Starting a family is one of the most life-changing experiences you can have. Raising children is exciting, exhausting, wonderful and scary. Suddenly, you have to think of another person, or persons, that will depend on you. Planning family finances means taking on a lot of responsibility.

In this article, you’ll learn about understanding family finances. We’ll also show you how to create a financial plan, and provide financial planning tips for new parents.

Understanding family finances

The key components of family finances can be broken down into three points.

- Income sources – the total amount of cash inflow coming into your family. This includes salaries, dividends and other forms of income, such as child support.

- Expenses and budgeting – expenses can be fixed (mortgage/rent, utilities) or flexible (entertainment, groceries). You can budget by adding up your income sources against your expenses, and then after subtracting your expenses from your income, you can see what you have left and use it for…

- Savings and investments – you can put your remaining money into a savings account until you need it. Or, with the aim of benefitting from the potential of the investment.

Remember that you can make changes from month to month. So, if you have a large expense, you can perhaps use some of your savings to help pay the cost.

The role of financial goals in family planning

Financial planning for parents can be made easier if you have a goal in mind. Then, you can focus more easily on what is important. Goals can help to motivate you to think more sensibly, if you are occasionally tempted to spend money on something that isn’t essential.

Your children may be too young to have any financial goals, but that doesn’t have to stop you from giving them a financial boost when they become an adult.

Or, you might discover that a new child can suddenly make your home seem a lot smaller. You could look to save towards an extension – or even a larger home.

How to create a family financial plan

Assess your current financial situation

Having a child is a massive financial commitment, so considering the three key components of family finances above is even more essential when you suddenly have more outgoings due to caring for your little one.

Define your financial goals

As we’ve seen, family finance goals are important, and they involve asking important questions. What is important for you and your growing family? And how do they measure up against what an achievable budget would be, going forward?

Create a family budget

Your family financial planning needs to be realistic. How achievable is it going to be to reduce spending and increase saving, when your outgoings are increasing? Be honest, but be kind to yourself too. You can’t always predict your expenses, but if you’ve a big event like a birthday, or the holidays, on the horizon, try to put some money to one side.

Build an emergency fund

If you don’t already have an emergency fund, now’s a good time. As important as planning is, having children can be unpredictable, and comes with unanticipated costs. And unfortunately, we can’t always foresee future events like job loss or expensive repairs, such as to your home.

Experts suggest that it’s a good idea to have at least three-to-six months’ worth of living expenses covered, in case of emergencies.

Insurance plan

Nobody wants to think about death, but you want to make sure your family is financially looked after, should the unthinkable happen.

Check if your employer would pay your partner anything if you were to die, and make sure you know that the money would go to the right person. Also, consider life insurance, which you can take out yourself, or with your partner, which can sometimes be cheaper.

Invest towards your goals and retirement

Your money might be secure in your bank account – but are you giving it a chance to grow? The longer you invest for, the greater the chance of your investments increasing in value.

You could even generate an income through investing, and offset rising inflation. Some of the most popular methods of investing include:

- Stocks and shares

- ISAs

- Pensions

- Peer-to-peer lending

Work towards a monthly/weekly budget

It’s best to work towards a monthly budget if you’re paid per month, which is the most common way. However, you may be paid weekly. And for some people, being paid weekly is more helpful, because it gives more control and flexibility when financing.

Review and adjust financial plans regularly

It’s very useful to have a firm family financial plan in place. However, be realistic, as the economy is always changing and can throw a few curveballs. And throwing a new child into the mix can make life even more unpredictable. Be kind to yourself and review and adjust your plan regularly – as often as you get paid, for example.

Financial planning for new parents

Unique financial challenges faced by new parents

It’s one of life’s less unkind ironies that just when money is needed the most, new parents have to contend with financial challenges such as reduced income due to working fewer hours, and the extra costs involved with bringing a child into the world and raising them.

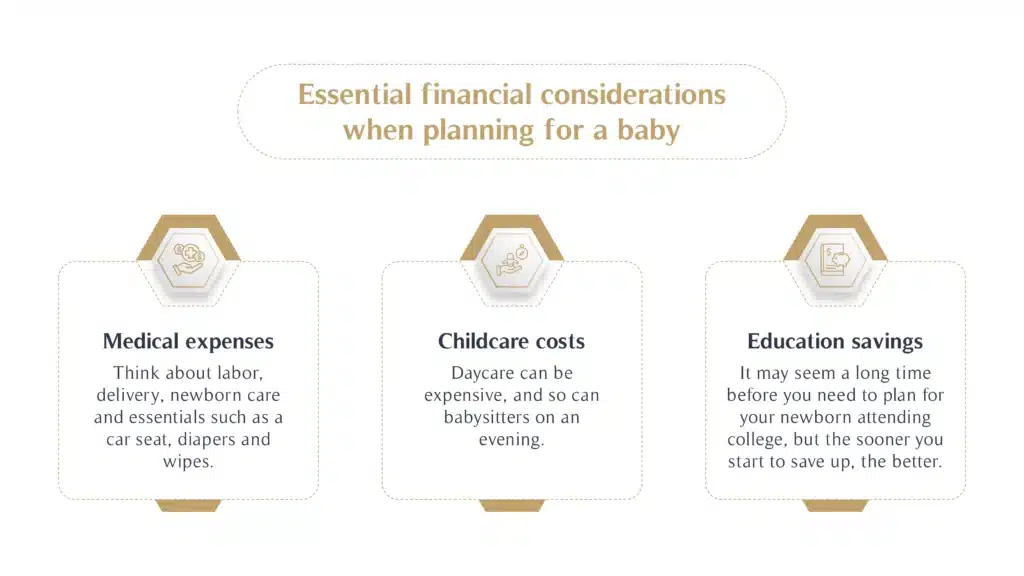

Essential financial considerations when planning for a baby

- Medical expenses – think about labor, delivery, newborn care and essentials such as a car seat, diapers and wipes.

- Childcare costs – daycare can be expensive, and so can babysitters on an evening.

- Education savings – it may seem a long time before you need to plan for your newborn attending college, but the sooner you start to save up, the better.

Financial planning for your family can seem daunting, but taking proactive steps makes the future less uncertain. Talk to an MHG financial advisor today and give your family the best possible opportunitites.