If you want to pursue legal action for your business, but you’re understandably concerned it could be too costly, you may want to consider litigation funding as a solution.

Litigation funding covers the legal costs for your business, reducing your financial strain. Although it used to be illegal in England and Wales, litigation funding is now accepted in arbitration and commercial disputes, and courts consider it a valid tool for allowing access to legal justice.

Key takeaways:

- Litigation funding is growing in popularity.

- Litigation finance lets you stay in control of your legal battle, but reduces the stakes.

- Litigation funding also works as an alternative investment option.

What is Litigation Funding?

Litigation funding (sometimes called litigation finance, third-party funding or legal finance) is a financial arrangement where a specialist funding company pays the legal costs of a case in exchange for a share of the proceeds if it succeeds.

In its most basic form, the overall purpose of litigation funding is to reduce the financial burden of pursuing legal claims, so individuals or businesses to access justice without having to cover high upfront costs.

The benefits of litigation funding are obvious, as it allows claimants to move forward with strong cases without draining their cash flow, while investors gain exposure to a unique asset class. Of course, there are risks too. Funders take a share of the winnings, and if the case fails, investors may lose their capital.

A few useful terms often come up in this space:

- Litigation finance: A funding arrangement covering legal costs.

- Third-party funding: External capital provided by a non-party to the case.

- Litigation funding loans: Short-term loans specifically for covering legal expenses.

- Loan notes: Debt instruments outlining repayment terms between lender and borrower.

While funders provide the financial backing needed, control of the case remains with the claimant. That said, litigation funders will usually request progress updates and they reserve the right to withdraw their support if the case runs into serious difficulties. Litigation funding provides both opportunity and protection, so those in need can get access to justice while sharing the financial risks involved.

Distinction Between Funding and Financing in Legal Contexts

When it comes to funding and financing in legal disputes, there are a number of differences. With traditional financing, you use conventional sources to fund your case, including:

- Personal savings

- Credit cards

- Loans from family/friends

- Borrowing from financial institutions

Litigation funding allows you to focus on your business, because the legal case is being funded by a third party, usually a specialised litigation fund.

The Role of Litigation Funders

Litigation funders specialise in different types of claims, so you can pick one that fits your legal case. Once they are involved, they act as passive investors, so you retain control during the litigation process. Any strategic decisions that may arise will require your consent. These can include:

- Settlement

- Claim withdrawal

- Filing an appeal

Why Litigation Funding is Different From Traditional Financing

The table below summarises how litigation funding differs from other forms of financing.

| Feature | Litigation funding | Traditional financing |

| Source of funds | Specialist litigation funders | Banks, personal savings, credit cards |

| Repayment terms | Only repay if you win (via agreed share) | Repay regardless of outcome |

| Risk to business | Legal costs off balance sheet; no recourse if lost | Potential debt and interest obligations |

| Impact on cash flow | Preserves working capital | Monthly repayments can strain cash flow |

The Process of Litigation Funding

How Litigation Funding Works

If a litigation funder accepts a claim, they pay your legal fees and other expenses that may arise during the claim process.

Sometimes, this can also cover adverse cost risks as the claim progresses. For example, if a court orders you to immediately pay your adversary the costs associated with a defeat at an interlocutory/interim hearing.

Or, they pay the cost at the end of your trial. Bear in mind that if you lose your trial, you may still be ordered to pay your adversary’s legal fees – despite your case having been funded.

Litigation Funding: Step-by-Step

Step 1 – Case evaluation: Funders assess merits, legal precedent and insurance coverage (e.g. ATE policies).

Step 2 – Agreement signing: Both parties agree on funding terms, return structure and reporting requirements.

Step 3 – Funding release: Funders pay legal costs directly to the law firm.

Step 4 – Case management: Legal team runs the case; funders may request updates, but don’t control decisions.

Step 5 – Outcome and settlement: If you win, funders receive their agreed share. If you lose, they typically get nothing.

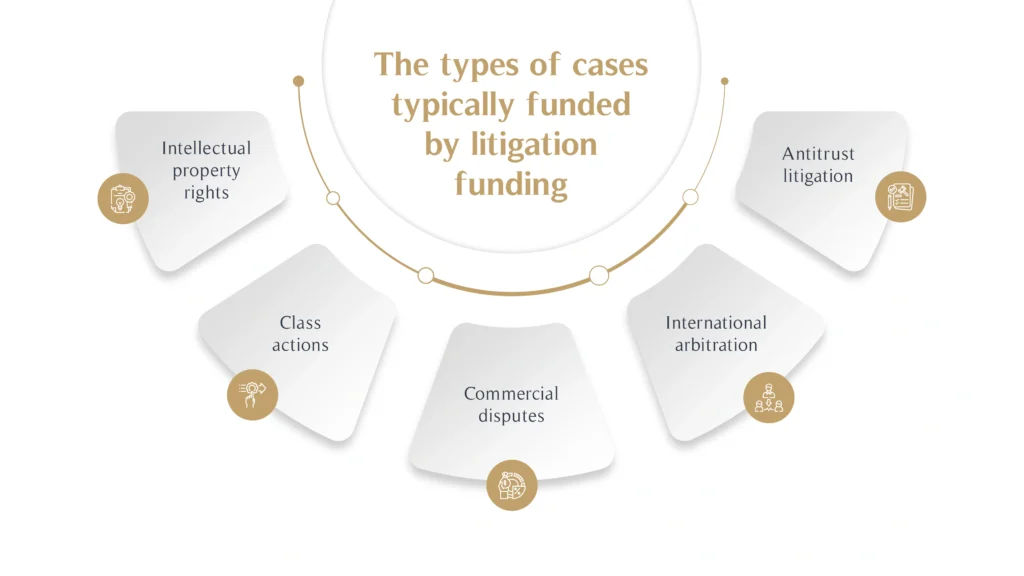

The Types of Cases Typically Funded by Litigation Funding

Litigation funders can support a wide range of cases, including:

- Intellectual property rights

- Class actions

- Commercial disputes

- International arbitration

- Antitrust litigation

The relationship between plaintiffs and funders can be complicated. Both hope to see a positive outcome, because if the plaintiff loses, they don’t usually have to repay the litigation funder for the money they provided. And there is the risk that a funder can pull out if they can see they may lose the case.

If you own a law firm, you may already be aware that litigation can be expensive and long. So you need flexible and straightforward litigation financing. You need Fenchurch Legal.

Fenchurch Legal, established in 2020, serves small-to-medium-sized law firms with short-term, tailored loans from six to 24 months, on a case-by-case basis. Only cases with a strong legal precedent, with full insurance from an ATE policy, are funded.

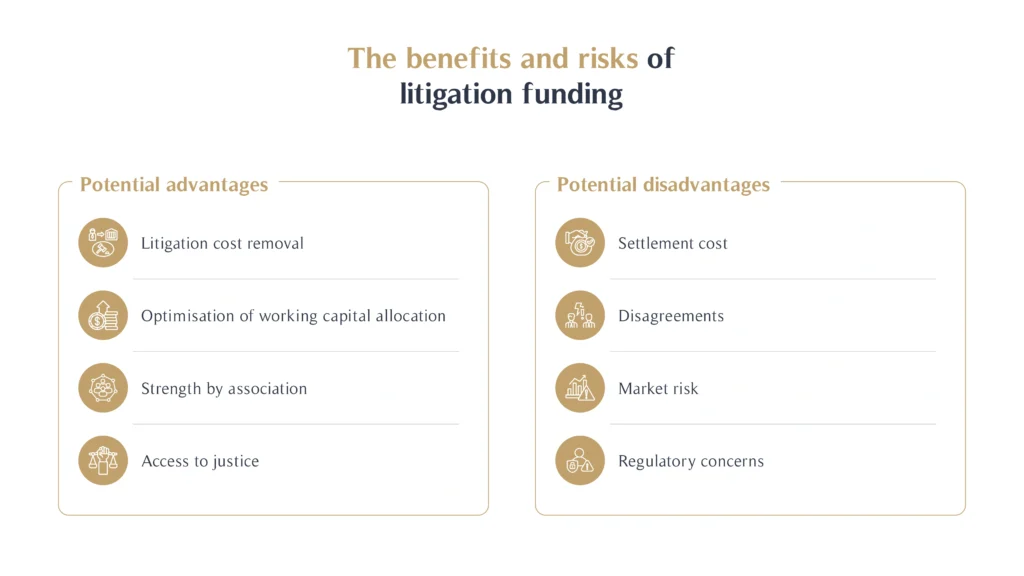

The Benefits and Risks of Litigation Funding

Advantages of Litigation Funding

- Litigation cost removal: No matter how lengthy the case is, you can remove this cost from your business balance sheet

- Optimisation of working capital allocation: The money you save can be retained and invested directly into the development of your business

- Strength by association: If you work with professional, experienced litigation funders, you send a message to your rival that you are determined to win the case

- Access to justice: You can pursue legal claims without an upfront cost

Potential Disadvantages of Litigation Funding

- Settlement cost: The funder’s share could be significant

- Disagreements: Litigation funders may want a say in how the case progresses

- Market risk: Funders must consider the unpredictability of the market

- Regulatory concerns: The regulatory environment can vary depending on location

Recent UK research suggests that third-party legal funding is enabling individuals, SMEs and corporations to access justice that they might have missed out on. However, the impact remains frustratingly small unless further reforms take place.

UK Regulations & Legal Framework

Litigation funding was once prohibited in England and Wales, but legal reforms in the late 20th century opened the door for its use in commercial disputes and arbitration. These changes marked a shift from strict common law restrictions to a more regulated framework, driven by a desire to improve access to justice.

Today, the sector operates under the guidance of the Association of Litigation Funders (ALF) and the UK Civil Justice Council. The Civil Justice Council’s Code of Conduct for Litigation Funders sets out clear expectations on transparency, capital adequacy, and dispute resolution, ensuring that both clients and investors can engage with confidence.

You can read the full guidelines on the UK government’s website.

Litigation Funding as an Alternative Investment Option

The rise of UK litigation funding also offers the chance for investors to do well. For example:

- Steady returns: You can make 10-13% per annum.

- Low risk: There’s little correlation with traditional markets, so you can avoid economic volatility.

- Diversification: Broaden the horizons of your portfolio beyond stocks and shares.

Litigation funding is an emerging alternative asset class that attracts investors seeking steady returns with low correlation to traditional markets.

Investor Benefits:

- Attractive yields: Target returns of 10-13% p.a. (Fenchurch Legal data).

- Low market correlation: Independent from equities, bonds, and property markets.

- Impact investing: Your capital helps individuals and SMEs access justice.

- Diversification: Expands portfolios beyond conventional asset classes.

| Asset Class | Average Annual Return |

| Litigation Funding | ~10–13% |

| UK Equities (FTSE 100) | ~5–6% |

| Corporate Bonds | ~5.5% |

| Gilts (UK Govt Bonds) | ~4.0% |

Risks for Investors:

- Case loss can mean capital loss

- Extended case durations (12–36 months)

- Regulatory changes affecting viability

- Need for diversification across multiple cases

Example Investment Scenario:

- Investment: £100,000

- Timeframe: 18 months

- Potential Return: £115,000 – £119,000 (based on 10-13% p.a.)

- Risk: Loss is possible if the case fails

Case Studies

1. Small Business Victory

A manufacturing SME faced a breach-of-contract dispute. Without funding, they would have abandoned the claim. A litigation funder covered £250,000 in legal costs.

- Duration: 14 months

- Outcome: £1.2M settlement

- Funder return: 25% of proceeds

2. Investor Return Example

An investor committed £50,000 to a pool of commercial disputes.

- Duration: 24 months

- Outcome: 12% annualised return (£13,000 profit)

- Risk mitigation: Investment spread across five cases.

What are Loan Notes?

A loan note is a key financial tool used in investing and lending. Also known as a promissory note, bill of exchange or formal IOU, a loan note is a debt agreement that outlines all the terms under which a lender loans money.

Loan notes can be offered to shareholders and employees as incentives, rather than typical stocks and shares.

Companies like Fenchurch Legal and MHG Capital offer lucrative opportunities, so get in touch to find out how they can help.

Litigation funding is a relatively new and very welcome addition to the tools available if you need to take legal action. It mitigates risk, provides greater access to potential justice, and levels the playing field.

However, for litigation funding to grow in impact, litigation funders and clients must work together to develop robust funding agreements while meeting regulatory requirements.

Litigation Funding Loans: When They’re the Right Option

Litigation funding loans serve as short-term, tailored lending products (6 – 24 months) to help law firms or claimants cover costs while awaiting resolution. They differ from standard business loans by having repayment linked to the case outcome and being potentially secured against case proceeds, complemented by After the Event (ATE) insurance for risk mitigation.

Litigation funding is a timely addition to legal tools, mitigating risks and enhancing access to justice. However, there’s room for impact growth as litigation funders and clients collaborate to forge robust funding agreements compliant with regulatory requirements.

Through alternative litigation financing, businesses and investors can effectively navigate the complexities of legal disputes while minimizing financial risk.

Key Learnings

- Types of cases funded: Covers a range of legal disputes, including intellectual property rights, class actions and commercial disputes, providing essential financial support for SMEs.

- Process and control: Litigation funders act as passive investors while covering legal costs; business owners maintain control over strategic legal decisions.

- Investment risks and management: Though offering lucrative returns, investing in litigation funding involves risks like potential capital loss in case of failure and regulatory considerations.

- Strategic use: Mitigates legal cost risks, optimises working capital and strengthens a business’s ability to pursue justice without financial strain.

Get in touch with MHG Wealth today to learn more about litigation funding and why it’s a great alternative asset for your investment portfolio.