Imagine all your precious online photos, cherished social media memories, and even valuable cryptocurrency holdings – locked away, inaccessible to your loved ones after you’re gone. Yikes!

This is where digital estate planning comes to the rescue. It’s about securing your digital assets – everything from social media accounts to online investments – ensuring they’re managed or distributed according to your wishes.

This guide walks you through the essentials of digital estate planning, why it matters, the key steps to protect and manage your digital assets and how MHG Wealth can help you build a comprehensive digital estate plan.

Understanding Digital Assets

Before diving into planning, let’s break down what digital assets actually are—and why they’re essential in your estate plan.

What Are Digital Assets?

Digital assets include any valuable information or resources stored online or in electronic form. Examples include:

- Cryptocurrencies: Bitcoin, Ethereum, and other blockchain-based currencies with financial value.

- Banking & Investment Accounts: Online banking profiles, digital wallets, and investment platforms.

- Social Media Profiles: Accounts on Facebook, Instagram, LinkedIn, or any other platform that holds personal or business information.

- Digital Subscriptions: Services like Netflix, Amazon Prime, or cloud storage platforms.

- Intellectual Property: Digital rights, copyrighted materials, or online business assets.

These assets can have both financial and emotional value. For example, your cryptocurrency could be a significant part of your net worth, while social media accounts may hold sentimental memories or professional branding.

Importance of Recognising Digital Asset Holdings

Recognising digital assets as part of your estate is essential to ensure they’re handled as you wish after you’re gone. Unmanaged digital assets could lead to complications in estate administration, loss of access, and unclaimed valuable digital investments.

The Need for Digital Estate Planning

The fast-paced shift towards digital finance and online interactions has brought new considerations for estate planning.

Here are the reasons you need digital estate planning:

-

Growing Reliance on Digital Assets

More people than ever are relying on digital assets for financial and personal activities. Cryptocurrency investments, in particular, have become popular, while digital accounts like PayPal, Venmo, or investment apps can hold considerable funds. As digital assets grow, so does the need for a plan that provides heirs access and clarity.

-

Risks of Unplanned Digital Asset Management

Without a clear digital estate plan, your assets can become “lost.” Heirs may struggle to access online accounts, and passwords or cryptographic keys could become permanently inaccessible. Also, legal disputes may arise if the ownership of certain digital assets is unclear, creating potential conflict among beneficiaries.

-

Legal Implications of Digital Asset Ownership

Laws around digital inheritance are still evolving, and ownership rules vary between platforms and jurisdictions. While you may “own” digital assets in practice, the terms of service on many accounts can restrict transfer upon death. Without a clear digital estate plan, this complexity can create roadblocks for your beneficiaries.

Digital Asset Management

Effective digital asset management ensures that your digital wealth and personal data are secure, well-organised, and accessible when needed.

What is Digital Asset Management

Digital asset management involves cataloging, securing, and organising all your digital assets to ensure proper access. In estate planning, this process also includes sharing information with trusted individuals who can oversee your digital estate to ensure it’s passed on smoothly.

Best Practices for Managing Digital Assets

- Inventory Your Assets: Make a list of all online accounts, subscriptions, and digital assets.

- Secure Access Details: Store usernames, passwords, and security questions in a secure password manager or physical safe.

- Set Up Recovery Information: Keep recovery methods (like backup emails) updated to ensure access.

- Consider Multifactor Authentication (MFA): MFA adds an extra layer of security, especially for accounts holding sensitive data or financial assets.

Tools and Software for Digital Asset Management

Several tools and software options can support digital asset management, from basic password managers to specialised estate planning software. Examples include LastPass for secure password storage, Everplans for estate organisation, and Keeper for managing digital accounts with enhanced security. These tools can help keep your digital life in order and ease the estate planning process for your heirs.

Best Practices for Digital Estate Planning

Creating a digital estate plan takes intentional effort and proactive management.

Here are some steps to build a plan that will safeguard your digital assets.

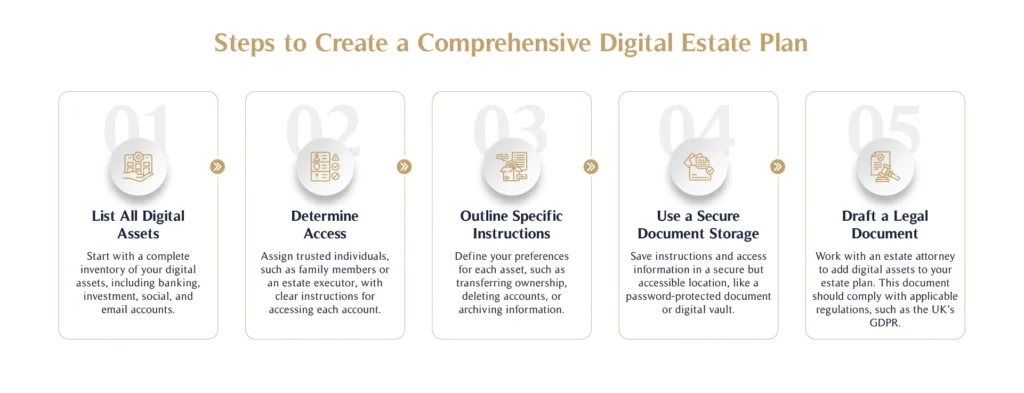

Steps to Create a Comprehensive Digital Estate Plan

- List All Digital Assets: Start with a complete inventory of your digital assets, including banking, investment, social, and email accounts.

- Determine Access: Assign trusted individuals, such as family members or an estate executor, with clear instructions for accessing each account.

- Outline Specific Instructions: Define your preferences for each asset, such as transferring ownership, deleting accounts, or archiving information.

- Use a Secure Document Storage: Save instructions and access information in a secure but accessible location, like a password-protected document or digital vault.

- Draft a Legal Document: Work with an estate attorney to add digital assets to your estate plan. This document should comply with applicable regulations, such as the UK’s GDPR.

Importance of Regular Updates and Reviews

Digital accounts are constantly evolving, so regular updates to your digital estate plan are necessary. Review it annually or whenever you make significant changes, such as adding new investment platforms or creating more online accounts.

Engaging Legal and Financial Professionals

Estate planning professionals can help create a comprehensive plan that addresses both traditional and digital assets. At MHG Wealth, our advisors are well-versed in digital estate planning and can help tailor your estate plan to include both digital and traditional assets for seamless management and transfer.

Common Pitfalls in Digital Estate Planning

Navigating digital estate planning can be challenging, especially with the unique complexities digital assets bring.

Here are some common pitfalls and how to avoid them.

-

Misunderstanding Digital Asset Ownership

Not all digital assets are owned outright by the account holder. For instance, some social media platforms and subscription services don’t allow account transfers after the owner’s death. It’s important to understand the terms of service for each asset and plan accordingly.

-

Neglecting to Include All Digital Assets

It’s easy to overlook smaller accounts or assets you use infrequently, but each account, even a simple social media profile, could contain valuable or sentimental information.

-

Failing to Communicate Plans with Heirs

If your heirs or executors don’t know about your digital assets or how to access them, your estate plan may fall short. Communicating with your family or a trusted advisor is essential for a smooth digital asset transition.

Conclusion

In today’s digital world, managing and protecting your digital assets has become as important as traditional estate planning. By taking the right steps—documenting assets, securing access, and working with professionals—you can ensure that your digital legacy remains secure and accessible for your heirs.

At MHG Wealth, we understand the complexities of digital estate planning and are here to guide you every step of the way. Our team can help you build a digital estate plan that aligns with your financial goals and personal values, providing peace of mind that your wealth is managed and transferred seamlessly.

Take control of your digital estate today. Connect with MHG Wealth’s advisors to learn how we can support you in protecting and growing your digital assets for generations to come.