wakala: An agency contract where someone acts on behalf of another person to manage their investments.

These products offer a way for investors to participate in the financial markets while adhering to Islamic principles. However, they are often subject to complex rules and regulations so it’s crucial to do your research – or better still, get advice from a qualified Shariah advisor so you can ensure compliance and really understand any associated risks.

What about Wealth Management?

Investing in Dubai could require a more comprehensive approach to your financial planning to properly manage your financial assets in this exciting but complex environment. You may need help and advice that goes beyond mere investment management to include various aspects of financial well-being, including estate planning, risk management, and tax optimisation.

Our wealth management in services in Dubai can help with:

Investment Management

Selecting and managing suitable investment vehicles, such as stocks, bonds, real estate, and alternative investments. This is especially true if you want to benefit from Sharia-compliant options.

Risk Management

Identifying and mitigating potential risks that could impact your wealth, including market fluctuations, currency fluctuations, and geopolitical events.

Tax Planning

Optimising your tax liability through legal and ethical means will help you take advantage of Dubai’s tax-friendly environment.

Estate Planning

You will no doubt want to ensure a smooth transition of your assets to future generations – so you will need help creating wills, trusts, and other legal instruments.

Conclusion

Dubai offers a thriving tax-free environment for your investments. If you carefully consider your financial goals, risk tolerance, and research the various investment options available, you can make the right informed decisions you need to maximise your returns.

However, as with all specialist investments, it is always good to seek professional advice who can help you stay updated on market trends and navigate this investment landscape effectively. Only with with careful planning and diversification can you build a solid financial foundation in Dubai and reap the rewards of this dynamic, high-growth economy.

Get in touch with MHG Wealth Management today to speak with one of our qualified advisors who have years of experience working with investments in Dubai and the UAE.