Are you looking to invest in property, but you’re not sure how to get started? Property investment is a popular investment option in the UK. Plus, this is only set to grow, despite the financial climate being a little uncertain.

House prices might be predicted to fall this year. But things are definitely on the up. Savills predicts house prices will rise 20% between 2025 and 2028. So now could be an ideal time to look into the benefits of making money from property.

This guide is for property investors, both old and new. We’ll show you how to begin real estate investing, what type of property to invest in, and more.

How to get started with property investment

It can be hard to take the first step towards investing. What do you need to do? How can you get the right advice? Here are a few tips that would-be property investors need to consider when getting started.

- Decide on your property investment goals – are you hoping for capital appreciation through rising house price value, or long-term yield from rental income?

- Find experienced property investment experts – get in touch with us to find out more about how to invest in property

- Choose a property type – which best matches your risk profile? We can look at your financial situation and advise.

Residential vs commercial properties

Understanding which type of property to invest in is a very important factor. So, let’s take a look at the main types of property you can invest in and how they work.

- Residential – Homes or apartments, such as single-family houses, studios and townhouses. If you decide to invest in residential property, you would usually rent the building out to other people and generate income from doing so.

- Commercial – This property isn’t primarily used as residence. This includes office and retail space. Commercial property owners might run a business out of such a space, but investors usually lease them out to other businesses.

Key considerations

- Location – Is there a high-demand rental market in the area? Is it likely to become more appealing to tenants in the future? Does it need to be close to where you live?

- Market trends – Staying up-to-date with property market trends helps you to be competitive and make better decisions about where to invest.

- Yield – One simple way to work out how much you might make is to calculate the potential yield, which shows the annual rental income as a percentage of the total value of the property.

Property investment for beginners: step by step

Want to know how to start investing in property? Don’t worry; we’ve covered all the basics. Here are some specific strategies to consider.

Specific strategies for investing in the UK property market.

- Buy-to-let investment – Buying a property to rent out to tenants. You’ll gain regular income and long-term capital growth. However, to make your investment appealing, you’ll need to keep ongoing management and maintenance in mind.

- Property flipping – This involves buying a property, renovating it, and then selling it at a higher price, to gain profit. You can gain quick returns this way through renovations, but bear in mind that if market conditions change suddenly, your profitability could be affected.

- Property investment funds – Investing in these, also known as Real Estate Investment Trusts (REIT), allows for indirect property ownership and diversification, without you needing to give hands-on management. A professional management team provides and oversees your diversified portfolio of property.

- Tax efficiency – For example, you could leverage tax relief and allowances through utilising capital gains tax, to minimise taxes if selling a property at a profit.

Tips for finding properties to invest in

Finding properties to invest in has never been easier, thanks to a wide array of options.

- Real estate investing websites – Platforms such as Zoopla and Rightmove let you search by selecting specific criteria such as location, property type and price.

- Specialised investment property websites – These sites cater specifically for investors and offer specific features such as property analysis.

- Local estate agents – Negotiate favourable deals through local market knowledge.

- Auctions – You could have the chance of securing a property below market value, but property auctions can be risky.

Property investment financing

UK house prices usually range between £200,00 and £3,000, and you’ll need a minimum deposit of at least £50,000 to £75,000.

Enhance potential returns and avoid debts and financial strain with the right financing for you.

- Financial leverage – Use the money from a loan or mortgage to supplement your own money.

- Financial gearing – This refers to the ratio of debt to equity, and helps you determine whether a property is a worthwhile investment.

- Property development financing – These are often short-term loans, used by investors to develop a new building or refurbishing an existing one.

- Commercial mortgaging – Up to 75% of the cost to purchase a property, offering terms of up to 30 years.

- Mezzanine financing – Secured against the property, rather than you or the business.

- Bridging finance – The lender takes a first charge on your property and opts to exit once the loan is repaid.

Strategies for low-cost property investment

Low-cost ways to invest

- Rent a room to a lodger and earn up to £7,500 tax-free through the government’s Rent a Room scheme.

- Property lease options involve investing as little as £1 a month, setting the length of agreement and agreeing on a potential purchase price for later on.

- With crowdfunding, investors pool their money, so everyone involved owns a small share.

- Partnerships are similar to crowdfunding, but on a smaller scale, between two or more investors.

- Peer to peer investing lets individuals lend money to individual property developers and businesses.

Property investment companies for beginners

When it comes to property investment companies for beginners, Airbnb is one of the most well-known and a great place to start.

With Airbnb, you have the chance of making more money than through traditional renting, and through an established company, but operational costs can be higher.

As we’ve already mentioned, real estate investment corporations, also known as REITs, are companies that own, operate, or finance real estate across property sectors. REITs are a popular choice as they offer liquidity and diversification.

Financial Considerations and Costs

When diving into property investment, it’s essential to understand the full scope of financial considerations and associated costs. Proper planning can prevent unexpected expenses and ensure your investment is a profitable venture.

Upfront Costs

Before you can start earning income from your property, you’ll need to cover several initial expenses. These include:

- Deposit: In the UK, a minimum deposit for property investment typically ranges between 15% and 25% of the property’s value, depending on the type of mortgage. For example, on a £200,000 property, you’d need at least £30,000 to £50,000 upfront.

- Stamp Duty Land Tax (SDLT): This tax is based on the purchase price of the property. For buy-to-let properties, additional surcharges may apply. Use an SDLT calculator or consult with experts to determine the exact amount.

- Legal Fees: Solicitors’ fees for property purchases often range from £800 to £1,500, including searches and Land Registry charges.

- Valuation Fees: A lender may require a property valuation to approve your mortgage, costing between £150 and £1,500, depending on the property’s value.

Ongoing Expenses

Once you’ve purchased the property, you’ll face regular expenses to maintain it and manage tenants. These include:

- Mortgage Payments: Monthly mortgage payments are a critical ongoing cost. Buy-to-let mortgages, in particular, require you to meet the interest-coverage ratio (ICR), which lenders use to assess affordability.

- Letting and Management Fees: If you hire a letting agent, expect to pay 8%–15% of the rental income for their services.

- Maintenance Budget: Allocate at least 10% of annual rental income for maintenance and repairs to avoid financial strain during emergencies.

- Service Charges: For leasehold properties, service charges and ground rent are additional ongoing costs.

- Insurance: Landlord insurance, covering property and liability risks, is an essential cost.

Financial Safety Net

Maintaining a financial safety net is critical. This should cover:

- Unexpected Costs: For example, major house repairs like a roof replacement.

- Void Periods: Periods when your property is vacant, leading to lost rental income. Experts recommend setting aside at least 6 months’ worth of expenses.

Mortgage Options

Choosing the right mortgage is pivotal to maximising returns. Key options include:

- Buy-to-Let Mortgages: Specifically designed for landlords, these usually require higher deposits and have slightly higher interest rates than residential mortgages.

- Interest-Only Mortgages: These lower monthly payments but require repayment of the full loan amount at the end of the term.

- Repayment Mortgages: Higher monthly payments but gradually reduce the loan amount.

Consulting mortgage brokers can help identify the best option based on your credit score, goals, and financial circumstances.

Risks and Challenges

Property investment can be rewarding, but it’s not without its pitfalls. Understanding the risks and preparing for challenges will help you navigate this complex market.

Market Volatility

The property market is influenced by factors such as economic conditions, interest rates, and tenant demand. A sudden house price fall could reduce the value of your investment, impacting both your rental income and potential capital appreciation. Stay informed about market trends and diversify your portfolio to mitigate this risk.

Property Management

Managing a rental property involves more than collecting rent. Challenges include:

- Dealing with Difficult Tenants: Late payments, property damage, or breaches of contract can create stress and financial strain.

- Major House Repairs: Structural issues or outdated systems can lead to costly renovations.

- Void Periods: Times when your property is unoccupied can disrupt cash flow. Proactive marketing and maintaining the property in desirable condition can help minimise these gaps.

Regulatory Challenges

The UK property market is subject to increased laws and regulations, including:

- Compliance with Financial Conduct Authority (FCA) guidelines.

- Changes in landlord responsibilities, such as energy efficiency standards.

- Licensing requirements for HMOs (Houses in Multiple Occupation).

For more insights into navigating these challenges, read our article on Investing in Dubai vs. UK Real Estate.

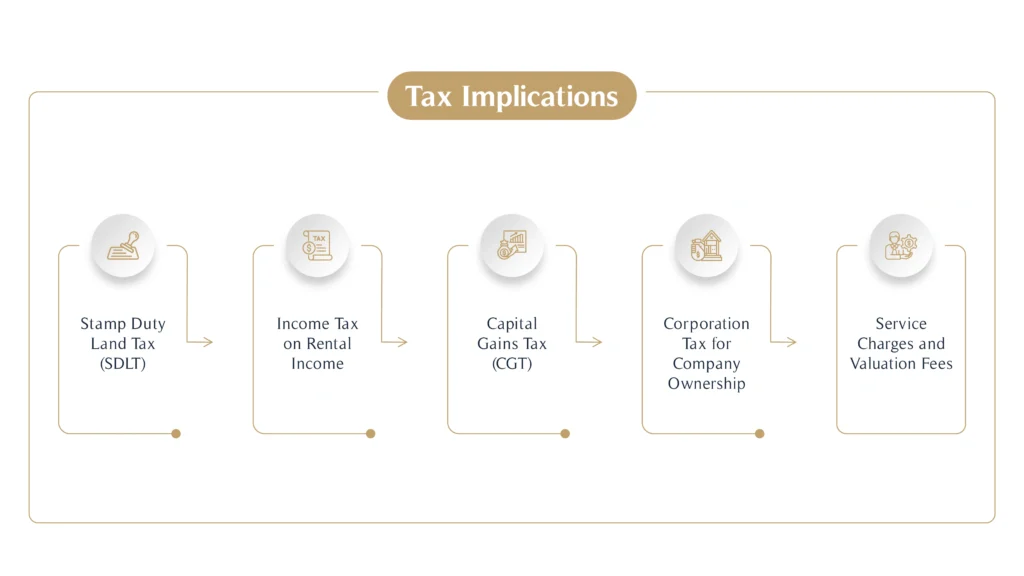

Tax Implications

Taxes can significantly impact the profitability of your property investment. Understanding your obligations and opportunities for relief is vital.

Stamp Duty Land Tax (SDLT)

SDLT applies to property purchases over a certain threshold, with higher rates for buy-to-let properties. For example:

- Properties under £250,000: Standard rates apply.

- Additional properties: A 3% surcharge on top of standard rates.

Calculate SDLT costs carefully to include them in your budget.

Income Tax on Rental Income

Rental income is taxable, but landlords can offset some expenses, such as:

- Mortgage Interest Tax Relief: Limited to basic rate tax.

- Tax Deductible Expenses: Includes letting fees, maintenance costs, and insurance.

Capital Gains Tax (CGT)

When selling a property at a profit, CGT is payable on the gains. Rates vary depending on your income tax band:

- Basic rate taxpayers: 18%.

- Higher rate taxpayers: 28%.

Strategies like company ownership can help manage these liabilities.

Corporation Tax for Company Ownership

If you own properties through a limited company, profits are subject to corporation tax (currently 19%). This structure can be beneficial for those with multiple properties or high income.

Service Charges and Valuation Fees

Don’t overlook additional costs like service charges for leasehold properties and valuation fees for refinancing or selling.

For a deeper dive into tax considerations, visit our guide on Is Property a Good Investment in the UK?.

Conclusion

There’s a lot to consider when you decide to join the ever-growing band of property investors. From property type, to funding, to strategies, it can feel daunting.

However, take all the considerations we’ve mentioned here into account, be prepared to keep learning, and get in touch with an expert group of advisors, and you stand to reap financial rewards for years to come.

MHG Wealth Management is just the company you need for sound property investment advice. Speak to us today.