The financial world is vast, dynamic, and filled with opportunities – and risks. Building a balanced investment portfolio across multiple countries is one of the smartest ways to grow your wealth, reduce risks, and secure your financial future.

But what does “balanced” really mean? And how do you navigate international markets without losing sleep over currency fluctuations or geopolitical events?

This guide simplifies the complexities of investing in multiple markets and walks you through global portfolio strategies to ensure a balanced investment plan that aligns with your goals.

Understanding Investment Portfolios

What is an Investment Portfolio?

An balanced investment portfolio is the sum of all your financial assets, designed to meet your specific investment goals. Think of it as your financial “toolbox,” containing:

- Equities: Shares in companies that offer growth potential.

- Bonds: Debt securities providing steady income and lower risk.

- Real Estate: Property investments for income and capital appreciation.

- Alternative Investments: Assets like commodities, hedge funds, or private equity.

Key Components of a Balanced Portfolio

A well-balanced portfolio contains:

- Diversification Across Asset Classes: Spread your investments across equities, bonds, and alternatives to balance risk and return.

- Geographical Diversification: Invest in markets across North America, Europe, Asia, and emerging economies.

- Risk Management: Adjust the weight of high-risk and low-risk assets to match your risk tolerance and financial goals.

The Role of Asset Allocation

Asset allocation is the cornerstone of portfolio management. It’s about deciding how much of your money to invest in each category, based on:

- Time Horizon: Are you investing for 5 years or 30 years?

- Risk Tolerance: How much volatility can you handle?

- Financial Goals: Are you focused on retirement, buying property, or wealth preservation?

For example:

- A conservative investor may lean heavily on bonds and real estate.

- An aggressive investor might allocate more to equities and emerging markets.

Proper allocation ensures your portfolio is robust enough to weather market volatility while achieving steady growth.

The Importance of Diversification for Your Portfolio

Why Diversify Your Portfolio?

Diversification is like creating a safety net for your investments. If one asset underperforms, others can help offset the loss. The same logic applies to geographical diversification. By investing across multiple countries, you’re not betting on a single economy. The principle is simple: don’t put all your eggs in one basket.

Benefits of diversification include:

- Reduced Risk: If one market underperforms, gains in other regions or industries can offset losses.

- Consistent Returns: A mix of high-growth and stable assets ensures steady performance over time.

- Global Opportunities: Exposure to high-growth sectors in emerging markets or stable economies can enhance returns.

How Investing Across Multiple Countries Mitigates Risk

Economic cycles, political events, and currency fluctuations vary across countries. By diversifying globally, you avoid overexposure to one region’s risks, such as:

- Recessions in developed economies.

- Political instability in emerging markets.

- Sector-specific downturns (e.g. technology slumps).

Examples of Diversified Portfolios by Region

- North America: Tech stocks like Apple or Amazon, US Treasury bonds, and real estate investment trusts (REITs).

- Europe: Blue-chip stocks like Nestlé, corporate bonds, and ETFs tracking the FTSE 100.

- Asia: Exposure to growth in China or India through mutual funds or ETFs.

- Emerging Markets: Investments in Brazil or South Africa for high-risk, high-reward opportunities.

5 Key Global Portfolio Strategies

Define Your Financial Goals

Start with the end in mind. Are you saving for retirement, buying a home, or building wealth to pass down to future generations? Your goals will dictate:

- Your time horizon: Are you investing for the next five years or 30 years?

- Your risk appetite: Can you tolerate market fluctuations, or do you prefer steady, low-risk growth?

Example: If your goal is long-term wealth accumulation, you might lean more toward equities and international investments. For shorter-term goals, you might prioritise bonds and cash equivalents.

Assess Your Current Financial Situation

Understand where you stand today. Calculate:

- Your net worth (assets minus liabilities).

- Monthly income and expenses.

- Available funds for investment after accounting for an emergency fund.

This clarity will help you determine how much you can allocate to your portfolio and guide your investment decisions.

Diversify Across Asset Classes

A balanced portfolio includes a mix of:

- Equities: For long-term growth.

- Bonds: For stability and income.

- Real Estate: For diversification and inflation protection.

- Alternative Investments: Like gold or private equity, to hedge against market volatility.

Each asset class behaves differently under various economic conditions, reducing the overall risk of your portfolio.

Embrace Geographic Diversification

Don’t put all your eggs in one basket, or one country. Invest across multiple regions to spread risk and tap into global growth opportunities. For example:

- North America for tech innovation.

- Europe for stable blue-chip stocks.

- Asia for emerging market growth.

Monitor and Rebalance Regularly

Your portfolio will shift over time as markets fluctuate. What starts as a 50% equity allocation could grow to 60% if stocks perform well. Rebalancing helps you stay aligned with your original strategy and risk tolerance.

Factors to Consider When Selecting International Investments

Investing globally opens up exciting opportunities, but it also comes with unique challenges. Here’s what to keep in mind:

Economic Stability

Research the economic health of the countries you’re considering. Look for:

- Stable GDP growth.

- Low inflation rates.

- Reliable regulatory systems.

Example: Developed markets like the US and Germany offer stability, while emerging markets like India and Brazil provide higher growth potential but come with greater risks.

Currency Fluctuations

Investing in foreign assets means exposure to currency risk. A strong domestic currency could erode your returns from international investments. Diversifying currencies across your portfolio can help offset this risk.

Market Regulations

Different countries have varying rules around foreign investments. Familiarise yourself with:

- Taxation laws.

- Repatriation of profits.

- Reporting requirements.

Cultural and Political Risks

Political instability or cultural shifts can impact certain industries or markets. Stay informed about the geopolitical climate in the regions you’re investing in.

Sector Opportunities

Some regions excel in specific industries. For example:

- Asia is a hub for technology and manufacturing.

- Europe leads in sustainable energy and healthcare.

- The US dominates in innovation and tech startups.

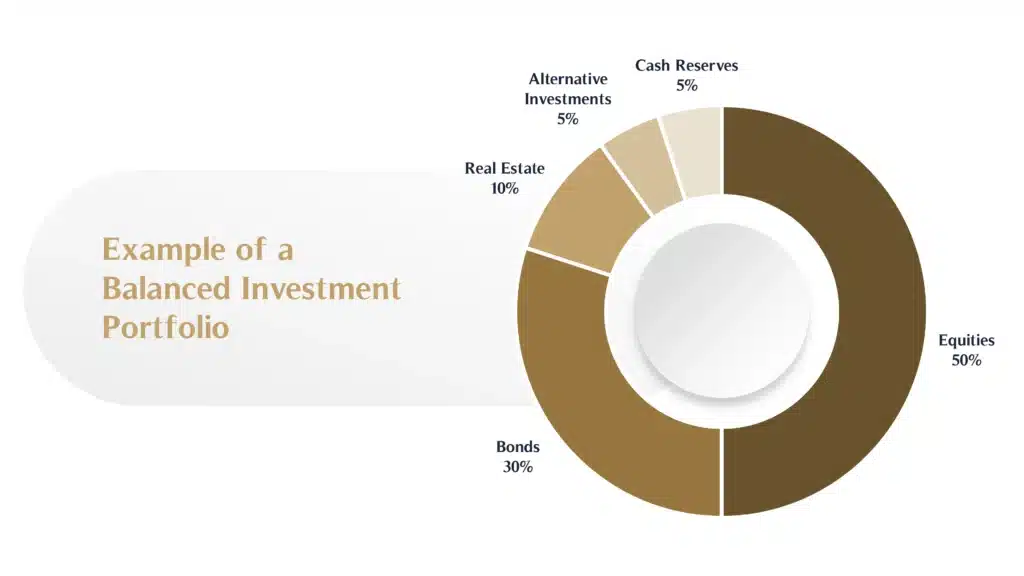

Example of a Balanced Investment Portfolio

Here’s a practical example of a globally diversified portfolio for a moderate-risk investor:

Equities (50%)

- North America (20%): Invest in blue-chip companies like Apple and Microsoft for stability and growth.

- Europe (15%): Focus on industries such as healthcare and renewable energy.

- Asia (15%): Explore emerging markets ETFs, targeting technology and infrastructure sectors.

Bonds (30%)

- UK Government Bonds (15%): For stability and predictable income.

- Global Corporate Bonds (15%): Higher yields with moderate risk.

Real Estate (10%)

- Commercial Property Funds (5%): Invest in high-demand markets like London or Frankfurt.

- Residential Real Estate (5%): Focus on rental properties in stable economies.

Alternative Investments (5%)

- Gold ETFs (3%): Hedge against inflation.

- Private Equity Funds (2%): High-growth potential over the long term.

Cash Reserves (5%)

- Held in multiple currencies for quick liquidity and flexibility.

This balanced investment portfolio not only spreads risk but also ensures exposure to high-growth opportunities across the globe.

Conclusion

Building a balanced investment portfolio across multiple countries is a rewarding strategy that requires careful planning. By diversifying geographically, allocating assets strategically, and staying informed about global trends, you can create a resilient portfolio that grows with you.

At MHG Wealth, we specialise in helping investors like you build customised portfolios tailored to your financial goals. Whether you’re just starting out or looking to optimise an existing portfolio, our advisors are here to guide you every step of the way.

Ready to invest globally? Contact one of our investment advisors to take the first step toward financial freedom.