People have been flocking to the United Arab Emirates (UAE) in recent years. It’s an exciting place with loads of opportunities and plenty of perks (including the lack of personal income tax). It’s also a growing business hub with excellent job opportunities. It’s not surprising the UAE is a very alluring prospect for expats.

If you are an expat, or thinking of becoming one, there’s lots to consider. One important aspect of living in another country is that you need to think about your retirement plan and making arrangements to ensure the transfer of assets in the event of your death. Whether you like it or not, it’s important to have a will in the UAE. And it isn’t as easy as if you were in the UK.

When drafting wills in the UAE, you need to consider the Sharia law. This Islamic law governs nearly all aspects of life in the country, including how your assets are divided when you die. If a non-Muslim doesn’t include provisions that address this, your assets might not be distributed how you want them to be.

This comprehensive guide covers the law, and all other aspects of wills in the UAE for expats.

Reasons for making wills in the UAE as an expat

The reasons for making a will in the UAE are the same as if you were in any country. These include:

- To control what happens when you die

- To provide for your children financially

- To safeguard the family home

- To protect your partner if you’re not married

- To pay the right level of tax

- To name your children’s guardians

- To make gifts and donations

- To reduce the chances of a financial dispute

- To say who you would like to settle your affairs

- To make provisions for your pets

- To define medical treatment

Common misconceptions about wills in the region

- Only old people need a will – Your age shouldn’t matter if you’re worrying when to make a will. Life is unpredictable, so if you have assets and dependents, you should make one.

- A verbal will is enough – Verbal agreements are important in the UAE, but they’re not enough. Only written, registered and witnessed wills are valid.

- Will registration in the UAE is too complicated – You might be concerned the process could be overwhelming, but with the right guidance,

- You don’t need a will if you’re an expat – If you don’t have a will registered in the UAE, your assets may be subject to Sharia law.

- Only blood relatives can be beneficiaries – You can choose your beneficiaries. It can be anyone, including charities.

Will registration in the UAE

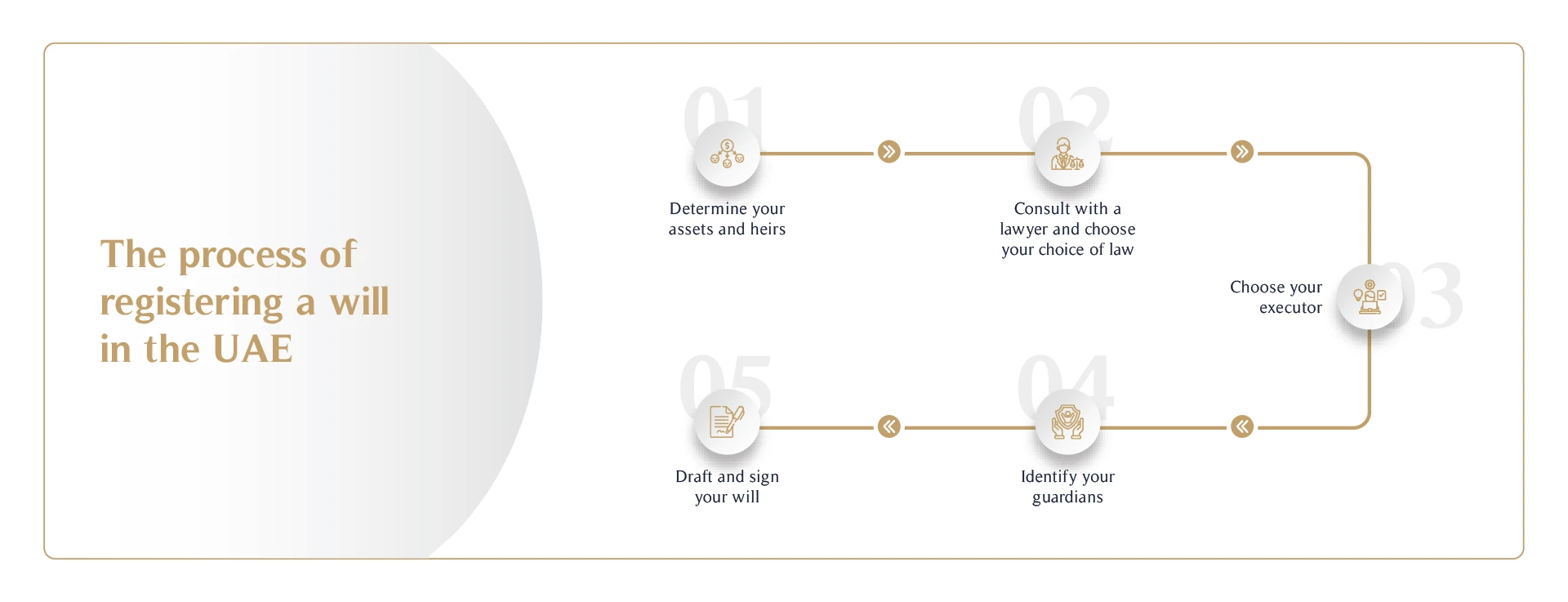

The process of registering a will in the UAE

- Determine your assets and heirs

- Consult with a lawyer and choose your choice of law

- Choose your executor

- Identify your guardians

- Draft and sign your will

Then, it’s time to register, and there are two main options for doing so. Depending on which way you choose, you can register online and via English-language versions. Costs vary, but are usually around AED 2,000.

- Dubai International Financial Centre (DIFC) Wills and Probate Registry – This covers non-Muslim expats in Dubai, and can be expanded to include worldwide assets.

- Abu Dhabi Judiciary Department (ADJD) Wills Registry – For non-Muslim expats residing in Abu Dhabi.

Along with registering wills in the UAE, applicants must also apply for a Legal Heir Certificate. The legal heirs must also produce two male witnesses of the same nationality as the testator.

If you don’t draft a will in the UAE that specifies your wishes, your will may be subject to Sharia law. Under this law, the distribution of your assets would be subject to a set of rules based on the relationship between you and your heirs – which may not be in line with your wishes – particularly if you have a non-traditional family structure.

Types of wills: DIFC will vs Dubai court will

Wills in Dubai are simpler than you might think, thanks to DIFC wills.

DIFC wills

The DIFC Wills Service Centre (WSC) looks after wills for non-Muslim residents of the UAE. When you register a WSC will in Dubai, you can rest assured your assets are distributed according to your instructions.

Dubai court wills

Dubai court wills uphold and represent Sharia law. Most legal matters in the UAE are processed through the Dubai court and its branches.

Differences between DIFC wills and Dubai court wills

There are a number of differences between DFC wills and Dubai court wills that you should consider as an expat.

- Coverage – DIFC wills cover all emirates, while Dubai court wills only cover Dubai and Ras al Khaimah.

- Religion – DIFC wills are for non-Muslims only. Dubai court wills are for Muslims and non-Muslims.

- Language – DIFC wills are only drafted in English. If you were to register a Dubai court will, all your documents would need to be translated into Arabic. This usually costs around DH 1,500.

- Price – DIFC wills cost approximately DH 5,000 to DH 15,000, while a Dubai court will cost around DH 2,000 to DH 5,000.

As you can see, you need to take all these factors, and more, into consideration. If you’re an English-speaking non-Muslim expat in Dubai, a DIFC will is the most appealing option. If Arabic is your first language, and you reside in Abu Dhabi, you’ll require a Dubai court will.

When should you start retirement planning and making a will?

Anytime is the right time to make a will. Whether you’re elderly, a student or a new parent, if you have possessions that you’d like to be distributed a specific way, you should consider making a will. Doing so isn’t about anticipating your end of life; it’s about protecting your wishes for your loved ones. For example, without a will, your estate may be distributed in accordance with Sharia Rule. To learn more, read our guide on UAE inheritance law for expats.

Living in the UAE is an exciting opportunity, full of possibilities, but if you’re an expat living there, you still need to consider making a will, and making sure you do it right. For a comprehensive approach to securing your financial legacy, consider how your end of service benefits in the UAE can be integrated into your will and estate plan. With that in mind, it’s a good idea to speak to the experts. And that’s where we come in.

Our team of qualified advisors can help you plan for retirement and your later years. For peace of mind through proper estate planning, get in touch with MHG Wealth today.