Investing is a powerful tool for wealth creation, but success requires patience, discipline, and strategic planning. Long-term investment strategies focus on sustained growth over time, allowing investors to maximise returns while minimising the risks associated with short-term market volatility. This guide explores key strategies, including the buy-and-hold investment strategy and future investment strategies that can help individuals build wealth over time.

Understanding Long-Term Investment Strategies

Long-term investment strategies involve holding assets for extended periods, typically five years or more, with the goal of capital appreciation and wealth accumulation. Unlike short-term trading, which relies on market timing and frequent transactions, long-term investing emphasizses fundamental value, diversification, and the compounding effect of returns.

Key Benefits of Long-Term Investment Strategies:

- Compounding Growth: Earnings generated from investments are reinvested, accelerating wealth accumulation over time.

- Reduced Transaction Costs: Fewer trades mean lower fees and taxes.

- Lower Emotional Stress: Investors are less affected by daily market fluctuations, reducing impulsive decision-making.

The Buy-and-Hold Investment Strategy

The buy-and-hold investment strategy is a cornerstone of long-term investing. It involves purchasing quality assets and holding them through market ups and downs, rather than attempting to time the market.

Why Buy-and-Hold Works:

- Market Resilience: Despite short-term fluctuations, markets historically trend upwards over the long term.

- Tax Efficiency: Long-term capital gains are taxed at lower rates compared to short-term trades.

- Compounding Returns: Reinvested dividends and earnings drive significant portfolio growth.

Examples of Buy-and-Hold Investments:

- Blue-Chip Stocks: Established companies with strong financial histories (e.g., Apple, Microsoft).

- Index Funds & ETFs: Low-cost, diversified funds that track market indices.

- Real Estate: Properties held for long-term appreciation and rental income.

Diversification: A Pilar of Long-Term Investing

Diversification is key to reducing risk while maximising returns. A well-diversified portfolio includes a mix of asset classes, industries, and geographies to ensure balanced exposure.

Strategies for Diversification:

- Stocks and Bonds: Balance high-growth equities with stable fixed-income assets.

- Sector Allocation: Invest across different industries (e.g., technology, healthcare, finance).

- International Exposure: Consider emerging and developed markets to hedge against local downturns.

- Alternative Investments: Private equity, real estate, and commodities can provide additional stability.

Future Investment Strategies

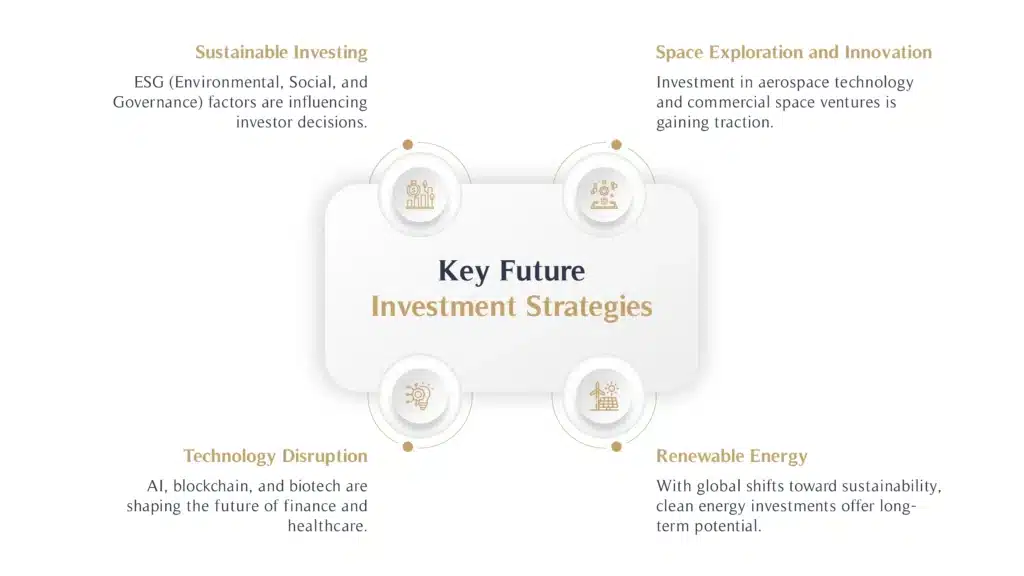

As financial markets evolve, future investment strategies are becoming increasingly important for long-term investors. Emerging trends and disruptive technologies are reshaping the investment landscape.

Key Future Investment Strategies:

- Sustainable Investing: ESG (Environmental, Social, and Governance) factors are influencing investor decisions.

- Technology Disruption: AI, blockchain, and biotech are shaping the future of finance and healthcare.

- Renewable Energy: With global shifts toward sustainability, clean energy investments offer long-term potential.

- Space Exploration and Innovation: Investment in aerospace technology and commercial space ventures is gaining traction.

Risk Management in Long-Term Investment

While long-term investing reduces short-term volatility, it still carries risks. A sound risk management approach is essential to protect capital.

Risk Management Strategies:

- Portfolio Rebalancing: Periodically adjust allocations to maintain target risk levels.

- Emergency Fund: Maintain liquidity to avoid forced asset sales during downturns.

- Investment Horizon Matching: Align investment choices with financial goals and timeframes.

- Emotional Discipline: Avoid panic selling during market downturns and stay focused on long-term goals.

Practical Steps to Implement Long-Term Investment Strategies

- Set Clear Goals: Define financial objectives, risk tolerance, and time horizon.

- Conduct Research: Analyze potential investments based on fundamentals and future growth potential.

- Leverage Tax-Advantaged Accounts: Use IRAs, 401(k)s, and other accounts to maximize tax efficiency.

- Stay Consistent: Regularly invest through market fluctuations to benefit from dollar-cost averaging.

- Review and Adjust: Periodically reassess portfolio performance and make necessary adjustments.

Conclusion

Building wealth through long-term investment strategies requires patience, discipline, and a well-structured approach. By leveraging the buy-and-hold investment strategy, diversifying portfolios, and integrating future investment strategies, investors can navigate market fluctuations and achieve sustainable financial growth. The power of compounding returns, tax efficiency, and risk management plays a crucial role in ensuring long-term success.

As the financial landscape evolves, opportunities in emerging markets, technology disruption, ESG investing, and alternative assets offer new avenues for wealth accumulation. Alternative investments—such as private equity, hedge funds, real estate, commodities, and cryptocurrencies—can provide portfolio diversification and potential risk-adjusted returns that are less correlated with traditional stock and bond markets.

For those seeking expert guidance in long-term investing, MHG Wealth provides tailored financial solutions designed to help clients build and sustain wealth over time. With a focus on strategic asset allocation, risk management, and future-focused investment strategies, MHG Wealth empowers investors to make informed decisions and secure financial stability in the long run.

What are the most effective long-term investment strategies?

The most effective strategies include buy-and-hold investing, portfolio diversification, reinvestment of dividends, and using tax-advantaged accounts such as IRAs and 401(k)s. These strategies help investors achieve long-term financial growth while mitigating risk.

How does a buy-and-hold investment strategy work?

A buy-and-hold investment strategy involves purchasing quality assets and retaining them over a long period despite market fluctuations. Investors benefit from long-term capital appreciation and the power of compounding returns.

What are the benefits of long-term investing?

Long-term investing provides advantages such as lower transaction costs, tax benefits, reduced emotional stress, and the ability to leverage market resilience. It allows investors to build wealth steadily without frequent trading.

What are future investment strategies to consider for long-term growth?

Future strategies include investing in ESG (Environmental, Social, and Governance) funds, technological advancements like AI and blockchain, renewable energy sectors, and emerging markets, all of which show promising long-term growth potential.

How does diversification impact long-term investment success?

Diversification helps reduce risk by spreading investments across multiple asset classes, industries, and regions. This ensures a balanced portfolio that can withstand economic shifts and market volatility.

What role do emerging markets play in long-term investment strategies?

Emerging markets offer high growth potential and diversification benefits but also come with increased volatility. Investing in these markets can be beneficial if approached with a balanced risk strategy.

How can technological advancements influence future investment strategies?

Technologies such as AI, blockchain, and biotech are shaping the future economy, and creating new investment opportunities. Investors who adapt to these innovations can benefit from the growth of disruptive industries.