Are you interested in opening an offshore bank account, but you’re not sure if it’s right for you?

Having an offshore account can lead to many benefits – especially if you have business activities and/or family connections in other countries.

If you’re finding it all a bit confusing and want to know more, you’re in the right spot. So, what is offshore banking? This article will help you discover offshore banking meaning, the benefits of an offshore bank account, how it compares to domestic banking, how to open an offshore account, and much more.

Understanding offshore banking

What is offshore banking?

Offshore banking is a term that relates to banking activities taking place outside of an account holder’s home country. So, if you hold a bank account in a country you don’t live in, you’re involved in offshore banking.

Offshore bank accounts and financial services are commonly used by:

- Global businesses

- Multinational corporations

- People with connections to other countries

What is an offshore bank account?

An offshore bank account is a current or savings account held in another country. These bank accounts let you:

- Hold money

- Make payments

- Receive payments

You can do this in another currency, or possibly multiple currencies.

The distinction between offshore and domestic banking

There is no big difference between offshore and domestic banking, other than the location and perhaps the type of banking services on offer.

Key benefits of offshore banking

Here are some of the best benefits of offshore banking to consider.

Asset protection and security

You can use an offshore account to safeguard your assets beyond your home borders. Some countries, such as Hong Kong, the Isle of Man or Singapore, benefit from transparent, stringent regulations. This can add peace of mind if you’re in a country that has recurring risks such as asset seizures, high inflation rates and/or financial instability.

Diversification of investments

Offshore banking offers you much greater diversity than a domestic bank account. You can hold multiple currencies in separate bank accounts, and conduct financial transactions in different currencies.

Such an approach can help protect you against the impact of fluctuating currency, which can sometimes be more pronounced in your own country.

Tax advantages and financial privacy

If you establish an offshore bank account in a tax haven such as Dubai, you can enjoy significant tax advantages, including lower tax rates or possibly even exemptions. This would shield you from potentially tough tax laws in your home country. This is legitimate providing you operate within the law – you don’t want to risk conducting tax evasion.

Many countries, such as Belize, have stringent laws regarding banking confidentiality. Such regulations prioritize and maintain the anonymity of account holders, ensuring account information remains secure.

Access to international markets and currencies

Access to international markets and currencies allows you to enjoy:

- International expertise and investment advice

- Favourable international investment opportunities

- Higher interest rates

- Visibility of live exchange rates and management of foreign exchange, which can reduce currency conversion and associated fees

How to open an offshore account

Steps to open an offshore bank account

It’s not difficult to set up an offshore account. Here’s how:

- Choose your bank – Whichever country you choose, look for a reputable bank. You’ll want to consider fees, stability, accessibility and the services on offer. Then, get in touch with your chosen bank and find out their process for opening an account.

- Get the relevant documents together – You’ll most likely have to provide your bank with proof of identity, proof of address, and documents pertaining to the source of your funds, to prove you’re not money laundering.

- Submit your application – Send your application form and documents to the bank. This could be done digitally or in the post, depending on their procedures. The bank will then complete due diligence checks.

- Make an initial deposit – The amount you deposit will depend on your bank and the type of offshore account you are opening.

- Access your new account – When your bank has approved your application and received your opening deposit, you’ll be given instructions on how to access your account online or through other banking channels.

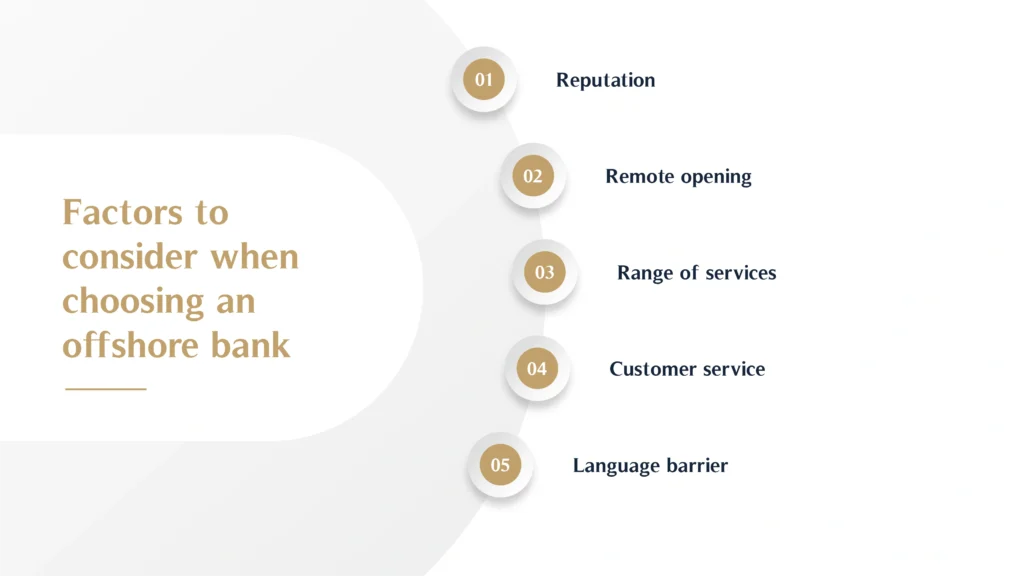

Factors to consider when choosing an offshore bank

Here’s what you need to consider when you choose which bank to open an offshore account with.

- Reputation – Is the bank known for its quality service? Is it able to fulfil your requirements? Take a look at customer reviews online to help you find out.

- Remote opening – As the bank account will be held in another country, it would be very convenient if you can open the account remotely.

- Range of services – What services are provided? If you’re looking for services such as managed mutual funds, or an offshore trust, you’ll need to do your research.

- Customer service – You’ll be largely depending on the bank’s staff to conduct your business, so you’ll be wanting prompt customer service and swift action to resolve potential issues.

- Language barrier – It’s best to avoid any communication issues due to language differences, if possible.

Offshore Banking and Money Laundering

Offshore banking has often been a subject of debate, particularly due to its perceived association with money laundering and financial crime. While offshore accounts offer undeniable advantages such as financial privacy and tax efficiency, they have occasionally been misused for unlawful purposes.

The Association Between Offshore Banking and Money Laundering

Money laundering involves disguising the origins of illicit funds, making them appear legitimate. Offshore banking, with its global reach and banking secrecy rules, can sometimes provide the perfect cover for such activities. Illicit funds may be moved into offshore financial centres to bypass local regulations, evade taxes, or facilitate organised crime.

The underground economy benefits from this lack of transparency, particularly when offshore accounts are used to hold assets acquired through illegal activities. According to the Financial Action Task Force (FATF), tax evasion, organised crime, and even the financing of terrorism often involve offshore accounts as intermediaries. This highlights the importance of global financial system reforms to address these vulnerabilities.

However, it’s crucial to note that the vast majority of offshore banking activities are legitimate. Many individuals and businesses use offshore accounts for diversification, asset protection, and access to international markets, as discussed in What Are Fixed Income Investments.

Regulatory Measures and Compliance in Offshore Banking

To combat the misuse of offshore accounts, stringent regulatory measures have been implemented globally. These measures aim to strike a balance between preserving the benefits of offshore banking and ensuring compliance with anti-money laundering (AML) laws. Key initiatives include:

- Anti-Money Laundering Compliance (AML): Offshore banks are now required to implement rigorous Know Your Customer (KYC) procedures, ensuring that account holders are properly identified and their transactions monitored.

- International Finance Regulations: Agreements such as the Common Reporting Standard (CRS) require banks to share financial information with tax authorities worldwide.

- Offshore Banking Regulation: Jurisdictions known for offshore banking, such as Switzerland and the Cayman Islands, have introduced laws to enhance transparency while maintaining financial privacy.

- Regulation of Cryptocurrency Transactions: With the rise of cryptocurrency, clearing houses and regulators are addressing risks associated with using digital assets for laundering funds through offshore accounts.

For individuals and businesses, understanding these regulations is essential to avoid compliance issues. Expats, for example, should be aware of how Double Tax Agreements can affect their offshore investments.

Statistics on Money Laundering Through Offshore Accounts

To grasp the scale of the problem, consider these statistics:

- The United Nations Office on Drugs and Crime (UNODC) estimates that $1.6 trillion is laundered annually, representing around 2-5% of global GDP.

- Offshore financial centres are often linked to approximately 50% of global money laundering cases, highlighting their critical role in the global financial system.

- A report by Europol revealed that 90% of criminal organisations rely on money laundering to legitimise their earnings, with offshore banking being a common method.

Responsible Offshore Banking: The Way Forward

While offshore banking provides undeniable benefits, it’s important to engage with reputable financial institutions and adhere to international finance regulations. Compliance with AML measures ensures that offshore banking remains a valuable tool for legitimate purposes rather than a haven for illicit funds.

If you’re considering opening an offshore account, understanding its impact on your investment strategy is vital. Learn more about how interest rates affect investments and ensure your offshore banking aligns with your financial goals.

Conclusion

It’s important to stay on top of any tax laws or regulation changes that might occur in both your home country and the country in which you hold an offshore account. As an offshore account holder, you would be responsible for tax obligations, and these can change over time.

So, the benefits of offshore banking include potential tax advantages, financial privacy, asset protection, diversification opportunities, and much more. There’s no wonder so many people set up offshore accounts. But you will also be aware now that there are lots of factors you need to think about.

Feeling overwhelmed? Don’t be. Get in touch with MHG Wealth today, and we’ll be more than happy to help.