End of service benefits are a key part of your total compensation in the UAE, and for expats without access to state pensions, they can play a major role in long-term financial security. Yet many professionals overlook how these payouts fit into a broader retirement plan.

At MHG Wealth, we help expats align their gratuity entitlements with investment, pension, and residency strategies to protect and grow their wealth. Whether you plan to retire in the UAE or abroad, integrating your end of service benefits into a larger financial plan is essential.

For more on retirement options available to expats, read our full guide on the UAE pension scheme for expats.

What Are End of Service Benefits in the UAE?

End of service benefits, commonly known as gratuity payments, are lump-sum amounts paid to employees when they leave a company, provided they have completed at least one year of continuous service. These benefits are mandated under UAE Labour Law and are designed to support employees after the end of their employment.

Expats and UAE nationals alike are entitled to these benefits, though the rules can vary depending on whether the employer is in the mainland, a free zone, or part of the DIFC.

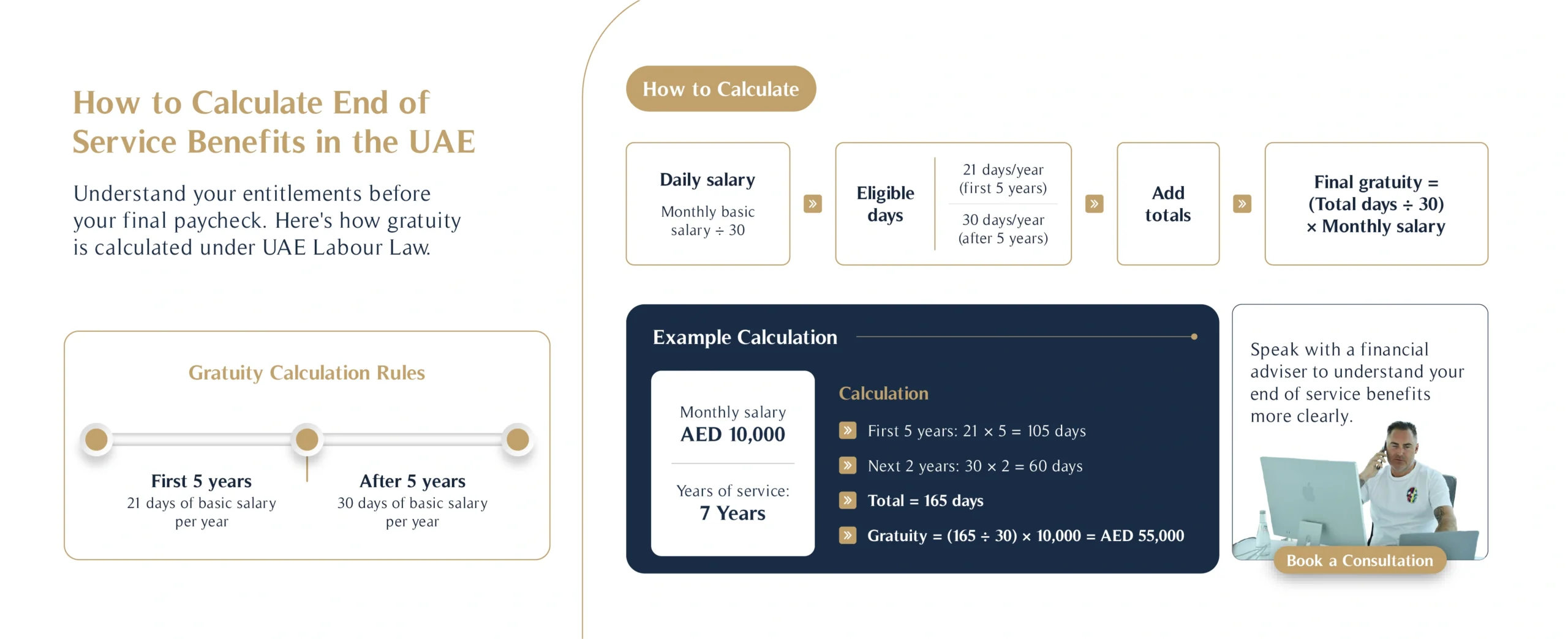

How To Calculate End of Service Benefits in the UAE

Understanding how end of service benefits are calculated is essential for estimating your final payout and ensuring you’re not short-changed.

The standard gratuity calculation under UAE Labour Law is based on your basic salary and your length of continuous service:

- 21 days of basic salary for each of the first five years of service.

- 30 days of basic salary for each additional year beyond five years.

To calculate your gratuity:

- Determine your daily basic salary: divide your monthly basic salary by 30.

- Multiply by the number of eligible days (21 or 30) based on your years of service.

- Sum the totals from each applicable period – free calculator here.

For example, if your basic monthly salary is AED 10,000 and you have worked for 7 years:

- First 5 years: 21 days x 5 = 105 days

- Next 2 years: 30 days x 2 = 60 days

- Total = 165 days of salary

- Equivalent in AED: (165 / 30) x 10,000 = AED 55,000

Key End of Service UAE Rules to Remember:

- Only basic salary is used: Housing, transport, and other allowances are not included.

- Gratuity is capped: The total cannot exceed two years’ worth of your final salary.

- Uninterrupted service: Breaks in employment or contract changes may affect your entitlement.

- Partial years are prorated: If you worked 7 years and 3 months, that extra time counts proportionally.

- Type of contract matters: Unlimited and limited contracts may differ in terms of entitlement, especially if you resign.

By regularly tracking your service duration and understanding your salary structure, you can anticipate your gratuity and use it to support longer-term financial planning.

New Alternatives: DIFC Employee Workplace Savings Scheme (DEWS)

The DIFC replaced the traditional gratuity system with the DEWS (DIFC Employee Workplace Savings) scheme, where employers make monthly contributions into a professionally managed fund on behalf of their employees.

This model:

- Offers investment growth potential.

- Provides more transparency.

- Ensures that funds are secured even if the employer faces financial difficulties.

Employers outside the DIFC may still adopt similar schemes voluntarily, signalling a shift towards more sustainable employee benefits.

Common Mistakes That Reduce Your End of Service Benefits

Many employees unintentionally reduce their end of service payouts due to a lack of awareness or planning. Here are key pitfalls to avoid:

- Early resignation before completing one full year: If you leave before completing 12 months, you’re not entitled to any gratuity. Even just a few days short could cost you thousands.

- Failing to review employment contracts for gratuity clauses: Some contracts contain clauses that offset gratuity with other benefits or discretionary bonuses. Others might reference different calculation methods. Always read the fine print and clarify with HR.

- Borrowing against future gratuity: While some employers allow this, it reduces your final payout and can create complications if you leave earlier than expected.

- Not keeping accurate records of salary and service duration: Employers are required to track this, but errors do occur. Keep your own file with salary changes, job title updates, and key employment dates.

- Ignoring changes in the law: Labour reforms and free zone updates can change eligibility or calculation methods. Staying unaware could result in a smaller payout.

- Assuming allowances count toward gratuity: Only your basic salary is considered. Failing to understand this may give you a false sense of your expected entitlement.

- Overlooking final settlement deductions: Unused leave, company loans, or notice period issues can reduce your final payment. Get a clear breakdown before your last working day.

Avoiding these common errors ensures you retain full access to what you’ve earned and positions you to use your gratuity strategically.

9 Smart Strategies to Maximise Your End of Service Benefits in the UAE

Here are actionable ways to get the most from your end of service entitlement:

- Negotiate a higher basic salary: Since gratuity is based solely on basic pay, pushing for a better basic salary (even if allowances stay the same) can significantly increase your benefit.

- Understand your contract terms: Make sure your contract does not contain clauses that limit or alter your gratuity entitlement. Some employers try to offset gratuity with retirement contributions.

- Stay for at least one full year: You forfeit gratuity if you resign before completing 12 months of service. If you’re close, consider staying a bit longer to qualify.

- Avoid early resignation penalties: In some cases, resigning before completing five years may result in a reduced gratuity. Know when your full entitlement kicks in.

- Track your employment history: Maintain a personal record of your start date, salary changes, and contract amendments. This can protect your claim and help with calculations.

- Ask about voluntary pension schemes: Some employers offer enhanced end of service benefits through workplace pension schemes like DEWS. Explore your options early.

- Invest your gratuity wisely: Rather than spending it immediately, consider placing it in an offshore pension, savings account, or diversified portfolio to build long-term wealth.

- Plan for tax and repatriation: If you’re returning to a home country or moving elsewhere, understand how your gratuity might be taxed and the best way to transfer funds internationally.

- Consult a financial advisor: An expert can help you integrate your end of service benefit into a broader financial strategy, including retirement, investment, and succession planning.

For those considering long-term relocation or dual residency, explore citizenship by investment options to strengthen your financial resilience.

What Happens If You Leave the UAE?

If you leave the UAE permanently, you are still entitled to your accrued gratuity. However, it is important to:

- Confirm final settlements with your employer before departure.

- Ensure your payment method is reliable, particularly for overseas transfers.

- Consult on tax implications in your next country of residence.

A well-structured exit strategy can help preserve your end of service benefits and ease your transition.

Conclusion

End of service benefits in the UAE can serve as a valuable financial cushion if understood and managed effectively. From negotiating your basic salary to planning for cross-border tax implications, taking a strategic approach will help you unlock the full value of your gratuity.

For tailored guidance on integrating your end of service benefits into a broader financial plan, speak to a financial advisor in Dubai from MHG Wealth today.

End of Service Benefits UAE FAQs

Can I lose my end of service benefit?

Only in cases of gross misconduct or termination under specific disciplinary grounds. Always refer to your contract and the UAE Labour Law.

Is gratuity taxed?

There is no income tax in the UAE, but your home country may consider it taxable. You’ll need to check with a tax adviser or get in touch for one of our advisors to learn more about your situation.

How long does it take to receive my gratuity?

Typically within 14 days of your final working day, but it may vary.

Can my employer reduce or delay my gratuity payment?

In most cases, no. End of service benefits are a legal obligation under UAE Labour Law. However, disputes may arise if salary records or contract terms are unclear, so keep documentation.

Can I receive my gratuity in a foreign currency or into an overseas account?

Yes, but this must be agreed upon with your employer. Exchange rates and transfer fees should also be considered.

Do gratuity benefits count toward pension planning?

They can. Many expats treat their gratuity as the seed for retirement savings or as part of their pension drawdown strategy.

Can I reinvest my gratuity tax-efficiently?

Yes, especially if you’re relocating to a jurisdiction with favourable tax laws. Offshore pensions or expat investment platforms are common strategies. Get in touch to learn more about your investment opportunities.