The United Arab Emirates (UAE) is one of the most popular destinations in the world for expats. In fact, expats make up more than 88% of the population. And it’s not surprising, because the UAE is a country of extraordinary wealth and glamour. People flock to the UAE to do business, and a huge reason for that is its simplified tax system. It’s a tax haven and a growing business hub with excellent career opportunities.

If you’re an expat considering moving to the UAE, or are already there, you may benefit from the country’s simplified tax system.

However, when it comes to taxes for expats, there are still considerations to take into account. In this guide, we’ll delve deep into expat taxes in the UAE.

Who counts as a UAE tax resident?

There are three main scenarios in which you can become a UAE tax resident:

- You have physically resided in the country for at least 183 days within a calendar year.

- Your stay in the UAE is uninterrupted – and meets the 183-day requirement – over a period of 12 months.

- You have a valid residence visa, issued by the UAE government.

So now you know if you fit the bill (or will do if you move there) to be considered a UAE tax resident. But what are the main forms of taxation for expats in the UAE?

Taxes for expats in the UAE

Personal income tax

Here’s the best news concerning expat taxes – there is no UAE income tax to pay. If you meet the criteria above, you are generally not subject to taxation on your personal income. You can work in Dubai or elsewhere in the UAE without any income tax deductions, because the UK and the UAE have a double taxation agreement.

Corporate income tax

Until recently, there was also no UAE corporate income tax. However, in 2023 the government announced a corporate income tax of 9% for taxable income above AED 375,000 (equivalent to approximately £79,990). However, although businesses now have to pay corporate tax in the UAE, this is still a good rate compared to the UK (where the corporate tax rate is 25%) and other countries, and workers still won’t pay tax on their personal income.

Other taxes

- Municipal/Property tax – property taxes in the UAE vary, but in general, are based on property value. In Dubai, property tax is 5% of a property’s annual rental value, whether residential or commercial.

- Value added tax (VAT) – the VAT rate in the UAE is 5%. But some items are excluded, including the export of services and goods to outside the GCC. Businesses earning above AED 35,000 per year need to register for VAT.

- Inheritance tax (IHT) – there is no federal regime for IHT in the UAE. However, if there is no will, handling of the inheritance depends on whether the deceased was Muslim. If you’re a British national living in the UAE, you remain subject to UK IHT on your worldwide assets.

Differences between tax obligations in the UAE vs the UK

The main difference in expat taxes between the UAE and the UK is the lack of personal income tax in the UAE.

Personal income tax

The UK’s personal income tax rate is progressive. This means, the more you earn, the higher the percentage you pay.

Also, there is no national insurance to pay in the UAE. The lack of personal income tax and national insurance means expats working in Dubai or elsewhere in the UAE will earn potentially thousands more per month, which means a significant boost to your personal income.

Corporate income tax

Other tax rates are lower in the UAE. The current main corporate income tax rate in the UK is 25% on taxable profits above £250,000. In the UAE, it’s 9% for taxable income above AED 375,000, which equates to around £79,990.

Property tax

There are a number of property tax obligations in the UK, including:

- Council tax

- Rental income tax

- Capital gains tax

Whereas property tax in the UAE, as seen above, is much simpler. In Dubai for example, expats would simply pay 5% of a property’s rental value.

VAT

The flat rate for VAT in the UK is 20%, but in the UAE, it is only 5%.

Avoiding double taxation

The UK and the UAE have a double tax treaty. This agreement means that generally, tax for expats in Dubai and elsewhere in the UAE is kept simple. This is because the treaty mostly ensures expats from the UK don’t pay tax twice on the same income.

It’s not always so simple, however. There are exceptions to some rules. For example, although personal income tax in the UAE isn’t applicable, income derived from activities in the oil and gas industries are.

To gain further knowledge about double taxation agreements, read our dedicated article, or get in touch with one of our advisers.

Tax implications when returning to the UK from the UAE

The rules for returning to the UK from the UAE are the same as returning from any other country – you must tell HMRC. The sooner you can let them know, the better, as your tax liability will differ greatly depending on whether you are a UAE resident or not.

The UAE will also understandably need you to get your books in order. This means you’ll need to:

- Cancel your residency status

- Cancel your work visa

- Close all your UAE bank accounts

- Pay any outstanding fines or debts in full

With all this in mind, you’re advised to plan ahead – a year ahead, if possible. Ideally, you’ll want to do so at the beginning of the UK tax year – just to make the process smoother.

Bear in mind that returning to the UK means a return to UK taxes. But it varies depending on your situation.

If you’ve been away for more than a full tax year, but less than five years, you’ll be considered a temporary non-UK resident. This means you’ll have to pay tax on selected income (at home and overseas) and capital gains tax on assets purchased before you left the UK.

Whereas if you’ve been abroad for more than five years, the rules will differ because you won’t be classed as a temporary non-resident.

Also, be aware that even visiting the UK can trigger UK residency!

Tax assistance services for expats in the UAE

Navigating the UAE’s tax system might seem straightforward given its reputation as a tax-friendly environment. However, for expatriates, the complexities of global tax compliance, double taxation agreements, and residency status can require tailored expertise. That’s where expat tax services come in—helping you simplify your financial management, ensure compliance, and make the most of your income while living in the UAE.

What are expat tax services?

Expat tax services are specialised advisory and compliance solutions designed specifically for expatriates. These services focus on managing international income taxes, understanding double taxation treaties, and aligning with both local and global tax obligations. For expats in the UAE, they offer clarity and peace of mind, ensuring that your financial affairs are handled accurately.

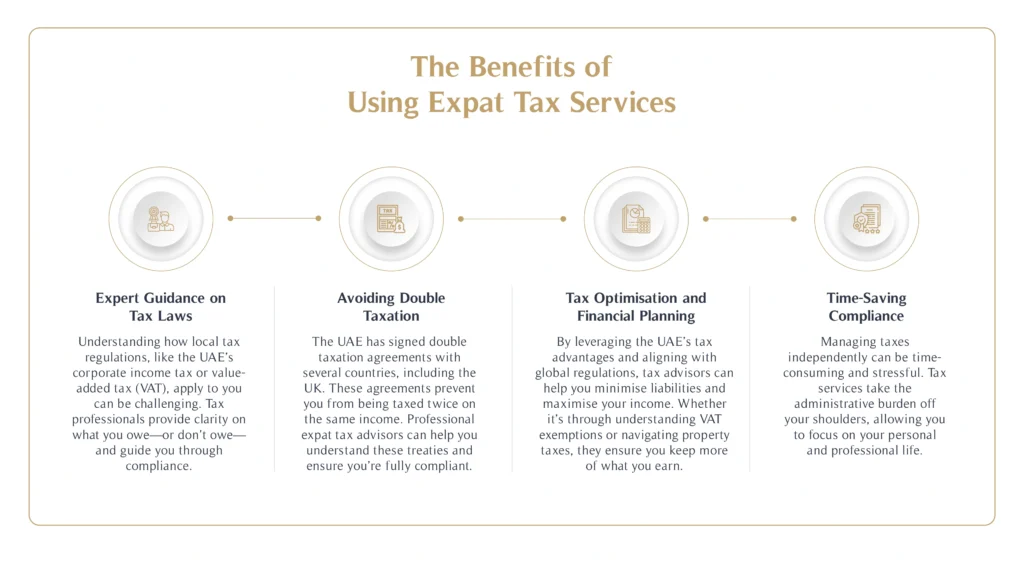

The Benefits of Using Expat Tax Services

Engaging professional tax assistance services as an expat in the UAE provides a wide range of benefits:

- Expert Guidance on Tax Laws

Understanding how local tax regulations, like the UAE’s corporate income tax or value-added tax (VAT), apply to you can be challenging. Tax professionals provide clarity on what you owe—or don’t owe—and guide you through compliance. - Avoiding Double Taxation

The UAE has signed double taxation agreements with several countries, including the UK. These agreements prevent you from being taxed twice on the same income. Professional expat tax advisors can help you understand these treaties and ensure you’re fully compliant. Read more about double taxation agreements here. - Tax Optimisation and Financial Planning

By leveraging the UAE’s tax advantages and aligning with global regulations, tax advisors can help you minimise liabilities and maximise your income. Whether it’s through understanding VAT exemptions or navigating property taxes, they ensure you keep more of what you earn. - Time-Saving Compliance

Managing taxes independently can be time-consuming and stressful. Tax services take the administrative burden off your shoulders, allowing you to focus on your personal and professional life.

Examples of expat tax services providers in the UAE

Several companies in the UAE specialise in expatriate tax advisory and compliance:

- PwC UAE: A global leader in tax and legal services, offering tailored tax advisory and compliance services for individuals and businesses.

- EY Tax Services: Renowned for its expertise in mobility tax services, helping expats manage their financial affairs across borders.

- KPMG UAE: Provides comprehensive guidance on UAE tax compliance, VAT filing, and cross-border tax planning.

Each of these providers offers unique strengths, but working with a firm that understands your individual needs, such as MHG Wealth, ensures a more personalised approach.

Why Expat Tax Services Are Important

Even in a tax-friendly environment like the UAE, expatriates must manage their finances with precision. Factors such as global investments, income from multiple countries, or plans to return home require expert knowledge. A professional tax advisor can ensure you’re not only compliant but also benefiting from every opportunity to optimise your finances.

Get advice from MHG Wealth

Taxes for expats in the UAE are very alluring. You’ll keep more of your finances for yourself, and that’s one of many reasons people flock to Dubai and elsewhere in the UAE.

However, although there are fewer tax rules in the UAE than the UK, there are exceptions to some of these rules – and the double tax treaty doesn’t always apply. And if you plan on returning to the UK, things become more complicated.

MHG Wealth are experts in the UAE tax rules. From income tax to corporate tax in the UAE, we can give you the guidance you need to make the most of your money. So whether you’re based in Dubai or Abu Dhabi or anywhere else in the UAE, set up a private consultation with us today.

FAQs About Expat Taxes in the UAE

Is the UAE tax-free for expats?

Yes, there’s no personal income tax in the UAE. However, expats must be mindful of taxes in their home countries and other financial obligations.

What are the taxes for foreigners in the UAE?

Foreigners in the UAE may encounter VAT (5%), corporate taxes (9% for businesses earning above AED 375,000 annually), and property taxes, depending on their residency and activities.

How can I save taxes in the UAE?

Saving taxes as an expat involves leveraging the UAE’s tax treaties, working with professional advisors, and understanding exemptions like those for exports under VAT. Learn more about tax-saving opportunities here.

What taxes do UAE residents pay?

UAE residents are typically subject to VAT, property taxes, and corporate income taxes. However, personal income tax and inheritance tax are not applicable in the UAE.