Dubai, often called the “City of Gold,” is a hub of luxury, innovation, and opportunity. But while the city’s skyline dazzles with extravagance, the high cost of living can be a challenge for many residents.

The reality is, small daily expenses can quietly drain your budget. You might enjoy showing off that AED 30 coffee every morning or taking a cab to work at AED 50 per ride—but have you ever stopped to calculate the true cost? By the end of the month, that coffee habit alone adds up to AED 900, while your daily cab rides could cost over AED 1,500! These seemingly minor choices can make a significant dent in your finances, often without you realising it.

At MHG Wealth, we believe that financial freedom starts with smart spending. This guide provides practical, easy-to-implement strategies to help you cut costs, optimise your budget, and make the most of your earnings in Dubai, without sacrificing the lifestyle you love.

Understanding the Cost of Living in Dubai

Living in Dubai can be expensive, and it’s easy to fall into the lifestyle trap where spending seems inevitable due to the city’s luxury appeal. However, it’s important to remember that managing your finances wisely can help you live comfortably, even on a modest salary. Imagine a family of four living on AED 5,000 per month or a couple managing on AED 50,000/month—both can live happily if they stick to a budget that balances their needs and wants without overspending.

By separating needs and wants, you can better identify areas where you might reduce spending and create a sustainable budget that supports your lifestyle in Dubai. Now, let’s take a look at the major wants and needs in Dubai.

Needs

- Housing: AED 2,000 to AED 8,000 per month (depending on location & the kind of apartment(studio, 1 BHK etc.) )

- Utilities: AED 500 to AED 1,000 per month

- Transportation: AED 300 to AED 2,500 per month (based on mode of transport)

- Groceries: AED 1,500 to AED 2,000 per month

Wants

- Dining out: AED 1,000 to AED 2,000 per month (based on frequency of dining out)

- Entertainment & Leisure: AED 500 to AED 1,500 per month (cinemas, events, shopping, etc.)

- Luxury goods & Services: AED 500 to AED 3,000 per month (depending on lifestyle)

Now, let’s explore the top tips for saving money in Dubai.

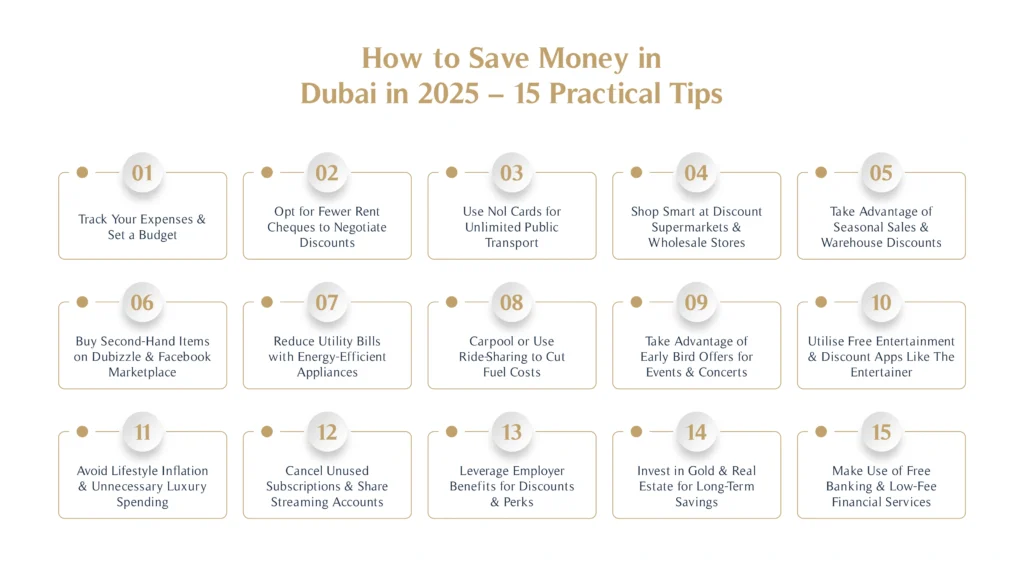

How to Save Money in Dubai in 2025 – 15 Practical Tips

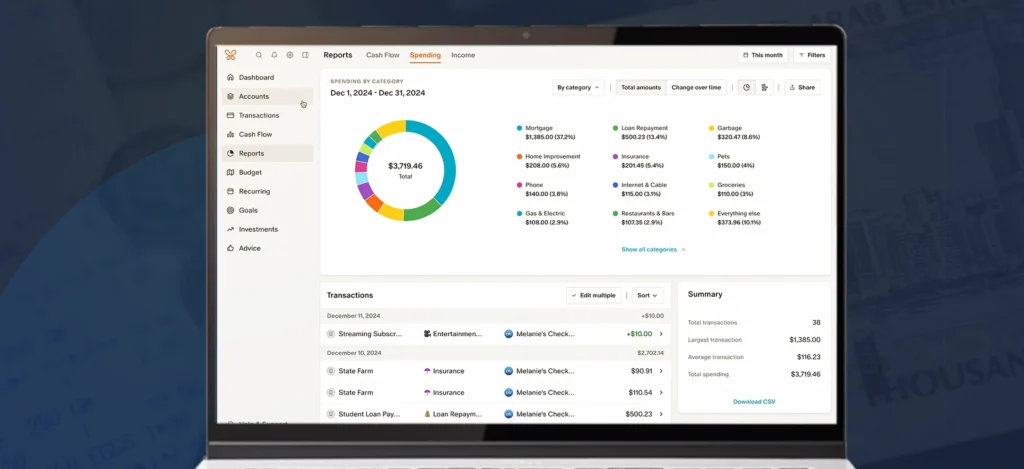

1. Track Your Expenses & Set a Budget

Tracking your expenses and setting a budget is essential for managing your finances in Dubai. Start by categorising your monthly costs—housing, utilities, transportation, and groceries—and track your spending regularly. Set realistic limits for each category and adjust as needed. Consider having separate bank accounts for spending and saving, and choose a bank offering competitive interest rates for your savings to maximise returns.

2. Opt for Fewer Rent Cheques to Negotiate Discounts

Many landlords in Dubai offer discounts if you pay rent in fewer cheques. Instead of six payments a year, negotiate for three or four, which can lower your rent by 2-5%. Some property owners may even provide an additional discount if you opt for a one-time annual payment. This strategy can help you reduce your overall housing costs, leaving more room in your budget for savings and investments. If needed, consider rental payment plans from banks that allow for lump-sum payments while letting you repay in instalments.

3. Use Nol Cards for Unlimited Public Transport

Dubai’s Nol Card offers a cost-effective way to travel across the city’s metro, buses, trams, and water transport. For less than AED 800, you can get a three-month unlimited pass, significantly reducing transport costs compared to daily tickets or fuel expenses. With metro connections covering key locations, Nol Cards save both time and money while helping you avoid traffic congestion. Consider upgrading to a Silver or Gold Nol Card for added convenience, depending on your travel frequency.

4. Shop Smart at Discount Supermarkets & Wholesale Stores

Supermarkets in Dubai regularly offer deals, often updated in brochures once or twice a week. Stores like Carrefour, Lulu, and Union Coop provide significant discounts—sometimes up to 80%—especially on groceries. Many local supermarkets also offer free home delivery, making shopping more convenient. Join their WhatsApp groups or check their stories for daily or weekly deal updates. Shopping strategically during sales can help you cut costs substantially while stocking up on essentials.

5. Take Advantage of Seasonal Sales & Warehouse Discounts

Seasonal sales and warehouse discounts in Dubai offer great opportunities to save on a wide range of products. Whether it’s electronics, clothing, or home appliances, these sales often feature up to 70-80% off. Keep an eye on major shopping events like Ramadan, Black Friday, and year-end sales, and consider buying in bulk to get the most value for your money.

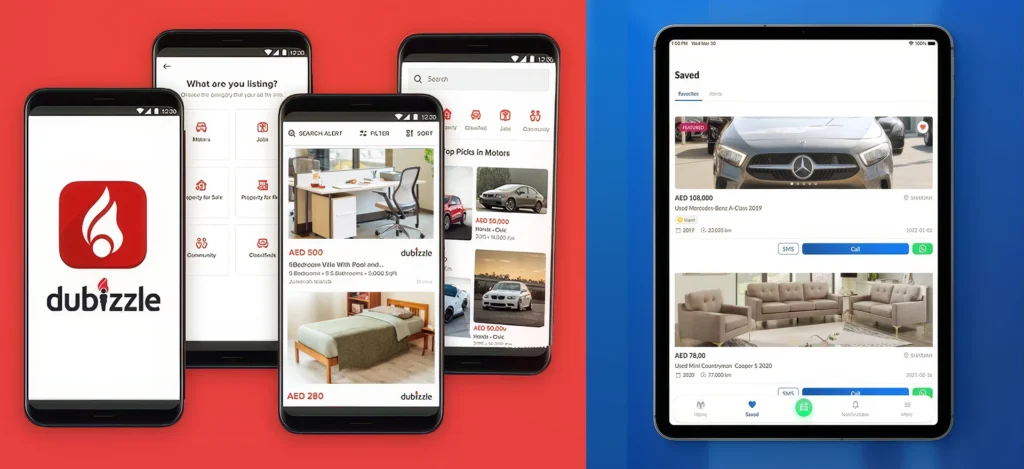

6. Buy Second-Hand Items on Dubizzle & Facebook Marketplace

Dubai’s second-hand market offers high-quality products at a fraction of the original price. Many expats sell barely used items before relocating, making platforms like Dubizzle and Facebook Marketplace ideal for finding furniture, electronics, and even cars at great discounts. Always verify the condition of items and compare prices before purchasing. Joining local community groups can also help you find the best deals and avoid scams.

7. Reduce Utility Bills with Energy-Efficient Appliances

Cutting down on electricity bills is easier when using energy-efficient appliances. Look for devices with a high Emirates Authority for Standardisation & Metrology (ESMA) rating, as they consume less power while delivering the same performance. Switching to LED bulbs, smart thermostats, and inverter ACs can significantly reduce your DEWA bill. Additionally, avoid keeping appliances on standby mode and use power-saving settings on your electronics to minimise energy waste.

8. Carpool or Use Ride-Sharing to Cut Fuel Costs

Carpooling or using ride-sharing services is an effective way to reduce fuel costs in Dubai. Sharing a ride with others or opting for services like Uber, Lyft, Careem, or other local apps like RideNow can significantly lower your transportation expenses. It helps you save on fuel, parking fees, and vehicle maintenance. Additionally, carpooling reduces your carbon footprint, making it a win for both your wallet and the environment.

9. Take Advantage of Early Bird Offers for Events & Concerts

When planning to attend events or concerts in Dubai, always try to book your tickets early, especially through platforms like PlatinumList. Booking tickets 30-40 days in advance can help you access early bird offers at discounted prices. Waiting until closer to the event may result in prices doubling, making it more expensive to attend. Keep an eye on upcoming events and secure your tickets early to enjoy significant savings.

10. Utilise Free Entertainment & Discount Apps Like The Entertainer

The Entertainer App and the Smiles app are must-haves for anyone looking to save money on dining, entertainment, and leisure activities in Dubai. With thousands of buy-one-get-one-free deals on restaurants, hotels, theme parks, and salons, these apps quickly pay for themselves. Additionally, many banks offer buy-one-get-one-free ticket promotions for films at popular cinemas like Novo and Vox in city centres, further enhancing your savings. Many banks and telecom providers offer these apps for free as part of their service packages, so be sure to check if you can access them at no extra cost.

11. Avoid Lifestyle Inflation & Unnecessary Luxury Spending

As salaries increase, it’s easy to fall into the trap of spending more on luxury and non-essential items. Instead of upgrading to a bigger apartment or a high-end car, focus on increasing savings and investments. Maintaining a simple lifestyle while growing your wealth will ensure long-term financial stability. Avoid unnecessary expenses by evaluating whether each purchase aligns with your financial goals.

12. Cancel Unused Subscriptions & Share Streaming Accounts

With internet and mobile plans in Dubai often including free access to Prime Video, StarzPlay, or other streaming platforms, avoid paying for separate subscriptions. Instead, share accounts with family members to cut costs. Review your monthly expenses to identify unused memberships and cancel any that aren’t adding value. Many entertainment and fitness apps also offer bundle deals or yearly plans at reduced rates.

13. Leverage Employer Benefits for Discounts & Perks

Many employers in Dubai offer valuable benefits that can help you save money. Take advantage of discounts on healthcare, transportation, and retail, or participate in company-sponsored wellness programs. Some employers may also provide subsidised meals, gym memberships, or access to exclusive deals with partner businesses. By leveraging these perks, you can reduce your out-of-pocket expenses and make your salary go further. Always inquire about available employee benefits to maximise your savings.

14. Invest in Gold & Real Estate for Long-Term Savings

Dubai is known for its strong real estate market and tax-free gold purchases. Investing in property can provide long-term rental yields, while gold remains a stable asset during economic fluctuations. Take advantage of low transaction costs in Dubai’s gold markets and explore real estate opportunities in up-and-coming areas for higher returns. Whether it’s a short-term flip or long-term investment, research market trends before making any decisions. Read more on the best investment strategies for young professionals in the UAE here.

15. Make Use of Free Banking & Low-Fee Financial Services

Dubai offers a variety of free banking and low-fee financial services that can help you save money. Look for banks that offer no monthly account maintenance fees, free withdrawals from ATMs, and zero charges on international transfers. Additionally, consider using online-only banks or digital wallets like Revolut or Mashreq Neo, which often have lower fees compared to traditional banks. By carefully selecting your banking options, you can avoid unnecessary charges and keep more money in your pocket.

Conclusion

Saving money in Dubai is all about making smart financial choices. Whether you’re a resident or a visitor, simple changes can lead to significant savings. To save money on food and groceries, shop during sales, use discount apps, and cook at home.

If you’re living or working in Dubai, opt for affordable housing, use public transport, and take advantage of employer perks. Planning a holiday in Dubai? Book flights and hotels in advance, use Nol cards for transport, and look for entertainment deals. For currency exchange savings, compare rates at multiple exchange centres instead of airport kiosks. By making informed decisions, you can save money fast and enjoy Dubai without overspending.

For expert financial guidance on saving, investing, and growing your wealth in Dubai, consult MHG Wealth and get personalised strategies tailored to your financial goals. Explore our financial advisory services today.

FAQ’S

Is it possible to save money in Dubai?

Yes, with the right budgeting and smart spending habits, saving money in Dubai is achievable. Using public transport, shopping during sales, leveraging discounts, and cutting unnecessary expenses can help reduce costs while maintaining a good lifestyle.

What is the best way to save money in the UAE?

The best way to save money in the UAE is by tracking expenses, setting a budget, using discount apps like The Entertainer and Smiles, opting for public transport, and taking advantage of employer benefits, cashback offers, and free banking services.

How to live cheaply in Dubai?

To live cheaply in Dubai, choose affordable housing, use public transport, cook at home, avoid unnecessary subscriptions, and shop during seasonal sales. Carpooling, using Nol cards, and leveraging buy-one-get-one-free deals can also significantly reduce monthly expenses.

How much can you save in Dubai per month?

Savings depend on income and lifestyle. A well-planned budget can allow individuals to save 20-40% of their salary. For instance, someone earning AED 15,000 may save AED 3,000 to AED 6,000 monthly by managing expenses wisely.