Investing isn’t just about numbers; for many, it’s deeply tied to values and beliefs. Sharia-compliant investing offers a financial pathway that blends the principles of Islamic law with modern investment opportunities to grow wealth ethically.

This form of investing is gaining traction, particularly in regions like the UAE and the Middle East, as more investors seek options that align with their faith and values. Sharia-compliant investing not only respects Islamic teachings but also emphasises fairness, social responsibility, and ethical profit-sharing.

In this guide, we’ll explore what Sharia-compliant investing is, the rules it follows, the types of investments available, and how it compares to conventional investing.

Whether you’re just starting or looking to refine your investment portfolio, this guide provides a clear and practical understanding of Sharia-compliant finance.

Understanding Sharia-Compliant Investing and its Principles

Sharia is a comprehensive legal and ethical system of principles derived from the Quran and the Hadith (sayings and practices of Prophet Muhammad, peace be upon him). It provides ethical and legal frameworks for Muslims, covering everything from personal conduct to financial dealings.

In the context of finance, Sharia lays out rules designed to ensure fairness, justice, and mutual benefit in transactions. Its principles emphasise ethical behaviour, social responsibility, and the importance of aligning financial activities with Islamic values.

For Muslims, adhering to Sharia-compliant finance means choosing investments and transactions that honour their faith. For others, it represents an opportunity to engage in ethical and socially responsible investing.

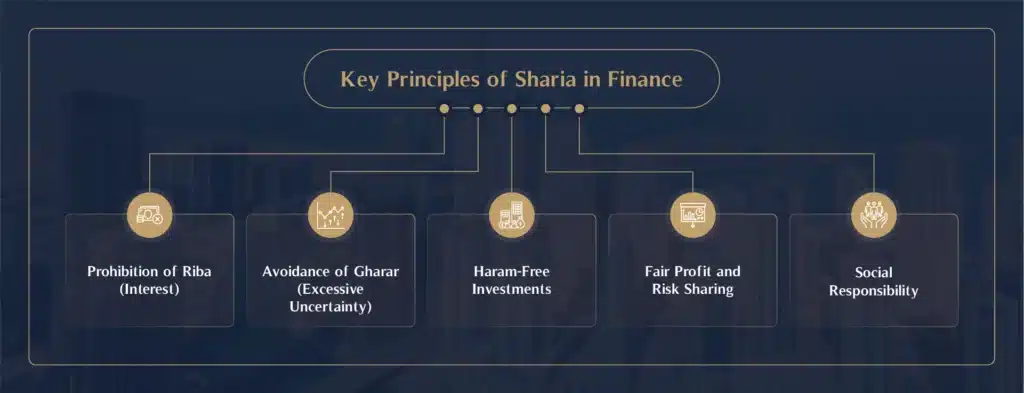

Key Principles of Sharia in Finance

Prohibition of Riba (Interest):

Interest is strictly forbidden in Sharia because it’s seen as exploitative. Instead of earning through interest, Sharia-compliant investments focus on profit-sharing or generating income from tangible assets.

Avoidance of Gharar (Excessive Uncertainty):

Transactions must be clear and transparent. Sharia prohibits speculative activities or deals involving high levels of uncertainty, such as gambling or trading derivatives.

Haram-Free Investments:

Investments must steer clear of industries or activities considered harmful or unethical under Islamic law. These include alcohol, gambling, pork production, and certain financial services.

Fair Profit and Risk Sharing

Financial dealings should benefit all parties involved. Sharia encourages structures like Mudarabah (profit-sharing partnerships) and Musharakah (joint ventures) where profits and risks are shared equitably.

Social Responsibility:

A portion of wealth should be used to support the less fortunate, reflecting the Islamic principle of zakat (charitable giving)

What Is Prohibited Under Sharia Law?

Sharia places clear restrictions on certain financial activities to ensure ethical practices. Sharia law forbids:

- Interest-Based Earnings (Riba): Charging or earning interest is forbidden.

- Speculation (Gharar): Investments involving gambling, uncertainty, or excessive risk are not allowed.

- Haram Industries: Investments in businesses related to alcohol, tobacco, gambling, pork, and unethical practices are prohibited.

By adhering to these principles, Sharia-compliant finance ensures that wealth creation is fair, ethical, and aligned with Islamic values.

Best Shariah-Compliant Investments

Sharia-compliant investments provide a way to grow wealth ethically.

Some of the most popular Sharia-compliant investments types include:

- Sharia-Compliant Stocks:

These are shares in companies that meet Sharia guidelines. Businesses involved in permissible activities, such as technology, healthcare, and halal food production, are typically eligible. - Sukuk (Islamic Bonds):

Unlike conventional bonds that pay interest, sukuk are structured to provide returns through asset-backed income. Investors essentially own a portion of the underlying asset and share in its profits. - Real Estate Investments:

Properties used for ethical purposes, such as residential or commercial leasing, align well with Sharia principles. - Sharia-Compliant Funds:

Mutual funds or ETFs focused on Sharia-compliant companies allow investors to diversify their portfolios without compromising their values. - Alternative Investments:

Innovative products like Fenchurch Legal or MHG Capital offer unique opportunities for Sharia-compliant growth, catering to both traditional and modern financial goals.

Sharia-Compliant Stocks and Their Performance

Many investors assume that limiting investments to Sharia-compliant options reduces the potential for growth. However, the reality is quite different. Sharia-compliant stocks often perform well because they emphasise long-term value, sustainable practices, and reduced financial risk.

Stocks undergo rigorous screening to ensure they align with the ethical and financial guidelines of Islamic finance.

Examples of Sharia-Compliant Stock Indexes

- S&P 500 Shariah Index: This index includes approximately 275 Sharia-compliant constituents from the S&P 500. Over the last decade, it has demonstrated competitive performance, averaging an annual return of 14.25% as of March 2024, outperforming the conventional S&P 500, which achieved 12.96% annually during the same period. This index excludes sectors like traditional banking and instead has heavier weightings in technology and healthcare

- Dow Jones Islamic Market World Index: Established in 1999, this index features around 4,700 constituents worldwide and focuses on sectors such as technology, healthcare, and industrials. It has provided steady returns while aligning with Islamic financial principles, serving as a comprehensive benchmark for global Sharia-compliant investments

- MSCI World Islamic Index: With roughly 370 constituents, this index filters Sharia-compliant large- and mid-cap stocks from 23 developed markets. It emphasises technology, energy, and healthcare stocks and has consistently provided robust returns similar to its parent MSCI World Index

Insights on Performance

Sharia-compliant stocks tend to outperform during economic downturns due to their exclusion of high-risk and heavily leveraged businesses. For instance, during the COVID-19 pandemic, sectors like technology and healthcare, common in Sharia-compliant indexes, outperformed traditional industries like banking and energy.

However, these indexes may underperform in periods when financial and conventional banking stocks thrive, as seen during the banking recovery in 2016.

Examples of Successful Sharia-Compliant Funds

Sharia-compliant funds have carved a niche in the global financial market, attracting both faith-based and ethical investors.

Here are some standout examples of successful sharia-compliant funds:

1. HSBC Islamic Global Equity Index Fund

Overview

This fund primarily invests in technology, software, and pharmaceutical sectors, aligning with Islamic investment principles. It includes 100 of the largest global stocks that meet strict Sharia-compliance standards.

Performance

Over the past decade, the fund has shown steady growth due to its focus on high-performing sectors. As of recent reports, it consistently provides competitive returns against conventional equity funds

2. Amana Funds (Managed by Saturna Capital)

Key Products

Amana Growth Fund (AMAGX): Focused on long-term capital growth.

Amana Income Fund (AMANX): Targets companies with stable dividend payouts.

Performance

The Amana Growth Fund achieved a five-year annual return of approximately 15.98% as of 2023, outperforming many conventional counterparts. Its adherence to ethical investment principles makes it a preferred choice among Sharia-conscious investors

3. S&P Dow Jones Shariah Indices

Notable Indices

The S&P 500 Shariah Index, launched in 2006, mirrors the traditional S&P 500 but filters out non-compliant companies.

Sector Weightage

With information technology comprising 38% of its holdings, it has outperformed traditional indices during tech sector booms

4. Oasis Crescent Funds

Portfolio Composition

Includes equity, Sukuk (Islamic bonds), and property investments.

Performance Highlights

Known for its consistent returns, the Oasis Crescent Global Equity Fund offers a diversified portfolio that has appealed to international investors

Performance Trends in Sharia-Compliant Funds

Sharia-compliant funds have witnessed significant growth over the years, particularly in regions with strong Islamic finance ecosystems. For example:

- Global Assets Under Management (AUM): As of 2023, the total AUM for Sharia-compliant funds exceeded $120 billion, up from $47 billion in 2008

- Regional Growth: The Gulf Cooperation Council (GCC) countries and Malaysia are leading the charge, fuelled by regulatory support and increased investor awareness.

Evaluating Sharia-Compliant Finance

How Do Sharia Funds Compare to Conventional Investments?

When placed side by side, Sharia-compliant funds often match, and sometimes outperform, conventional investments. Here’s why:

- Ethical Focus: Sharia funds avoid industries prone to volatility or unethical practices, leading to more stable returns.

- Tangible Asset-Backed Returns: Unlike speculative investments, Sharia funds derive income from real assets, ensuring transparency and reduced risk.

- Alignment with Sustainability Trends: The emphasis on ethical investing aligns with global trends favouring responsible and sustainable investments.

Key Criteria for Choosing Sharia-Compliant Investments

Investors should consider the following when choosing Sharia-compliant options:

- Certification: Ensure the investment is certified by a reputable Sharia board.

- Transparency: Look for clear and detailed information about how profits are generated.

- Performance: Evaluate historical returns to ensure competitiveness.

- Alignment with Values: Confirm that the investment aligns with both your financial goals and your ethical beliefs.

Importance of Adhering to Sharia Rules

Adhering to Sharia isn’t just about religious observance, it’s about fostering trust, fairness, and long-term growth. Investors who follow Sharia principles often experience peace of mind knowing their wealth is managed ethically and sustainably.

By choosing Sharia-compliant finance, you not only align your investments with your values but also contribute to a financial ecosystem that prioritises fairness, responsibility, and ethical growth.

For expats who now live in the UAE, you need to understand more than just how Sharia Rules impact investing. For more information, read our article on UAE inheritance law for expats.

Conclusion

Sharia-compliant investing isn’t just an option for Muslim investors, it’s a testament to how values-driven investing can foster long-term success. Its emphasis on fairness, ethics, and social responsibility makes it an attractive choice for those who want to grow their wealth while staying true to their principles.

At MHG Wealth, we specialise in crafting personalized financial plans that respect your values and help you achieve your goals. Whether you’re new to Sharia-compliant investing or looking to expand your portfolio, our experts are here to guide you every step of the way.

Take the first step today. Contact us to explore Sharia-compliant investment solutions tailored to your needs. Together, we can help you grow your wealth ethically and sustainably.