Tax planning is often overlooked, but it’s one of the most powerful tools for building wealth and achieving financial independence. Whether you’re saving for retirement, growing a business, or simply managing your day-to-day finances, understanding how taxes work can help you make smarter decisions.

Your tax liability is the total amount of tax you owe based on your income, investments, and other financial activities. Without proactive planning, you may end up paying more than necessary. For expats managing finances across borders, understanding double tax agreements is essential to avoid unnecessary taxation and optimise financial efficiency while complying with international tax laws

This article will guide you through practical strategies to help you lower your tax burden while staying compliant with UK tax laws.

Understanding Taxable Income

Before diving into strategies, it’s essential to understand the basics of taxable income.

What is Taxable Income?

Taxable income is the portion of your income that is subject to tax. It includes earnings from various sources, such as:

- Your salary or wages from employment.

- Profits from self-employment or freelance work.

- Interest from savings accounts.

- Dividends from investments.

- Rental income from property.

How Does the UK Tax System Work?

The UK uses a progressive tax system, meaning the more you earn, the higher the percentage you pay in taxes. Here’s a snapshot of the current tax brackets (2024/25):

- Personal Allowance: £12,570 – You don’t pay tax on income below this threshold.

- Basic Rate: 20% tax on income between £12,571 and £50,270.

- Higher Rate: 40% tax on income between £50,271 and £125,140.

- Additional Rate: 45% tax on income above £125,140.

Why Understanding Tax Brackets Matters

Knowing how much you can earn before hitting the next tax bracket allows you to plan your finances strategically. For instance, if you’re nearing the higher rate threshold, contributing to a pension or other tax-efficient investment can reduce your taxable income and keep you in a lower bracket.

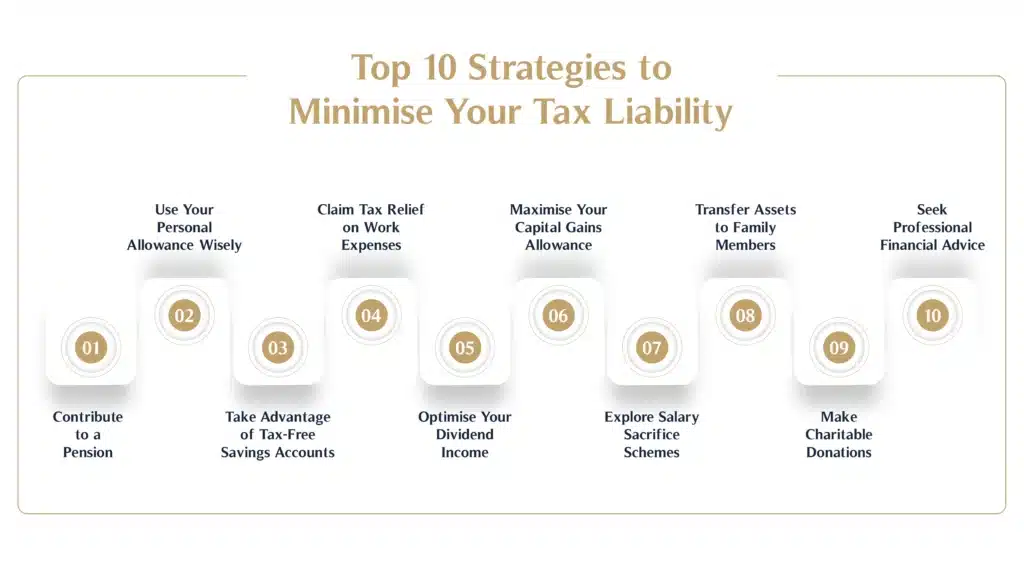

Top 10 Strategies to Minimise Your Tax Liability

1. Contribute to a Pension

Contributing to your pension not only helps secure your retirement but also reduces your taxable income. For example, if you earn £55,000 and contribute £5,000 to your pension, your taxable income drops to £50,000, keeping you within the basic rate tax band.

For higher earners, pensions offer significant tax relief:

- Basic rate taxpayers get 20% tax relief.

- Higher rate taxpayers can claim an additional 20% through their tax return.

2. Use Your Personal Allowance Wisely

The first £12,570 of your income is tax-free. If your income is below this threshold, consider ways to make the most of this allowance, such as transferring savings or assets to a spouse with lower earnings.

3. Take Advantage of Tax-Free Savings Accounts

Individual Savings Accounts (ISAs) let you save or invest up to £20,000 per year tax-free. Whether you prefer cash ISAs for safe growth or stocks and shares ISAs for potentially higher returns, these accounts shield your income from taxes.

4. Claim Tax Relief on Work Expenses

If you’re self-employed or incur expenses as part of your job, you can claim tax relief. Common eligible expenses include:

- Travel and fuel costs.

- Office equipment and supplies.

- Professional subscriptions.

- A portion of your home utility bills if you work from home.

5. Optimise Your Dividend Income

If you’re a business owner or have shares, dividends are an efficient way to receive income. The first £1,000 of dividend income is tax-free, and rates beyond this are often lower than income tax rates.

6. Maximise Your Capital Gains Allowance

The capital gains tax allowance for the 2024/25 tax year is £6,000. If you’re selling property, shares, or other investments, plan your sales to utilise this allowance effectively. For couples, transferring assets to a spouse can double the allowance.

7. Explore Salary Sacrifice Schemes

Salary sacrifice arrangements, such as those for childcare vouchers or cycle-to-work schemes, reduce your taxable income while providing valuable benefits. These schemes can be especially beneficial for reducing National Insurance contributions as well.

8. Transfer Assets to Family Members

Gifting income-producing assets to family members in lower tax brackets can help reduce the overall family tax burden. However, it’s essential to ensure compliance with inheritance tax rules when making significant gifts.

9. Make Charitable Donations

Charitable giving under the Gift Aid scheme can reduce your tax bill. For example, if you’re a higher-rate taxpayer, donating £100 allows you to claim back £25 through your tax return.

10. Seek Professional Financial Advice

The UK tax system is complex, and the rules can change frequently. A financial advisor can help you identify lesser-known reliefs, navigate tax legislation, and tailor a strategy to your unique situation.

Conclusion

Conclusion

Minimising your tax liability isn’t about avoiding taxes, it’s about being smart with your finances. From pension contributions to tax-free savings, there are countless ways to keep more of your income without breaking any rules.

Proactive tax planning ensures you’re not leaving money on the table, allowing you to invest in your future with confidence. At MHG Wealth Management, we specialise in personalised financial advice tailored to your goals. Whether you’re just starting out or are an experienced investor, we’re here to help.

Ready to optimise your tax strategy? Get in touch with us today to learn how we can support you.

Conclusion

Conclusion