We all know Dubai as one of the most influential global hubs for business and tourism in this century. Recently, it has seen significant and sustained growth in both its real estate and private equity markets. Investors are drawn to the city’s strategic location, favourable economic climate, and government initiatives promoting development.

But which of these two key investment opportunities are really the best choice in Dubai? We’re taking a look at some of the five most important factors you need to consider when making this decision.

Benefits of investing in real estate in Dubai

Real estate investment in Dubai has several advantages.

It offers exceptional capital appreciation. Dubai’s real estate market has historically demonstrated strong capital appreciation, making it an attractive option for long-term investors.

It can provide excellent rental income. Because the city also benefits from a thriving tourism industry and growing expat population, this creates a steady demand for rental properties, providing a potential source of passive income.

There are obvious tax benefits: Dubai offers a favourable tax regime, with no personal income tax and a corporate tax rate of 0%.

There are significant government initiatives. The Dubai government has implemented various initiatives to boost real estate development, such as infrastructure projects and visa reforms, further enhancing its appeal to investors.

There have been some high-profile examples of real estate developments that have led the way in this sector.

The Burj Khalifa – the world’s tallest building – is an iconic skyscraper in Downtown Dubai. It has attracted global attention and bolstered real estate values in the area.

The Palm Jumeirah is an artificial island, shaped like a palm tree, that offers luxury residential properties with stunning beachfront views, again, driving demand and prices.

The Dubai Marina is a vibrant waterfront development with high-rise residential towers, hotels, and a bustling marina. It is a magnet for investors looking for both lifestyle and financial returns.

The Dubai Hills Estate is a master-planned community that features luxury villas, townhouses, and apartments, offering a high-quality investment potential.

The Dubai International Financial Centre (DIFC) is a thriving business hub with premium office spaces and residential properties, attracting corporate professionals and investors seeking capital appreciation.

Risks of investing in real estate in Dubai

Real estate investment in Dubai carries certain risks.

The market is volatile. It can be subject to strong fluctuations, and is often influenced by factors like economic conditions, global events, and government policies.

Don’t forget the maintenance costs. Owning and managing any property involves ongoing expenses, including maintenance, utilities, and property taxes – and this is the same in Dubai.

Watch out for your liquidity. When it comes to selling your property and realising your investment, this can all take longer than you’d want. Liquidity can also be affected by market conditions.

Investing in Private Equity in Dubai

Private equity typically means investing in companies that are not publicly traded. In Dubai, private equity funds tend to focus on sectors (including real estate) but also technology, healthcare, and energy.

What are the key advantages of private equity investment in Dubai?

You get higher returns. Private equity funds often aim for higher returns compared to public markets, as they have the potential to actively influence the companies they invest in.

It’s a good way to ensure diversification. Investing in multiple companies across different sectors can help mitigate your risk.

It can give you access to significant growth opportunities. Private equity funds can identify and invest in promising companies with significant growth potential.

However, private equity investment also comes with certain considerations.

Your risk is a lot higher. Private equity investments are generally considered riskier than public market investments due to the illiquidity of the underlying assets and the potential for business failures.

It is a longer investment horizon. Private equity investments typically have a longer holding period. It may take several years for the companies to realise their full potential.

It’s all about due diligence! Thorough due diligence is essential to assess the quality of the investment opportunities and the management team of the target companies.

Private equity investment in Dubai has been significant

There are some notable recent examples of successful private equity firms operating in Dubai:

Abraaj Group: One of the largest private equity firms in the region, Abraaj has invested in various sectors in Dubai, including healthcare, education, and real estate.

Dubai Holding: A government-owned investment company, Dubai Holding has made significant private equity investments in sectors such as hospitality, retail, and technology.

Falcon Private Bank: A Swiss-based private bank with a strong presence in Dubai, Falcon has invested in private equity funds and direct deals in the region.

Mubadala Investment Company: A sovereign wealth fund from Abu Dhabi, Mubadala has made strategic investments in various sectors in Dubai, including energy, infrastructure, and technology.

Wafra Investment Advisory Group: A Kuwait-based investment firm, Wafra has invested in private equity funds and direct deals in Dubai, focusing on sectors such as healthcare and technology.

Real Estate vs. Private Equity in Dubai – Key factors you need to consider

Be sure about your investment goals. You’ll need to clearly define your investment objectives, and pin down your risk tolerance, desired return, and time horizon.

What is your appetite for risk? You should assess your comfort level with the potential risks associated with each investment type.

Where do you have knowledge or expertise? If you have an understanding or connections in either sector, it can make all the difference.

What are your liquidity needs? You will need to carefully evaluate your need for liquidity, real estate can be far less liquid than most private equity investments.

Just how diverse do you want your portfolio to be? Determine how each investment type fits within your overall investment portfolio.

REITs vs private equity real estate

When it comes to investing in real estate, two popular options stand out: Real Estate Investment Trusts (REITs) and Private Equity Real Estate. Each offers unique opportunities and challenges, making it important to understand their structural differences, benefits, drawbacks, and risk profiles to determine which aligns better with your financial goals.

Structural Differences

REITs operate as companies that own, manage, or finance income-generating properties, including commercial properties, residential developments, and mixed-use spaces. They pool funds from multiple investors and follow a mutual fund structure. Investors purchase shares, and REITs distribute income generated from rents or property sales as dividends.

REITs come in two main types:

- Publicly Traded REITs: Bought and sold on stock exchanges, offering high liquidity.

- Non-Traded REITs: Privately held, less liquid, but less exposed to stock market fluctuations.

Private Equity Real Estate, by contrast, focuses on acquiring, managing, and developing properties through pooled investor capital. These funds target long-term gains by actively enhancing the value of properties. Unlike REITs, private equity investments are not publicly traded, making them more exclusive and tailored to high-net-worth individuals or institutional investors.

Advantages and Disadvantages

REITs: Key Advantages

- Accessibility: Publicly traded REITs are open to everyday investors, often requiring smaller minimum investments.

- Liquidity: Shares can be bought or sold easily, making them a convenient option for short-term flexibility.

- Passive Income: Regular dividends provide a steady income stream, especially for investors seeking reliable cash flow.

- Diversification Potential: REITs invest across multiple property types and regions, reducing exposure to specific risks.

REITs: Key Disadvantages

- Market Volatility: Publicly traded REITs are influenced by stock market movements, exposing them to price fluctuations during economic downturns.

- Tax Considerations: Dividends are taxed as ordinary income, which may reduce overall returns for some investors.

Private Equity Real Estate: Key Advantages

- Higher Returns: Private equity funds aim for significant long-term returns through strategic acquisitions and property improvements.

- Customisation: Investors have the opportunity to collaborate with fund managers and sponsors to tailor strategies to their goals.

- Access to Value-Add Projects: Private equity often focuses on value-add projects, where properties are repositioned or redeveloped for higher returns.

Private Equity Real Estate: Key Disadvantages

- Illiquidity: Investments are locked in for several years, with limited opportunities for early withdrawal.

- High Capital Requirements: Entry points typically demand substantial financial commitment, restricting access to smaller investors.

Risk Profiles

- REITs: With diversified portfolios and steady income, REITs generally have a moderate risk profile. However, they remain susceptible to stock market volatility, particularly publicly traded REITs.

- Private Equity Real Estate: Higher risks come with greater potential rewards. These investments often face uncertainties, such as project delays, market changes, or management inefficiencies, requiring a long-term investment horizon.

For an in-depth comparison of private equity and other alternative investments, explore our guide on Alternative Investments vs Traditional Investments.

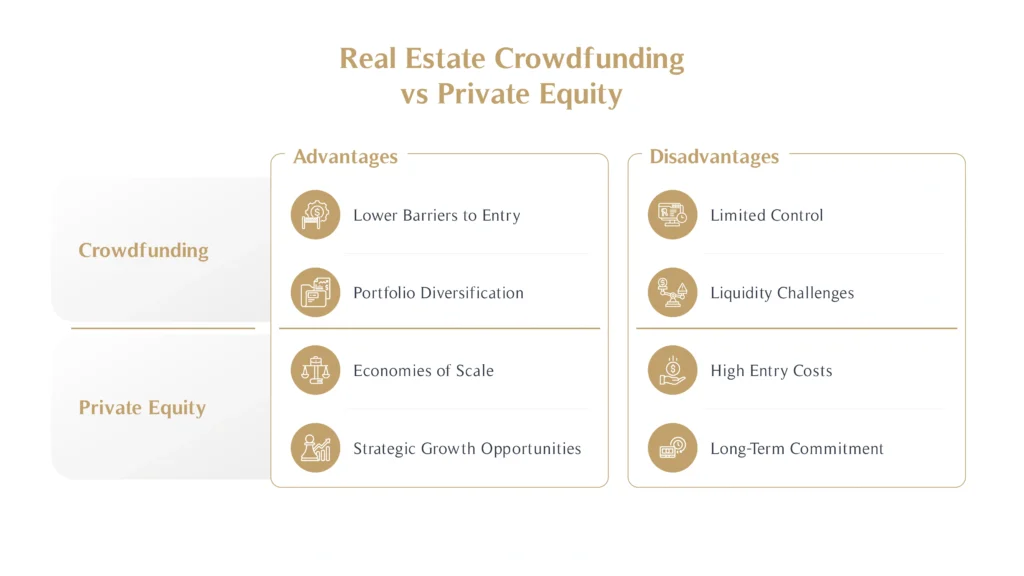

Real Estate Crowdfunding vs Private Equity

As digital platforms revolutionise real estate investing, real estate crowdfunding has emerged as an innovative and accessible alternative to private equity real estate.

Operational Differences

Real Estate Crowdfunding platforms pool capital from multiple investors to finance property acquisitions or developments. Investors can purchase fractional shares, allowing them to own small stakes in properties without significant upfront costs.

In contrast, Private Equity Real Estate involves larger-scale operations with capital sourced from institutional investors or wealthy individuals. It targets high-value projects and focuses on maximising returns through active asset management.

Accessibility and Diversification

Crowdfunding Advantages

- Lower Barriers to Entry: Crowdfunding platforms often require minimal investment amounts, making real estate accessible to a broader audience.

- Portfolio Diversification: Investors can diversify holdings across various property types, locations, and strategies, spreading risk.

Crowdfunding Drawbacks

- Limited Control: Investors have little say in property management or operational decisions.

- Liquidity Challenges: While more flexible than private equity, crowdfunded investments may still have restrictions on early withdrawals.

Private Equity Advantages

- Economies of Scale: Larger funds can negotiate better terms and access exclusive deals, boosting potential returns.

- Strategic Growth Opportunities: Private equity managers actively work to unlock value, focusing on high-growth or value-add projects.

Private Equity Drawbacks

- High Entry Costs: Significant capital is required, making it less accessible for average investors.

- Long-Term Commitment: Investments are typically tied up for years, requiring patience and financial stability.

Learn how Dubai’s tech ecosystem integrates crowdfunding as a driver of innovation in alternative investments.

Real Estate Syndication vs Private Equity

For those exploring collective real estate investments, real estate syndication is another avenue worth considering alongside private equity.

Key Similarities

- Pooling Resources: Both syndication and private equity rely on combined capital to acquire or develop properties.

- Professional Management: Syndications often involve a sponsor who manages the property, while private equity funds employ expert managers to oversee investments.

- Diversification Potential: Both options allow investors to access diversified portfolios, minimising risk.

Key Differences

- Ownership Structure: In syndication, investors form a legal partnership with the sponsor, directly owning a share of the property. Private equity investors own shares in a fund rather than the underlying properties.

- Project Scale: Syndications generally focus on single projects, such as a value-add project or a single income-generating real estate asset. Private equity funds often manage multiple properties or larger developments.

- Risk and Control: Syndications offer more control over individual investments, but private equity funds spread risk across diverse assets.

Choosing the Right Fit

Real estate syndication may appeal to investors seeking direct involvement in specific projects, while private equity is ideal for those with a higher risk tolerance and the ability to commit significant capital over the long term.

By carefully evaluating these options, you can determine which aligns best with your financial objectives.

Conclusion

Both real estate and private equity offer unique opportunities in Dubai’s dynamic market. Of course, the optimal choice depends on your individual circumstances, your risk tolerance, and investment goals.

You should conduct thorough research and seek professional advice before you can make an informed decision. Finding wealth advice that is appropriate to the Dubai economic context is essential. There are a number of excellent advisors who, despite being knowledgeable, have no direct experience in Dubai or other UAE states.

Financial advisors at MHG Wealth have decades of combined experience in the region and can help steer your investments and help you build a diverse, but advantageous portfolio for you. Whether real estate or private equity works better for you is probably personal – whatever your final decision, the right advice will help maximise returns and keep risk under control.

FAQs

Is private equity the same as real estate?

Not entirely. While private equity often includes real estate investments, it also spans other sectors like technology and healthcare.

Is it worth doing real estate in Dubai?

Dubai’s thriving property market offers significant growth potential and tax advantages, making it an attractive destination for real estate investment.

How profitable is Dubai real estate?

With rental income and strong demand, Dubai real estate provides steady cash flow and high returns, but success depends on market timing and location.

What are the disadvantages of private equity real estate?

The primary challenges include illiquidity, high capital requirements, and the potential for project-specific risks.