Are you wondering what to do with your money once you are no longer working? Are you looking for some advice regarding investing in retirement? Our helpful guide provides effective retirement investing strategies.

When you switch from building up your money in your pension to taking money out as you move into your retirement, the way you invest will need to change to reflect your new goals and new way of life.

Importance of investing in retirement

When you were building up your money in the early years, generally you were trying to grow it as much as possible. But, as you approach retirement, that may change. Now you might be trying to grow it to keep pace with inflation while also trying to protect it from any big drops in value.

Once you begin taking money out, the way you invest your pot needs to be more personalised to the goals you have for using your money.

For example, if you’ve taken some money – maybe to pay off your mortgage – but don’t intend to start drawing down more money for retirement until a few years later, you may want to focus on protecting the money and still trying to grow it slightly.

If, on the other hand, you want to begin using the money to give you a regular income, you might choose investments that won’t go up and down too much as the stock markets change.

This is important because if your pension pot drops in value and you continue to make withdrawals from it, it’ll be much harder for your pot to recover its losses when the stock market rises again. It’s particularly important in the early years of your retirement when losses can disproportionately affect how long you might be able to take income for.

Remember, you will probably live 20 years or more in retirement. So, if you take too much too early, especially when the markets are on a downturn, you could significantly reduce how long your income will last.

Understanding your retirement investment needs

When investing for retirement, consider these key factors:

- Risk Tolerance: Assess your comfort level with market fluctuations.

- Time Horizon: Determine how long your savings need to last.

- Income Goals: Set specific income targets for retirement.

- Tax Implications: Understand tax rules to minimise your tax burden.

- Diversification: Spread your investments across different asset classes to reduce risk.

- Professional Advice: Seek guidance from a financial advisor to create a tailored plan.

Where to invest for retirement

Stocks can be volatile, but offer significant long-term returns. However bonds are a more conservative option, providing steady income but lower returns.

Investing in property can generate income through rent or appreciation, but take a while to really pay dividends. Annuities can provide a guaranteed income stream. But it is worth considering alternative investments like commodities, precious metals, or collectibles, but be aware of their risks.

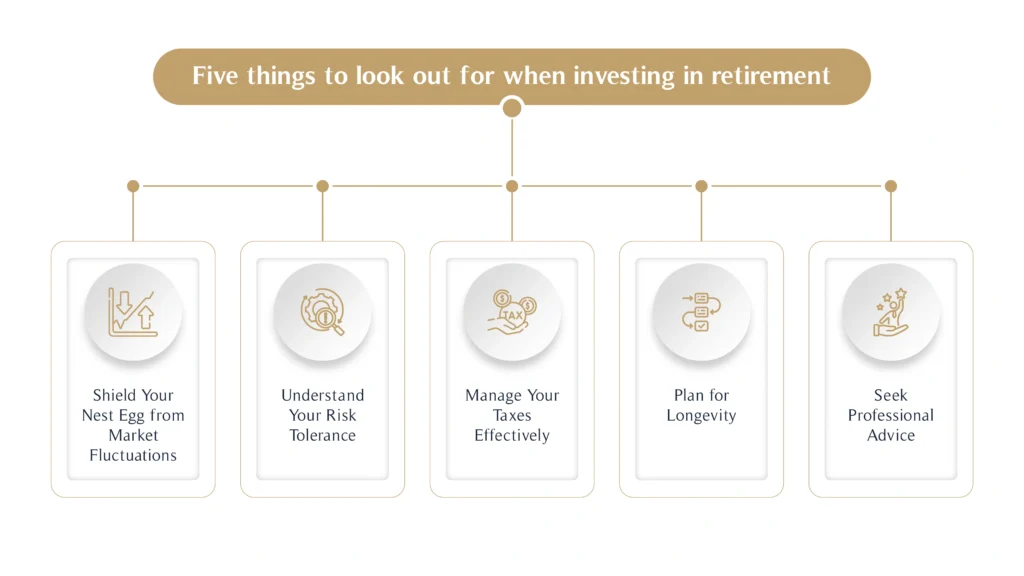

Five things to look out for when investing in retirement

Retirement marks a significant milestone in life, and investing in retirement wisely can help ensure a comfortable and financially secure future. However, the landscape of investing changes once you’ve left the workforce. Here are five crucial things to keep in mind:

1. Shield Your Nest Egg from Market Fluctuations

You should prioritise preservation because as you age, your primary goal should be to preserve your wealth rather than chasing high returns. Market volatility can significantly impact your retirement savings.

Make sure you diversify and spread your investments across various asset classes (stocks, bonds, real estate, etc.) to reduce risk. This helps mitigate the impact of any individual investment’s performance.

You may want to consider a slightly more conservative investment portfolio with a higher allocation to fixed-income securities like bonds or annuities. These investments offer lower returns but are generally less volatile than stocks.

2. Understand Your Risk Tolerance

You will want to assess your comfort level for risk – which might be lower now you are retired. Think about how well you’ll be able to deal with market fluctuations. Your risk tolerance will influence your investment choices.

Regular revaluation will help you monitor how your risk tolerance changes as you age and your financial circumstances evolve. It’s a good idea to periodically reassess your comfort level with risk and adjust your portfolio accordingly.

3. Manage Your Taxes Effectively

You should use tax-advantaged retirement accounts like IRAs, 401(k)s, ISA or SIPPs to defer capital gains and income taxes, as well as considering converting traditional IRA or 401(k) balances to Roth accounts during periods of lower income to potentially reduce future tax burdens.

You may need to sell underperforming investments to offset capital gains from other investments, reducing your overall tax liability.

4. Plan for Longevity

Be realistic about your life expectancy. You’ll need to factor in your expected lifespan when creating your retirement plan. You can use longevity calculators to estimate how long your savings need to last.

Don’t forget that annuities can provide a guaranteed income stream for life, helping to protect against outliving your assets.

You should determine the optimal age to start receiving Social Security benefits to maximise your lifetime benefits.

5. Seek Professional Advice

A certified financial planner can give you a personalised plan and the guidance you need to help you develop a comprehensive retirement plan. At MHG Wealth, our financial advisors review your portfolio and make necessary adjustments based on changing market conditions, plans to retire abroad, and your evolving needs.

Income generation from investments

Generating a steady income during retirement is a crucial aspect of financial planning. While capital preservation is essential, it’s equally important to ensure your savings work for you by producing a reliable income stream. Below, we delve into effective strategies for income generation from retirement investments and how to maintain the balance between protecting your capital and meeting your income needs.

Income-generating investments for retirees

- Dividend-Paying Shares:

Investing in companies that offer regular dividends provides a consistent income stream. Dividends can be reinvested to grow your capital or used as immediate income, depending on your financial goals. - Bonds:

Bonds are a conservative option for retirees seeking predictable returns.- Government Bonds: Offer lower risk and steady returns, especially useful for income stability.

- Corporate Bonds: Provide higher yields but come with slightly more risk.

- High-Yield and Income Funds:

These funds combine various income-generating investments, such as bonds, dividend-paying stocks, and real estate, offering diversification and regular payouts. - Annuities:

An annuity can be an excellent choice for retirees who want guaranteed income. With a fixed annuity, you receive a predetermined payment over your lifetime or a specified period, providing financial security and predictability. - Multi-Asset Funds:

These funds blend different types of investments (stocks, bonds, and alternative assets), offering income while managing overall risk through diversification.

Learn more about retirement income options in our article on Types of Pensions and Withdrawal Age in the UK.

Strategies for generating income in retirement

- Natural Yield Strategy:

Focus on investments that generate income through interest, dividends, or rent, rather than selling off assets. This approach preserves your capital while ensuring a steady income flow. - Pension Drawdown:

A flexible option that allows you to withdraw money from your pension while keeping the remainder invested. This method can provide tax-free income if planned carefully, but it’s vital to manage withdrawals to avoid depleting your savings prematurely. - Capital Drawdown with Caution:

In some cases, selling a portion of your investments to generate income might be necessary. Ensure withdrawals align with your financial plan and consider market conditions to minimise losses during downturns. - Tax Efficiency:

Use tax-advantaged accounts and strategies to maximise income. For example:- Opt for investments that offer tax-free income, like ISAs in the UK.

- Plan withdrawals to stay within lower tax brackets.

Balancing capital preservation and income generation

Balancing the need for income with the importance of preserving your capital is a delicate task:

- Assess Your Risk Tolerance:

Retirees often prefer conservative investments to reduce exposure to market volatility. However, retaining some growth-focused assets can help your portfolio keep pace with inflation. - Diversify Across Asset Classes:

Spreading your investments reduces risk and provides multiple income streams. Consider a mix of income-generating assets like bonds, dividend-paying shares, and high-yield funds, alongside growth-oriented investments. - Regular Portfolio Reviews:

Periodic reviews of your retirement investment strategy ensure your portfolio remains aligned with your income needs and changing financial goals.

For a deeper understanding of retirement investment strategies, visit our guide on Types of Investment Strategies.

Conclusion

Investing in retirement requires a thoughtful and strategic approach. By understanding your risk tolerance, time horizon, and income goals, you can create a personalised investment plan that aligns with your retirement objectives.

At MHG Wealth, our retirement planning service And do remember to seek professional advice and regularly review your portfolio to ensure it remains on track.