When you’re thinking about investing, knowing all the facts and feeling well informed can help you to feel more confident. Fixed income investments are an important part of a varied investment portfolio. If you’re planning on investing, you’ll want to consider the benefits of fixed-income investments. Our guide will explain what this type of investment is and they work.

What are fixed income investments?

The main thing you need to know is that they offer a fixed interest or coupon until their maturity date (the agreed-upon date the investment ends). Think of it as loaning money to a corporation or government entity and getting a set amount of interest on the money you’re lending.

With other investments, the amount you will receive is often not guaranteed. Non fixed investments are affected by markets, interest rates, inflation, and other factors – things that change all the time. So there’s an element of risk. When it comes to fixed income investments, you get a fixed stream of money at an agreed rate, which means there’s a lot less risk involved.

Why invest in fixed income?

Fixed income investments are a key part of any diversified investment portfolio because they’re lower risk. They offer a source of regular income and can reduce volatility. Fixed income investments are not affected by external factors in the same way. Let’s delve into some of the primary examples of this type of investment.

What are the different types of fixed income investments?

There are several different types of fixed income investments to consider. Here are some fixed income examples:

- Government bonds are issued by governments. The money you invest is used to help fund public projects.

- Corporate bonds work similarly to government bonds but companies use them to raise capital. For example, Fenchurch Legal offers two different loan note products. Its disbursement funding solution helps pay for third-party costs incurred by lawyers on behalf of their clients, whereas its Work in Progress (WIP) Funding uses corporate bonds to provide much-needed cash to help fund small ticket cases and assist with growth and expansion plans. MHG Capital also provides secured business loans to UK SMEs, whilst generating a high yielding, fixed income for investors.

- Municipal bonds are issued by cities, councils, states, and other government organisations to help finance local public projects.

- Certificates of Deposit (CDs) are a short-term savings product banks offer. With CDs, you agree to keep your money invested for an agreed timeframe. As a result, CDs often pay a higher interest rate than a typical instant-access savings account.

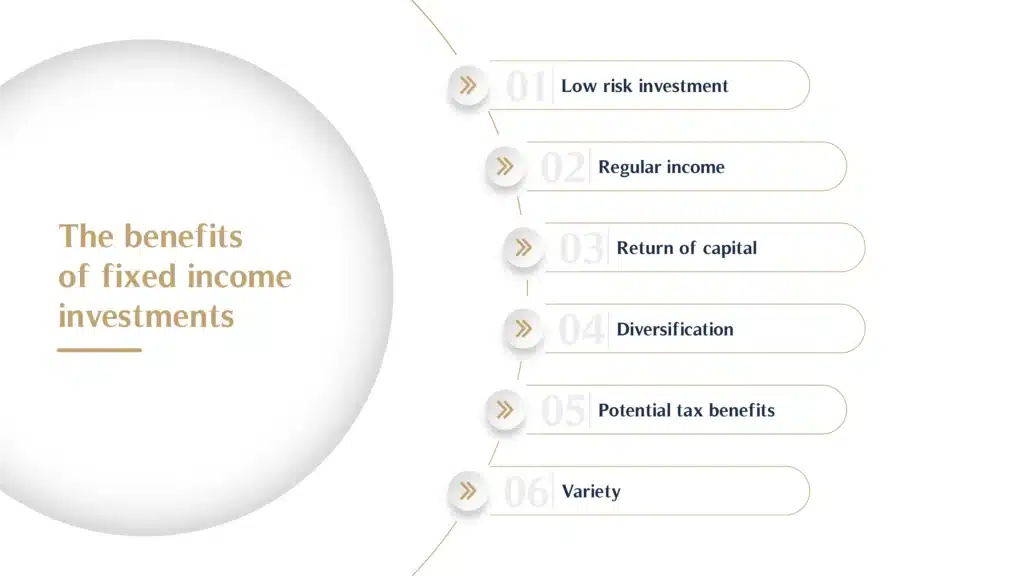

What are the benefits of fixed income investments?

Now that you understand the different types of fixed income investments available, it’s time to consider the potential benefits of fixed income investing compared to other types of investments.

Low risk investment

Fixed-term investments inherently carry lower risk. To date, the UK and US governments have never defaulted on a fixed income investment, making them a more secure option compared to equities.

Regular income

Fixed income investments provide a regular income stream, whereas dividends from equities can fluctuate. This stability improves investors’ ability to plan their finances and is particularly attractive for retirees or anyone else seeking a predictable flow of cash.

Return of capital

When you invest in fixed income securities (such as bonds), you will receive your initial investment (known as the principal) back when the bond reaches its maturity date, as long as there is no default. This is uncommon compared to other investment forms and provides assurance regarding your anticipated returns.

Diversification

Having a diverse portfolio is one of the best ways to futureproof your investments. Fixed income investments offer diversification beyond shares and properties. For example, in 2008, the global financial crash caused a 40% fall in equities while US Treasury bonds increased in value by 20%.

Potential tax benefits

Some types of fixed-term investments (such as municipal bonds) offer tax advantages to investors.

Variety

There are many different fixed income investment options to choose from, each of which offers a different level of return and risk. Whatever your investment risk profile, you’re sure to find a fixed income investment option to suit you.

What are the risks of fixed income investments?

All investments involve some element of risk. The best way to approach any investment decisions is to remain impartial. Imagine you’re holding someone else’s money in your hands; what would you tell them? You’d make sure you’ve looked at all the options and weighed up the arguments for and against investing in something. And considering all the risks is a key part of this.

Here are the three main risks to be aware of when choosing fixed income investments.

Interest rates

Rising interest rates can reduce the relative value of your fixed income investments. To lower this risk, aim to invest in bonds with varying maturity dates.

Risk of default

This relates to the risk of the borrower being unable to fulfil their financial obligations. Governments are typically considered risk-free, while other types of borrowers have varying risk profiles. You can lower this risk by investing in financially stable entities with a good credit rating.

Inflation

If the inflation rate rises, the investment will be unable to keep pace with rising costs. This leads to a lower purchasing power for the investor. Some government bonds, for example Real Return Bonds in the US, are tied to inflation. This means they are designed to protect the investor’s purchasing power, helping to negate this risk. How does inflation affect investments? Learn more in our helpful guide.

How do fixed income investments work?

Here’s some helpful information to explain how this type of investment works.

- Fixed income investments are basically debt instruments for companies and governments.

- When an investor buys a bond, they agree to lend the borrower a specific amount of money for a set period.

- In return, the investor receives a set amount of interest at regular intervals, known as the coupon.

- When the bond expires and reaches the agreed maturity date, the initial amount invested gets returned to the investor.

What to consider before investing in fixed income investments

Before you invest in fixed income investments, it’s essential to consider the amount of risk that you’re willing to take on, as well as how much capital you can safely afford to invest.

You’ll need to think about the proposed maturity date and how long you want to invest your money.

It’s also vital to draft a diversification strategy before investing. Choosing a range of fixed income investments with different maturity dates will help you create a more diverse portfolio, reducing risk and boosting the potential for higher returns.

Managing a fixed income portfolio

When managing a fixed income portfolio, diversification should be your top priority.

This means you should aim to invest in a range of fixed-term investments with different maturity dates to mitigate risks.

You must also carry out due diligence before investing in an entity. This includes making sure it has a good credit rating before you make any commitment to invest.

It’s also important to choose a range of investments as this helps to minimise risk while producing returns, even in a volatile financial market.

Seeking MHG Wealth advice

If you want to avoid the pressure and responsibility of selecting and managing your fixed-term income portfolio, MGH Wealth Management is on hand to help.

We have an industry leading team of international financial advisors on hand to help manage your investment portfolio.

Our trained professionals will help you to:

- Define your investment goals

- Research the different options available to you

- Create a diversified investment plan

- Invest your funds accordingly

- Monitor and adjust your investments as necessary

With our help, you can make informed decisions according to your personal goals and risk tolerance. We’ll also provide expert advice as the market changes.

MHG Wealth offers a wide range of investment options. If you’d like to discuss the potential investment opportunities available to you, why not set up a private consultation with us today?