A loan note is a key financial instrument often used in lending and investing, but its specifics can sometimes be confusing.

In this article, we’ll break down what a loan note is, how it works, and why it’s important for both borrowers and investors. Whether you’re exploring financing options or considering an investment, understanding loan notes is essential for making informed decisions.

What is a loan note?

A loan note, also referred to as a promissory note, bill of exchange or formal IOU, is a debt agreement that outlines the terms in which a lender loans money to a borrower.

They can be a simple and effective way for borrowers to raise capital for a purpose, project or investment and are often required for big ticket purchases.

Loan notes can be tax advantageous for borrowers and a convenient way for entrepreneurs to source capital from family or friends. With a host of safeguards in place to mitigate risk, they can also offer investors a promising investment that is often met with high returns.

Information contained in a loan note

This debt instrument allows the lender to set and state the terms in which the money has been borrowed. This will include:

- Name and address of the borrowing company and lender

- The loan amount

- Maturity date

- Interest rate

- Repayments process

- Any conversion terms.

Either party can draw up the agreement although this role typically sits with the lender.

The loan note will also outline the legal obligations of each party and the repercussions for failure to comply. This can include contractual penalties as well as the right to sue or seek arbitration. These clauses protect the lender and come with a guarantee that the borrower will pay off any debts before insolvency.

Repayment and interest calculation

A loan note consists of two parts: principal and interest. While the principal refers to the amount of money being loaned to the company, the interest refers to the amount of money accrued in line with a pre-agreed interest rate over the course of the loan.

This is calculated by multiplying the loan amount with the interest rate and then multiplying that by the length of the loan.

For example, if the value of the loan is set at $100,000 with an annual interest rate of 7%, the accrued interest per year would be $7,000. If the loan note duration is four years, the annual interest of $7,000 would then be multiplied by four yielding a total interest of $28,000 for the duration of the agreement.

The total amount owed to the lender by the maturity date in this example would be $128,000. It can be repaid in multiple instalments but this must be agreed at the beginning of the agreement and outlined clearly in the loan note.

Loan notes can however have a variable interest rate attached to the loan amount. This rate can fluctuate over the course of the agreement as it is based on an underlying benchmark interest rate or index. This comes with an obvious advantage that if the underlying interest rate declines, the borrower’s interest payments also fall.

However these can also rise and make for uncertain repayments. As interest rates vary, the required payment will go up or down according to a change in rate, as will the number of payments remaining before completion. This can make it harder for investors to predict future cash flow.

Parties involved

Lenders typically include private investors looking to diversify their investment portfolio and financial institutions raising capital to lend to business and consumer clients. Loan notes can however be a simple and convenient way for entrepreneurs to obtain seed capital from friends and family. They are also used in more than three quarters of vehicle leasing contracts and other big ticket purchases such as mortgages.

Borrowers can range from businesses looking to raise capital in order to diversify or refinance debt to governments raising capital to finance public infrastructure projects and non-profit organisations funding a cause.

A loan note can also be offered to shareholders and employees in lieu of stocks, shares or compensation as part of a business sale, settlement package or incentive plan.

Different types of loan notes

There are typically four types of loan notes. These include;

- Secured loan notes: Backed by a guarantee in the form of collateral belonging to the borrower such as property. In the event that a borrower defaults on their payments, the lender can take possession of assets to recoup their losses.

- Traded loan notes: Working in a similar manner to secured loan notes with the difference being that they can be bought and sold on a recognised exchange..

- Unsecured loan notes: This loan type does not involve collateral and means in the event of the borrower failing to comply with the terms outlined in the loan note, the lender would have to default to standard debt-collection procedures. These loan notes are significantly rarer as there is no personal obligation to repay debts should a company collapse.

- Convertible loan notes: Used when a business needs quick access to liquidity. As the name suggests, these can be converted into equity after an agreed time period or specific event occurs. The loan note must clearly outline the parameters for the ‘conversion event’ and it is often advised that provisions are established whereby the loan can be repaid without the conversion taking place.

Loan note vs. Other debt instruments

Loan notes are similar to bonds but typically have an earlier maturity date than other debt securities and are not as liquid. This means they may be more difficult to sell and yield less returns in the form of interest but offer a more predictable cashflow for investors.

They function like shares issued to multiple investors but are structured like any debt arrangement with interest payments. While loan notes and traditional loans are both forms of debt financing, loan notes offer more flexibility and a greater degree of safety for investors.

A borrower is much more likely to opt for a loan note over a traditional loan agreement when raising money from the public due to the fact that they are securities that can be publicly listed. They are also more likely to be used in lieu of shares or a cash settlement in an employer-employee relationship in order to save on taxable gains. This too is the case during a private equity transaction where loan notes can be tax advantageous.

Loan notes allow multiple lenders to be involved, are useful when no set amount of capital needs to be raised, applicable when there are to be no other obligations on the lender than to advance the money and when there is a possibility that the loan note is to be transferred during the life of the borrowing. Non-bank lenders will also typically be more involved in loan notes as banks tend to prefer to lend on standard terms under standard loan agreements.

Advantages and disadvantages of loan notes

Loan notes can be a mutually beneficial instrument for quickly and safely funding a new business or investment. While still being legally actionable, they are easier to enforce, simple to draw up and can facilitate borrowing from multiple investors under the same note. They can also widen the pool of lenders beyond traditional banks and include private investors, individuals and companies.

Borrowers can unlock access to capital without having to part with any of their assets or equity while benefiting from tax advantages. Loan notes can protect individuals from the tax liability that often comes with a lump-sum payment or package, making it a popular alternative to compensation in an employment setting. The same benefit applies during a business sale where a selling shareholder can defer any liability to capital gains or corporation tax on chargeable gains.

For investors, these loans represent a degree of reassurance due to a host of safeguards that ensure the debt is paid off before a new company reaches insolvency. Secured loans also ensure lenders can recoup their losses in the event of no repayment.

Like any investment however, there are some disadvantages, namely a lack of liquidity meaning loan notes may be difficult to sell quickly. There is also a risk of default which has no safety net in the case of an unsecured loan note. While loan notes can yield high returns, interest rates can prove higher on other debt investments such as bonds.

For borrowers, a personal guarantee is often provided in conjunction with the corporate security. This requires borrowers to ‘put their money where their mouth is’ and risk their own personal capital too.

How Loan Notes Work

Loan notes outline the terms of the loan, providing transparency and legal safeguards for both parties. Let’s dive into the detailed steps involved in issuing a loan note, its management, and the role of financial institutions in this process.

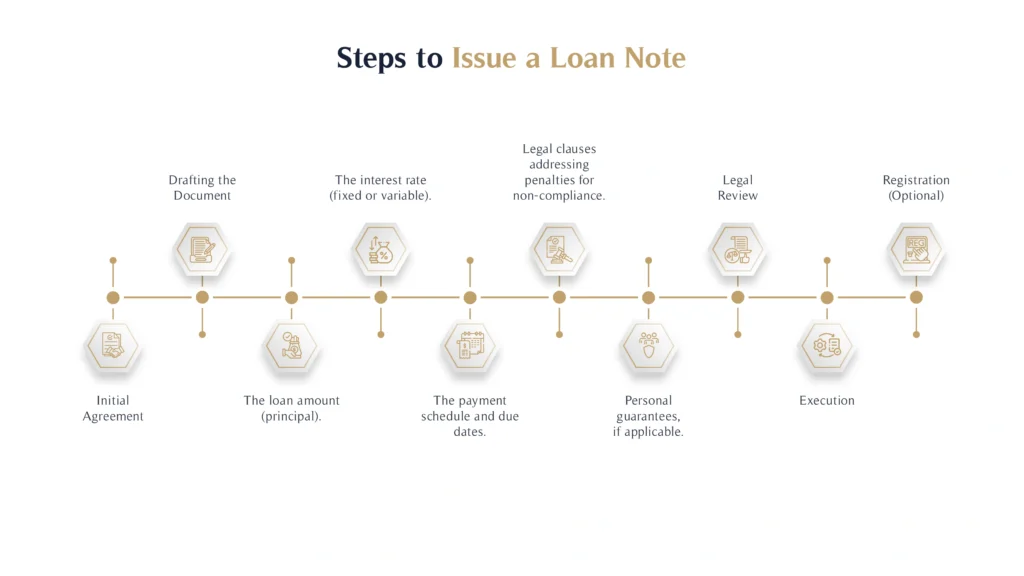

Steps to Issue a Loan Note

- Initial Agreement: The borrower and lender agree on the purpose of the loan and its key terms, such as the amount, interest rate, and repayment schedule.

- Drafting the Document: The lender, or a legal professional on their behalf, drafts the loan note. This document includes essential details such as:

- The loan amount (principal).

- The interest rate (fixed or variable).

- The payment schedule and due dates.

- Legal clauses addressing penalties for non-compliance or prepayment fees.

- Personal guarantees, if applicable.

- Legal Review: Both parties review the document to ensure all terms are clear and agreed upon. Arbitration clauses are often included to resolve potential disputes amicably.

- Execution: Both parties sign the loan note, making it legally binding.

- Registration (Optional): In certain cases, the loan note may be registered with a regulatory body or financial institution for additional security.

Management and Administration of Loan Notes

Managing a loan note requires ongoing attention to detail to ensure compliance with the agreed terms:

- Monitoring Payments: Lenders track repayments based on the outlined schedule, ensuring timely collection of principal and interest.

- Calculating Interest: Interest payments are calculated periodically, often monthly or quarterly, based on the agreed rate. A clear record helps prevent disputes.

- Adjustments for Variable Rates: For loan notes with variable interest rates, lenders adjust payments according to fluctuations in benchmark rates.

- Addressing Defaults: If a borrower fails to meet their obligations, lenders can initiate contractual penalties, arbitration, or legal action to recover the funds.

Role of Financial Institutions

Financial institutions play a pivotal role in the loan note process:

- Issuance and Underwriting: They facilitate the drafting and issuance of loan notes, ensuring compliance with financial regulations.

- Custody and Record-Keeping: Institutions often act as custodians, safeguarding the loan note and maintaining records of all transactions.

- Mediation Services: In cases of disputes, financial institutions may mediate between lenders and borrowers to resolve issues.

- Advisory Services: They provide strategic advice on structuring loan notes to meet specific financial goals, such as business financing or investment diversification.

By partnering with trusted financial institutions, borrowers and lenders can navigate the complexities of loan notes with greater confidence.

Loan Notes for Business Use

Loan notes are versatile financial instruments that can be strategically employed to meet the unique funding needs of businesses. From financing growth to facilitating major transactions, these notes offer businesses a tailored alternative to traditional loans.

Strategic Use of Loan Notes in Business Financing

- Raising Capital: Businesses can issue loan notes to secure funding for expansion, acquisitions, or operational costs without diluting equity.

- Facilitating Purchases: Loan notes are often used in big-ticket transactions, such as acquiring property, machinery, or other assets.

- Debt Refinancing: Companies can use loan notes to consolidate existing debts, securing better terms and interest rates.

Comparing Loan Notes to Other Financial Instruments

- Loan Notes vs. Promissory Notes: While both serve as agreements for repayment, loan notes are more formal and typically involve larger sums with structured repayment terms.

- Loan Notes vs. Convertible Loan Notes: Convertible loan notes offer businesses the flexibility to convert debt into equity under predefined conditions, making them ideal for startups or high-growth companies.

- Loan Notes vs. Traditional Loans: Loan notes provide greater flexibility, allowing businesses to negotiate terms more freely compared to the rigid structures of bank loans.

Explore how businesses can leverage offshore banking to enhance financial flexibility and optimise tax strategies.

Special Considerations for Loan Notes

While loan notes provide significant advantages, it is crucial to understand their legal and financial implications to avoid potential pitfalls.

Legal Significance of Loan Notes vs. Informal IOUs

Unlike informal IOUs, loan notes are legally binding documents that:

- Clearly outline the obligations of both parties, including repayment schedules, interest rates, and penalties for non-compliance.

- Offer recourse through legal channels, such as arbitration or litigation, in case of disputes.

- Provide greater security to lenders through mechanisms like personal guarantees or company stocks as collateral.

Key Considerations for Borrowers and Lenders

- Due Diligence: Borrowers should ensure they fully understand the terms of the loan note, including any prepayment fees or legal obligations.

- Risk Mitigation: Lenders should evaluate the borrower’s creditworthiness and consider secured loan notes for added protection.

- Tax Implications: Both parties must be aware of the tax consequences, especially in private equity transactions or when using company stocks as collateral.

Role of Traded Loan Notes

Traded loan notes offer liquidity, allowing lenders to buy and sell them on recognised exchanges. However, borrowers should understand the potential impact of such trading on their repayment obligations and interest rates.

Investing in loan note agreements

Investing in loan note agreements helps to ensure stable, fixed returns, reduced risks and a diversified portfolio. Explore more with companies such as Fenchurch Legal and MHG Capital who have lucrative opportunities in their loan note offering.

Are you looking to diversify your investment portfolio and achieve higher returns? Our industry leading team of financial advisors at MHG Wealth Management are here to guide you through the process, ensuring you make informed and profitable decisions. Get in touch today.