The UAE is a magnet for businesses worldwide, renowned for its business-friendly environment and tax advantages. With no personal income tax and a corporate tax system designed to encourage economic growth, it’s an attractive destination for entrepreneurs and companies alike.

However, with the recent introduction of corporate tax on specific types of income, the need for well-thought-out business structuring has never been more crucial.

Proper corporate tax planning and structuring can help you minimise tax liabilities, comply with regulations, and position your business for long-term success.

Whether you’re establishing a new business or revisiting your current structure, this guide offers practical corporate tax panning insights to help you structure your business for maximum tax efficiency in the UAE.

Key Considerations for Corporate Tax Planning & Efficient Business Structures

Setting up your business in the UAE involves more than just registering a company name, it requires careful consideration of your business structure to ensure maximum tax efficiency.

Here’s how the type of entity, location, and nature of your business activities play a crucial role.

Type of Entity

The structure you choose directly impacts your tax obligations and operational flexibility.

Common options include:

- Limited Liability Company (LLC): Ideal for businesses aiming to operate on the mainland. LLCs allow direct access to the local market and flexibility in operations but are subject to UAE’s corporate tax regulations.

- Branch Office: Suitable for international businesses expanding into the UAE. As an extension of the parent company, its income might be taxed in the parent company’s jurisdiction or in the UAE, depending on treaties.

- Free Zone Company: A popular choice for businesses prioritising tax benefits. Free zone companies are exempt from corporate tax on qualifying income but have limitations on direct mainland trade.

Choosing the right entity ensures your business is structured to take advantage of available tax benefits while maintaining operational efficiency.

Location Matters

Where you set up your business in the UAE has a significant impact on your tax liabilities and opportunities:

- Mainland Companies: These entities can trade freely within the UAE but are subject to corporate tax on applicable income.

- Free Zone Companies: Located in specific zones designed to attract foreign investment, these entities often enjoy tax exemptions and operational perks but face restrictions on mainland trading.

- Offshore Companies: These are ideal for international trading or holding assets outside the UAE. Offshore entities benefit from no local taxation but cannot operate within the UAE’s economy.

Understanding the unique advantages of each location helps align your business goals with tax efficiency.

Nature of Business Activities

The type of work your company engages in can also determine the tax incentives available to you. For instance:

- Industries like renewable energy, healthcare, and technology may enjoy reduced tax rates or complete exemptions under specific UAE policies.

- Free zones often offer targeted benefits for businesses aligned with their strategic focus, such as trading in the Dubai Multi Commodities Centre (DMCC) or financial services in the Dubai International Financial Centre (DIFC).

Proper alignment of your business activities with the UAE’s economic priorities can significantly boost your tax efficiency.

Benefits of Free Zone Companies

Free zones in the UAE are strategically designed to attract foreign investors and businesses. They offer unparalleled tax and operational benefits, making them an attractive option for entrepreneurs and corporations looking for tax-efficient solutions.

Here are some of the key benefits of free zone companies:

Tax Advantages

Free zone companies enjoy a range of tax benefits, including:

- Corporate Tax Exemption: Income generated within a free zone often qualifies for exemption from corporate tax, provided the business meets specific regulatory criteria.

- No Personal Income Tax: Earnings for business owners and employees are untaxed, maximising take-home income.

- No Withholding Tax: Payments like dividends and royalties are not subject to withholding taxes, further reducing tax burdens.

These tax advantages allow businesses to reinvest savings into growth and expansion.

Operational Flexibility

Free zone companies are designed for simplicity and efficiency:

- 100% Foreign Ownership: Unlike mainland businesses, free zone companies do not require a local partner, giving you full control over your business.

- Streamlined Licensing and Visas: Free zones simplify administrative processes, from obtaining trade licenses to securing employee visas, allowing you to focus on operations.

This flexibility is especially valuable for startups and international businesses entering the UAE market.

Restrictions of Free Zone Companies

While the advantages are numerous, there are some limitations to keep in mind:

- Mainland Trading Restrictions: Free zone companies cannot trade directly with the mainland UAE without a local distributor, which could add costs.

- Compliance with Regulations: Each free zone has specific rules and qualifying criteria. Failure to adhere to these can lead to penalties or loss of tax benefits.

By understanding these restrictions, businesses can plan operations to maximise benefits while staying compliant.

Top Corporate Tax Planning in the UAE Strategies

Once your business is set up, implementing the right tax strategies can enhance efficiency and compliance.

Here are some actionable steps:

1. Utilise Tax-Free Zones

Identify and leverage free zones aligned with your business goals. For example:

- DIFC (Dubai International Financial Centre): Ideal for financial services firms.

- DMCC (Dubai Multi Commodities Centre): Best for trade and commodities businesses.

Ensure compliance with qualifying criteria, such as maintaining a physical presence in the zone, to retain tax exemptions.

2. Leverage Double Taxation Treaties (DTAs)

The UAE has over 115 DTAs with countries worldwide. These treaties prevent businesses from being taxed twice on the same income. For instance:

- The UAE-UK DTA allows businesses and individuals to reduce their tax liabilities when operating in both jurisdictions, ensuring seamless cross-border transactions.

DTAs are particularly beneficial for expats and businesses with international operations.

3. Separate Business Units Strategically

Establishing multiple entities can optimise tax efficiency. For example:

- A holding company can manage assets and oversee subsidiaries while taking advantage of reduced tax liabilities on dividends and capital gains.

- Separate entities for different business functions (e.g., trading, manufacturing) can allow you to allocate taxable income strategically.

4. Maximise Expense Deductions and Tax Credits

Under UAE corporate tax laws, certain expenses are deductible, such as:

- Salaries and benefits.

- Office rent and operational costs.

- Marketing and professional services.

Keep detailed financial records to ensure you claim all allowable deductions and tax credits, thereby reducing your taxable income.

Common Tax Structuring Mistakes and How to Avoid Them

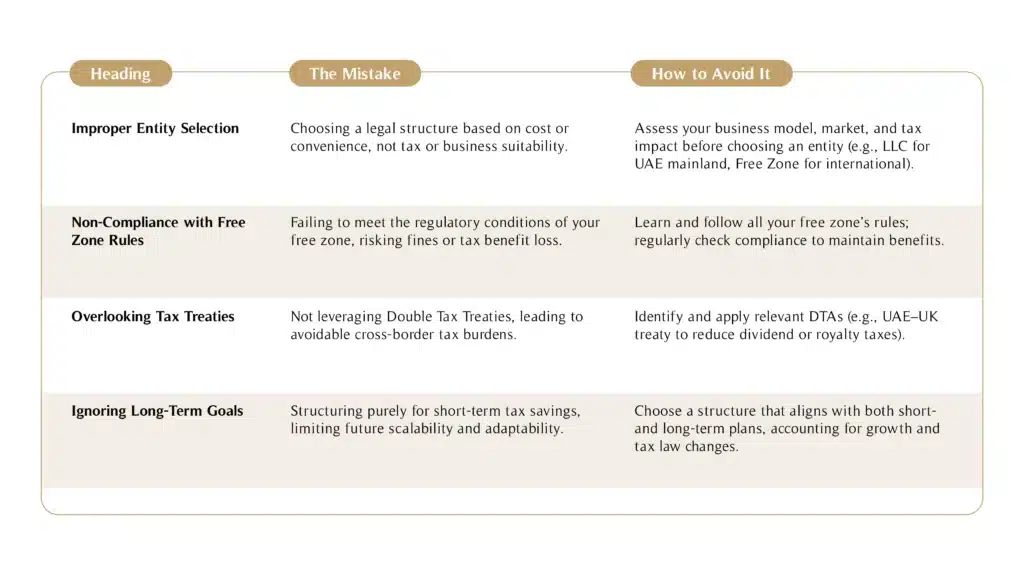

Tax efficiency isn’t just about making the right moves, it’s also about avoiding costly mistakes that can erode your profits and create legal challenges. Below are common tax structuring errors businesses make in the UAE and how to steer clear of them.

1. Improper Entity Selection

Choosing the wrong legal structure is one of the most frequent mistakes businesses make. Each type of entity, Limited Liability Company (LLC), branch office, free zone company, or offshore entity, comes with its own tax implications.

- The Mistake: Entrepreneurs often select a structure based on initial setup costs or ease of incorporation without fully understanding the long-term tax obligations tied to it.

- How to Avoid It: Conduct a thorough analysis of your business model, market goals, and tax regulations. For example, an LLC may work for businesses targeting the UAE mainland, while a free zone company may be more tax-efficient for international operations.

2. Non-Compliance with Free Zone Rules

Free zones in the UAE offer significant tax advantages, but these benefits are conditional on meeting strict regulatory requirements.

- The Mistake: Businesses sometimes fail to comply with qualifying criteria, such as maintaining a physical office or conducting specific permitted activities, which can lead to penalties or loss of tax exemptions.

- How to Avoid It: Understand and strictly adhere to the rules of your chosen free zone. Regularly review your compliance status to ensure continued eligibility for tax benefits.

3. Overlooking Tax Treaties

The UAE has an extensive network of Double Taxation Treaties (DTAs) designed to prevent businesses from being taxed in two jurisdictions.

- The Mistake: Many businesses fail to leverage these treaties, resulting in higher tax liabilities on cross-border transactions.

- How to Avoid It: Identify relevant DTAs for your industry and jurisdiction. For instance, if operating in the UAE and UK, the UAE-UK DTA can help reduce withholding taxes on dividends or royalties.

4. Ignoring Long-Term Goals

Structuring your business for short-term tax savings can be tempting, but it may hinder scalability and profitability in the future.

- The Mistake: Entrepreneurs often set up their companies without considering growth plans or future regulatory changes.

- How to Avoid It: Align your business structure with both immediate tax needs and long-term goals. Consider factors like scalability, potential expansions, and evolving tax laws in your strategy.

Role of Professional Advice in Corporate Tax Planning & Business Structuring

Navigating the UAE’s tax environment can be complex. Engaging legal and tax professionals can help you structure your business in a way that maximises tax efficiency and minimises risk.

Why Professional Advice is Crucial

Tax laws and regulations are constantly evolving. Professionals have the expertise to stay on top of these changes, ensuring your business remains compliant while benefiting from available tax incentives.

How MHG Wealth Can Add Value

- Entity Setup: Our tax advisors help you choose the most suitable legal structure based on your business goals and tax requirements.

- Tax Residency Solutions: We can assist in establishing tax residency for your business or employees, offering additional tax advantages.

- Cross-Border Planning: For businesses with international operations, we ensure that you leverage DTAs and avoid double taxation.

By consulting MHG Wealth, you can focus on growing your business while ensuring all tax-related matters are handled efficiently and effectively.

Conclusion

Structuring your business thoughtfully is a cornerstone of tax efficiency in the UAE. From selecting the right entity type to adhering to free zone regulations, each decision plays a pivotal role in optimising tax benefits and minimising liabilities.

Proactive planning is key, especially in an evolving tax environment. By aligning your business structure with both current opportunities and long-term goals, you can position your company for sustainable growth.

Don’t leave your tax efficiency to chance, seek professional guidance to unlock the full potential of operating in one of the world’s most business-friendly environments. Ready to optimise your business structure? MHG Wealth’s team of financial advisory experts are here to help. Contact us today to get started on your tax-efficient journey.