Wealth isn’t just about numbers in a bank account, it’s about freedom, security, and creating opportunities that shape your future.

Where you choose to live and invest directly impacts how much wealth you preserve, how effortlessly it grows, and the lifestyle you and your family enjoy. For high-net-worth individuals (HNWIs), relocating to a tax-friendly country isn’t just about moving, it’s about unlocking a world of financial advantages, global investment opportunities, and exclusive residency benefits.

But let’s be honest: relocating as an HNWI isn’t as simple as picking a new home and moving in. It’s a strategic financial decision, one that requires expert planning to ensure you maximise the benefits, whether it’s minimising tax liabilities, gaining access to exclusive business opportunities, or securing the best future for your children.

With expert HNW relocation planning, you can position yourself for greater financial security, business success, and long-term prosperity.

At MHG Wealth, we understand the complexity of global migration for high-net-worth individuals. If you’re looking for a low-tax jurisdiction, business-friendly environment, or a luxurious lifestyle upgrade, we provide expert guidance and concierge-level services to make your transition effortless.

But before we dive into how we can help, let’s explore why wealthy individuals relocate and which countries offer the best advantages.

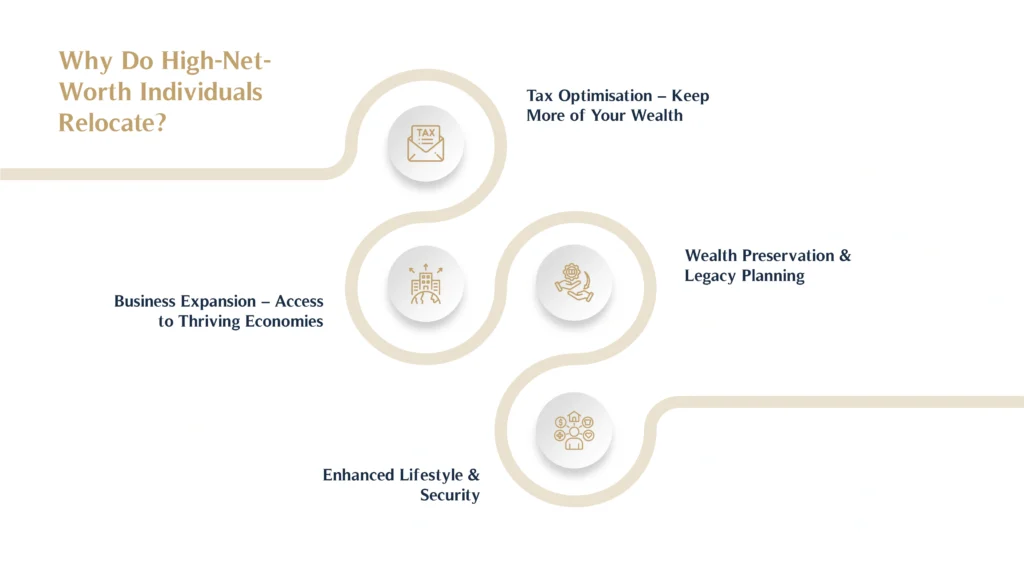

Why Do High-Net-Worth Individuals Relocate?

Have you ever wondered why the world’s richest people strategically choose their place of residence? It’s not just about luxury and exclusivity (although those are definitely perks!). The real reasons behind HNW relocation go much deeper:

1. Tax Optimisation – Keep More of Your Wealth

Taxation is one of the biggest financial burdens for HNWIs. In high-tax countries, you could be losing 40% or more of your income to the government, money that could be reinvested, preserved for your heirs, or spent on the things that truly matter to you.

That’s why billionaires like Elon Musk and Jeff Bezos have strategically moved their businesses and personal residences to more tax-friendly jurisdictions. Even celebrities like Shakira and Gerard Piqué have faced scrutiny over tax residency issues, proving just how important it is to have a proper wealth relocation strategy.

By choosing a country with no or low income tax, you can legally retain more of your earnings while benefiting from a stable and well-structured financial environment. Learn more about our tax residency solutions here.

2. Business Expansion – Access to Thriving Economies

A change in residency isn’t just about personal finances, it’s also about expanding your business opportunities. Some countries have:

- Fewer regulatory restrictions, making it easier to start and scale companies

- Pro-business policies that attract international investors

- Strong financial markets and access to global trade networks

For example, the UAE’s free zones allow foreign investors to own 100% of their businesses while benefiting from zero corporate and personal income tax. Meanwhile, Singapore serves as a gateway to Asia’s rapidly growing economy.

If your business goals extend beyond borders, relocating to a jurisdiction with a strong business infrastructure is a game-changer.

3. Wealth Preservation & Legacy Planning

You need to understand that wealth isn’t just about today, it’s about securing the future for your children, grandchildren, and generations to come.

The best HNW migration destinations offer:

- Asset protection laws that shield your wealth from political or economic instability

- Favourable inheritance laws that make it easier to pass down assets

- Access to world-class financial institutions and wealth managers

For instance, Switzerland’s strong banking privacy laws make it a top destination for wealth preservation, while Monaco’s inheritance-friendly policies attract ultra-high-net-worth families.

If your goal is to build a lasting financial legacy, relocating to the right country is a crucial step.

4. Enhanced Lifestyle & Security

Let’s face it: you’ve worked hard to build your wealth, shouldn’t you enjoy it in a place that offers luxury, safety, and world-class amenities?

HNWIs often relocate to countries that provide:

- Unparalleled luxury living – High-end real estate, fine dining, and premium lifestyle experiences

- World-class education – The best schools and universities for their children

- Top-tier healthcare – Access to private medical facilities with cutting-edge treatments

- Enhanced personal security – Exclusive, high-security residential areas

It’s no surprise that Monaco, Dubai, and Switzerland attract so many ultra-wealthy individuals, they offer a seamless blend of exclusivity, comfort, and stability.

So, where exactly are HNWIs moving to? Let’s take a look.

Top Destinations for High-Net-Worth Migration

1. United Arab Emirates (UAE) – The Ultimate Wealth Haven

The UAE, specifically Dubai, has transformed into one of the most attractive destinations for HNWIs. Why?

- Zero personal income tax – Keep everything you earn. Learn more about tax-free Dubai here.

- Luxury real estate market – Own stunning properties with high appreciation potential

- Business-friendly policies – 100% foreign ownership and tax-free business zones

- Golden Visa program – Long-term residency options for investors and entrepreneurs. Learn more about UAE pension schemes for expats here.

Did you know that football superstar Cristiano Ronaldo has property investments in Dubai? He’s not alone – celebrities, entrepreneurs, and investors alike are flocking to the UAE for its financial advantages and luxury lifestyle.

2. Monaco – Europe’s Billionaire Playground

Monaco is one of the most exclusive tax havens in the world. If you crave the prestige of living in a luxurious European city with high-net-worth neighbours, this is the place to be.

- No personal income tax – One of the most attractive tax policies in Europe

- Prestigious residency programs – Secure your place among the world’s elite

- High security & privacy – A haven for ultra-high-net-worth individuals

Want proof? Just look at Formula 1 stars, Hollywood celebrities, and global financiers, many have made Monaco their home due to its financial and lifestyle perks.

3. Switzerland – The Epitome of Financial Stability

Switzerland is synonymous with wealth preservation. With its world-renowned banking system and stable economy, it’s an elite destination for those who prioritise financial security and discretion.

- Ultra-secure banking system – Protect your assets with the world’s best banks

- Favourable tax structure – Optimise your wealth while complying with legal frameworks

- Luxury real estate and high-end living – Exclusive properties in Zurich, Geneva, and Lucerne

Many wealthy families choose Switzerland for its strong wealth management ecosystem, making it a top choice for legacy planning.

4. United Kingdom – A Premier Global Hub

For those who value a stable economy, legal transparency, and world-class education, the UK remains a top-tier destination.

- Investor visas for HNWIs – The UK Tier 1 Investor Visa offers a pathway to residency

- London’s thriving financial district – Access Europe’s leading business hub

- Top private schools and universities – Ideal for families prioritising education

Many global entrepreneurs relocate to London’s Mayfair and Knightsbridge, enjoying the city’s mix of wealth, culture, and opportunity.

Luxury Lifestyle & Investment Opportunities

Relocating as a high-net-worth individual (HNWI) isn’t just about tax efficiency or financial strategy, it’s about accessing exclusive investment opportunities, expanding your wealth, and securing a superior lifestyle.

Real Estate Investment – Own Prime Properties in the World’s Most Prestigious Locations

Luxury real estate is a proven strategy for wealth preservation and growth. Whether it’s a penthouse in Dubai, a seafront residence in Monaco, a historic estate in London, or a private villa in Geneva, investing in the right locations offers:

- High Capital Growth – Properties in top-tier cities continue to appreciate in value.

- Residency Perks – Many countries, like the UAE and Monaco, offer residency through property investment.

- A Prestigious Lifestyle – Exclusive real estate grants access to elite networks, top-tier amenities, and ultimate privacy.

For example: Cristiano Ronaldo owns luxury homes in Dubai and Madrid, not just for lifestyle but for long-term investment returns and financial security.

Business & Startup Ventures – Expand in Investor-Friendly Markets

Moving to the right country can open doors to business expansion and new investment opportunities. Destinations like the UAE, UK, and Singapore offer:

- Tax Breaks for Entrepreneurs – Low or zero corporate tax rates, reducing business costs.

- Strategic Market Access – Set up in a global financial hub for international trade and investment.

- Fast-Track Residency – Investor visas in the UK, UAE, and Singapore allow seamless business operations.

Did you know that Elon Musk moved Tesla’s headquarters to Texas for business-friendly tax policies? Smart decision, right? You can use the same strategy to maximise business growth and wealth preservation.

Residency & Citizenship Programs – Unlock Financial Freedom & Global Mobility

HNW relocation isn’t just about where you invest, it’s about securing financial freedom and international access. Investment-based residency and second citizenship offer:

- Visa-Free Travel – Gain access to hundreds of countries with elite passports like Portugal, Malta, or St. Kitts & Nevis.

- Wealth Security – Move assets to stable, tax-efficient economies for long-term protection.

- Exclusive Residency Programs – Fast-track citizenship in countries that welcome HNWIs.

How MHG Wealth Supports HNW Relocation

Relocating as a high-net-worth individual (HNWI) isn’t just about packing bags, it’s about securing your wealth, lifestyle, and future in a new country. MHG Wealth offers a seamless, concierge-level relocation service designed to handle every financial, legal, and logistical aspect of your move.

Concierge-Level Relocation Services

Moving abroad comes with a maze of paperwork, approvals, and legal requirements. We take care of it all, visas, residency applications, and property acquisition, so you can focus on settling into your new home with zero stress.

Bespoke Financial & Tax Planning

Every country has different tax rules, and without proper planning, you could end up paying far more than necessary. Our expert tax advisors ensure your wealth is structured to minimise global tax liabilities while staying compliant with local and international regulations. Whether it’s estate planning, offshore banking, or optimising investments, we tailor strategies to protect and grow your wealth.

Legal & Immigration Assistance

New country, new legal system, one wrong move can lead to costly penalties. Our specialists ensure that every financial and immigration decision aligns with local laws, keeping your assets and residency status secure.

Exclusive Networking & Business Setup

Success isn’t just about where you move; it’s about who you know. We connect you with key industry players, business leaders, and financial experts to help you establish strong professional and social networks. Need assistance setting up a business in the UAE or beyond? We guide you through company formation, banking, and compliance to ensure a smooth transition.

At MHG Wealth, we don’t just help you relocate, we help you thrive. Whether you’re moving to the UAE or another global wealth hub, our end-to-end solutions ensure your financial and personal interests are protected every step of the way.

Ready to make your move seamless and stress-free? Let’s talk.

Start Your High-Net-Worth Relocation Today

The world’s wealthiest individuals don’t just move, they strategise. The right HNW relocation plan can mean the difference between maximising wealth and missing opportunities.

Expert guidance, seamless relocation? Think MHG Wealth!

With a proven track record in wealth planning and HNW relocations, we ensure your move is strategic, tax-efficient, and stress-free. Don’t leave your financial future to chance, schedule your consultation with MHG Wealth today!

FAQs About HNW Relocation Services

What should HNWIs consider when investing in Dubai’s real estate market?

Key factors include location, market trends, developer reputation, ownership laws, and tax benefits.

How can I reduce risks when investing in Dubai’s property market?

Diversify investments, conduct due diligence, seek expert advice, plan an exit strategy, and comply with regulations.

Where can I get professional tax advice for relocation?

MHG Wealth connects you with international tax specialists to ensure efficient wealth structuring.

What steps should I take before relocating?

Plan your taxes, structure assets, secure legal compliance, assess lifestyle needs, and set up financial accounts.

Where should I manage and store my international assets?

Private banks, trusts, or family offices in financial hubs like Dubai, Switzerland, or Singapore offer secure and tax-efficient solutions.