Inheritance tax (IHT) is a significant consideration for individuals looking to pass on their wealth in the UK. Without proper planning, a large portion of your estate could be lost to taxes, leaving less for your heirs, and unnecessarily lining the governments pockets.

Fortunately, there are strategies you can use to reduce the tax burden and ensure that your estate is transferred to your loved ones with minimal cost.

This article aims to provides an extensive guide to understanding inheritance tax in the UK, explain how it works, and outline practical strategies for minimising its impact on your estate.

By the end, you’ll have a clearer picture of what steps to take to protect your wealth for your beneficiaries.

What is Inheritance Tax and Why Is It Important?

Inheritance tax is a tax on the estate (property, money, and possessions) of someone who has died. The standard rate in the UK is currently 40%, but it only applies to the part of your estate that’s above the tax-free threshold, which, as of the time of writing, is set at £325,000.

For many, the idea of losing a significant portion of their estate to inheritance tax is very concerning. However, with careful planning, you can reduce or even eliminate the tax liability on your estate.

Inheritance tax planning is essential for preserving your wealth for future generations. Without proper planning, the tax burden could reduce the value of what you leave behind. Effective planning ensures that your assets are distributed according to your wishes, instead of being diminished by taxes.

How Is Inheritance Tax Calculated

In the UK, inheritance tax is calculated based on the total value of your estate at the time of your death. The tax applies at a rate of 40% to the portion of your estate that exceeds £325,000, known as the nil-rate band. However, several allowances and exemptions can reduce the taxable value of your estate.

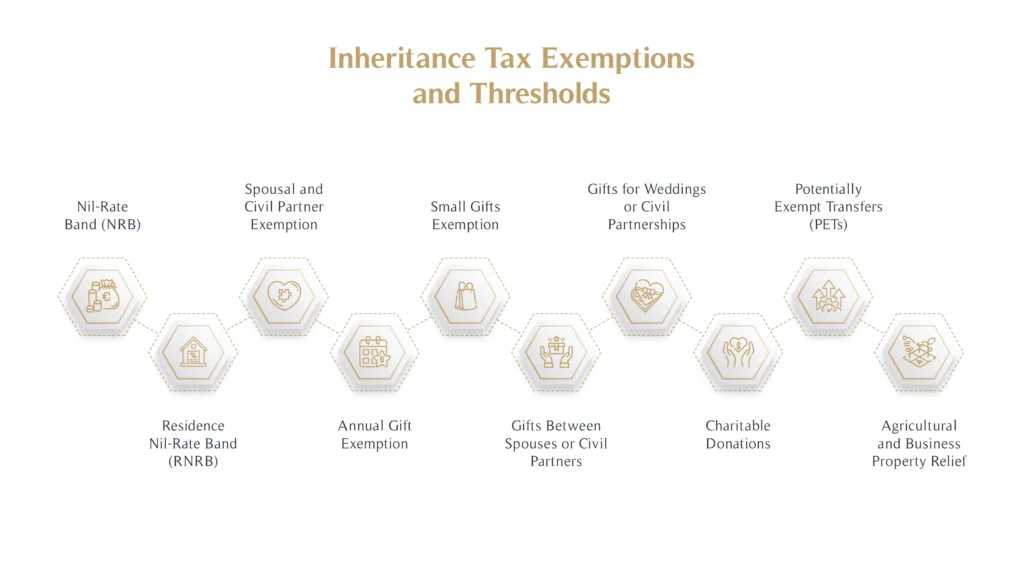

Inheritance Tax Exemptions and Thresholds

To effectively manage your estate, it’s crucial to understand the various exemptions and thresholds that can help reduce the inheritance tax liability.

Here’s a breakdown of the key exemptions and thresholds:

1. Nil-Rate Band (NRB)

The nil-rate band is the tax-free threshold for inheritance tax. As of 2024, the standard nil-rate band is £325,000. This means that estates worth up to £325,000 are not subject to inheritance tax. Any amount above this threshold is taxed at the standard rate of 40%.

For example, if your estate is worth £500,000, the first £325,000 is tax-free, and the remaining £175,000 will be subject to 40% inheritance tax.

2. Residence Nil-Rate Band (RNRB)

The residence nil-rate band (RNRB) is an additional allowance introduced to reduce inheritance tax for individuals passing on their family home to direct descendants (children or grandchildren). As of 2024, the RNRB is £175,000.

This means that if your estate includes a home passed to your children or grandchildren, you could benefit from an additional £175,000 tax-free allowance. When combined with the standard nil-rate band, it brings the total tax-free threshold to £500,000 for many estates.

Important Note: The RNRB tapers off for estates valued over £2 million, reducing by £1 for every £2 over this threshold.

3. Spousal and Civil Partner Exemption

One of the most significant exemptions is the spousal exemption. If you leave your estate to your spouse or civil partner, no inheritance tax is due on the amount passed to them, regardless of its value. This allows married couples and civil partners to transfer their estates tax-free to each other.

Additionally, if your spouse or civil partner does not use their full nil-rate band, it can be transferred to the surviving partner. This means that when the second partner dies, their estate can benefit from up to £650,000 of tax-free allowance (£325,000 per person).

4. Annual Gift Exemption

You can give away up to £3,000 each year, and it won’t count towards the value of your estate for inheritance tax purposes. This is known as the annual gift exemption. If you didn’t use your allowance in the previous tax year, you can carry it forward, allowing you to gift up to £6,000 in a single year.

5. Small Gifts Exemption

You can make unlimited small gifts of up to £250 to different individuals each year without these gifts being subject to inheritance tax. However, the small gifts exemption cannot be used in conjunction with the annual gift exemption for the same person.

6. Gifts Between Spouses or Civil Partners

Any gifts made between spouses or civil partners during their lifetime are exempt from inheritance tax, provided both are living in the UK.

7. Gifts for Weddings or Civil Partnerships

You can give tax-free gifts for weddings or civil partnerships, with the following limits:

- £5,000 for a child

- £2,500 for a grandchild or great-grandchild

- £1,000 for anyone else

These gifts must be made before the wedding or civil partnership ceremony and must be conditional on it taking place.

8. Charitable Donations

Gifts to charities are exempt from inheritance tax. Additionally, if you leave 10% or more of your estate to charity, the inheritance tax rate on the remainder of your estate is reduced from 40% to 36%. This incentive encourages charitable giving while reducing the overall tax burden on your estate.

For example, if your estate is worth £1 million and you leave £100,000 (10%) to charity, the remaining £900,000 will be taxed at the lower rate of 36%, instead of the standard 40%.

9. Potentially Exempt Transfers (PETs)

Gifts made during your lifetime can be potentially exempt transfers (PETs). If you survive for seven years after making a gift, it becomes entirely exempt from inheritance tax. However, if you die within seven years of making the gift, it may be subject to inheritance tax on a sliding scale, known as taper relief.

The taper relief rates are:

- 0–3 years: 40% (no relief)

- 3–4 years: 32%

- 4–5 years: 24%

- 5–6 years: 16%

- 6–7 years: 8%

After seven years, the gift is fully exempt from inheritance tax.

10. Agricultural and Business Property Relief

If your estate includes agricultural land or a business, you may be eligible for Agricultural Relief or Business Property Relief. These reliefs can reduce the taxable value of qualifying property by 50% to 100%, depending on the circumstances.

For example, agricultural property that has been owned and used for farming for at least two years before death may qualify for 100% relief. Similarly, business assets may be eligible for up to 100% relief if they’ve been owned for two years or more.

Importance of Knowing the Rules and Regulations in Different Jurisdictions

If you own property or have assets abroad, or if your beneficiaries live outside the UK, it’s important to be aware of the inheritance tax rules in those jurisdictions.

Some countries may have their own inheritance or estate taxes that apply to your assets.

Additionally, the UK has double taxation agreements with several countries, which can help prevent your estate from being taxed twice.

Understanding the rules in both the UK and any relevant jurisdictions is essential for effective inheritance tax planning.

How Financial Advisors Can Assist in Inheritance Tax Planning

Financial advisors are crucial in helping individuals understand the complexities of inheritance tax planning. They have the knowledge and expertise to assess your financial situation, understand your estate’s value, and recommend strategies to minimise tax exposure.

By working with a financial advisor, you can ensure that your inheritance tax plan is comprehensive and in line with the latest legal regulations.

If you’re looking for personalised advice on inheritance tax planning, MHG Wealth Management can provide the guidance you need. Contact us today to schedule a consultation and take the first step towards securing your financial legacy.

Benefits of Seeking Professional Advice

Inheritance tax laws are often complex and subject to changes, making it challenging for individuals to stay fully informed.

A financial advisor plays a critical role in guiding you through these intricacies, ensuring that your estate is planned in the most tax-efficient way. Similarly, an advisor can help you when it comes to UAE inheritance law for expats so your assets go exactly where you want them to.

By working with a professional, you can make informed decisions about how to structure your assets, take advantage of available exemptions, and avoid common mistakes that could increase your tax liability.

Here are the key benefits of seeking professional advice:

- Up-to-Date Knowledge: Financial advisors stay informed about the latest changes in inheritance tax laws, ensuring your estate plan remains compliant and effective.

- Tailored Solutions: They provide advice specific to your circumstances, offering solutions that align with your financial goals and personal needs.

- Maximising Exemptions: A professional can help you fully utilise tax exemptions and thresholds, such as the nil-rate band and spousal exemptions.

- Avoiding Common Mistakes: Advisors can guide you on managing lifetime gifts, ensuring they are used effectively to reduce tax liability.

- Comprehensive Planning: They offer a holistic approach, integrating inheritance tax planning with broader financial and estate planning strategies to protect your wealth.

Key Questions to Ask a Financial Advisor Regarding Inheritance Tax

When speaking to a financial advisor about inheritance tax, here are some key questions to ask:

- What are the most effective strategies for reducing my inheritance tax liability?

- How can I make the best use of the nil-rate band and other exemptions?

- How should I approach gifting assets during my lifetime to reduce inheritance tax?

- Would setting up a trust benefit my estate, and how does it work in practice?

- How often should I review my inheritance tax plan to ensure it remains effective?

Smart Strategies for Effective Inheritance Tax Planning

Inheritance tax can significantly reduce the value of your estate, but with the right strategies, you can minimise its impact.

By taking steps early and using available tax reliefs, exemptions, and allowances, you can effectively manage the tax burden and ensure that more of your assets are passed on to your loved ones.

Here are some smart strategies to consider for effective inheritance tax planning.

3 Strategies for Minimising Inheritance Tax

There are several strategies you can use to reduce your inheritance tax liability. These include:

1. Gifting During Your Lifetime

In the UK, you can make gifts of up to £3,000 each year without them being counted towards your estate for inheritance tax purposes. This annual exemption can be a simple and effective way to reduce the value of your estate over time.

Additionally, you can make unlimited small gifts of up to £250 per person each year, and larger gifts made more than seven years before your death may also be exempt from inheritance tax.

2. Setting Up Trusts

Trusts are a useful tool for managing how and when your assets are passed on to beneficiaries. By placing assets in a trust, you can retain some control over them during your lifetime while reducing the value of your estate for inheritance tax purposes. Trusts can also provide protection against other potential issues, such as creditors or divorce.

3. Using the Residence Nil-Rate Band and Other Exemptions

If you leave your home to your direct descendants (children or grandchildren), you can benefit from the residence nil-rate band, which adds an additional £175,000 to the tax-free allowance, bringing the total potential threshold to £500,000.

In addition to the RNRB, several other important exemptions, as discussed earlier, can further help reduce the taxable value of your estate.

Importance of Integrating Tax Planning with Estate Planning

Effective inheritance tax planning is only part of the broader estate planning process. Estate planning involves determining how your assets will be distributed and ensuring that your estate is managed efficiently after your death.

By integrating tax planning with estate planning, you can ensure that your estate is not only tax-efficient but also aligns with your wishes and legal requirements.

For instance, if you plan to pass on significant assets to your children, you’ll need to consider both the tax implications and how those assets will be managed over time. Trusts can play an essential role here, allowing you to control how and when your beneficiaries receive their inheritance, while also mitigating inheritance tax liabilities.

Practical Inheritance Tax Planning Tips

Here are some practical tips to keep in mind with your inheritance tax planning:

- Start Planning Early: The earlier you begin planning, the more options you’ll have to reduce your inheritance tax liability.

- Use Annual Exemptions: Make the most of the £3,000 annual exemption, as well as any additional gifting allowances.

- Review Your Plan Regularly: Inheritance tax rules and personal circumstances can change over time, so it’s essential to review your estate plan periodically to ensure it remains effective.

- Consider Setting Up a Trust: Trusts can provide both tax benefits and control over how your assets are distributed.

- Seek Professional Advice: Always consult with a financial advisor or estate planner who can help you develop a comprehensive strategy for managing your estate.

Conclusion

Inheritance tax planning is a critical part of protecting your wealth for future generations. By understanding how inheritance tax works in the UK, seeking professional advice, and implementing effective strategies, you can reduce the tax burden on your estate and ensure that your assets are passed on to your loved ones in the way you intend.

With careful planning, you can take control of your estate’s future, safeguarding your financial legacy and giving your beneficiaries the best possible outcome. Proactive planning not only reduces inheritance tax but also provides peace of mind for you and your heirs. The earlier you begin the process, the more options you have to protect your wealth and secure your legacy.

If you’d like personalised guidance on inheritance tax planning or other wealth management strategies, MHG Wealth Management’s chartered financial advisors are here to help.

Get in touch with us today to discuss how we can tailor a financial plan that ensures your estate is optimised for future generations.