When it comes to investing, there’s more than just numbers involved. Your mind plays a very important role in your investment decisions.

Behavioural finance theory is the study of emotional and psychological factors and how they influence the decisions you make. The psychology of money.

The choices you make can have a huge impact on the outcomes of any investments you make. So, by understanding the factors at play, you can become a better investor, because you’ll be able to make rational choices, rather than decisions based on emotions or personal biases.

In this article, we’ll explain in greater detail what the psychology of investing is. We’ll also look at the key concepts behind the theory, and run through common behavioural biases in finance.

Key takeaways:

- Behavioural finance is the theory that emotions and your psychology are a factor in the financial decisions you make.

- There are five concepts to behavioural finance theory.

- These can be broken down into common behavioural biases.

What is Behavioural Finance?

Behavioural finance is a subfield of behavioural economics, based on the theory that biases and psychological influences affect the behaviour of investment decisions.

The psychology of investing as a concept dates back to 1912, when George Seldon published Psychology of the Stock Market.

In 1974, psychologists Daniel Kahneman and Amos Tversky proposed that investors often make decisions based on subjective reference points, rather than objectively.

Then in 1980, Richard Thaler introduced the concept of mental accounting. This was the idea that people view their money differently, depending on its intended function. For example, an investor may decide to make different investments depending on whether it’s for their retirement, or to top up a school fund for their children.

In time Kahneman, Tversky and Thaler’s theories grew into the field known as behavioural finance.

Traditional Finance vs Behavioural Finance

Both concepts make different assumptions about the rationality of investors.

Traditional finance is focused on the rationale of individual investors, and aims to maximise their wealth through the consideration of all available information.

If you agree with behavioural finance theory, you understand that investors don’t always act rationally. It places more emphasis on understanding why investors make the decisions they make.

Key Concepts in Behavioural Finance

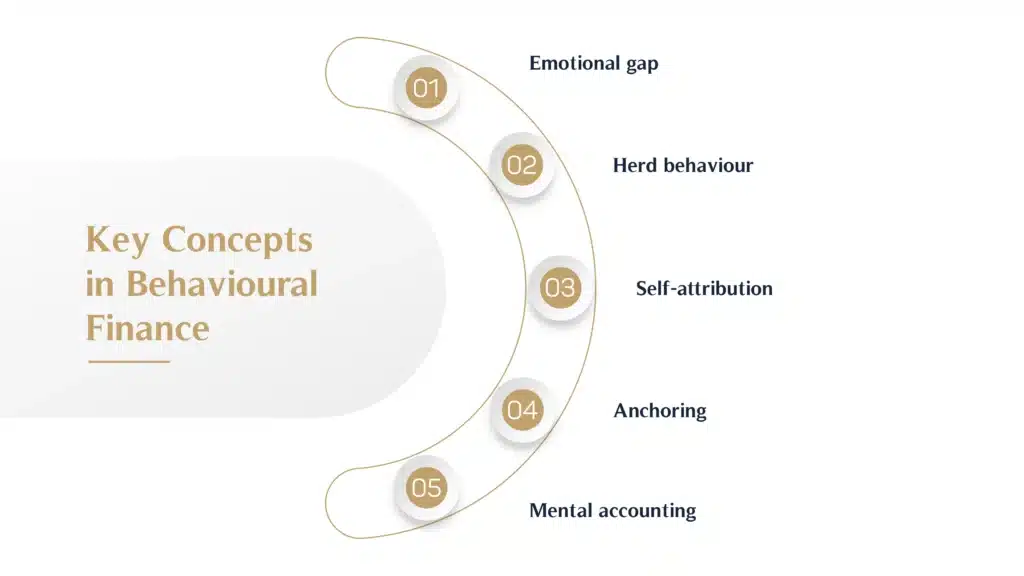

There are five main behavioural finance concepts:

- Emotional gap – Decision-making that is based on extreme emotions or strains. Anxiety, anger and/or fear can lead to irrational choices.

- Herd behaviour – The tendency for people to copy the behaviour of the herd majority Herding has caused many rallies and sell-offs in the stock market through the years

- Self-attribution – The tendency to make decisions that are caused by overconfidence in your own skill and/or knowledge. There is a danger of ranking your own knowledge higher than others.

- Anchoring – Attaching a level of spending to a specific reference point. For example, spending consistently based on a level of budget, or the rationalising of spending based on different satisfaction utilities.

- Mental accounting – A tendency to allocate money for certain purposes.

In a world in which AI in wealth management is becoming increasingly prevalent, it’s interesting to consider just how important emotions really are in investment decisions.

Allowing emotions to influence financial decisions can be the difference between roaring success, and bad decisions that cost you dearly. If you’re too confident and think you cannot lose, cockiness and a reality check could be your downfall. If you overthink things and worry too much, you could miss out on some great investments.

If you’re a business owner, getting advice from an expert team of financial advisers can really help provide a much-needed stabilising factor.

Emotions can be a factor in cognitive biases too, hinted at above, but broken down and explored in more detail below.

Common Behavioural Biases in Finance

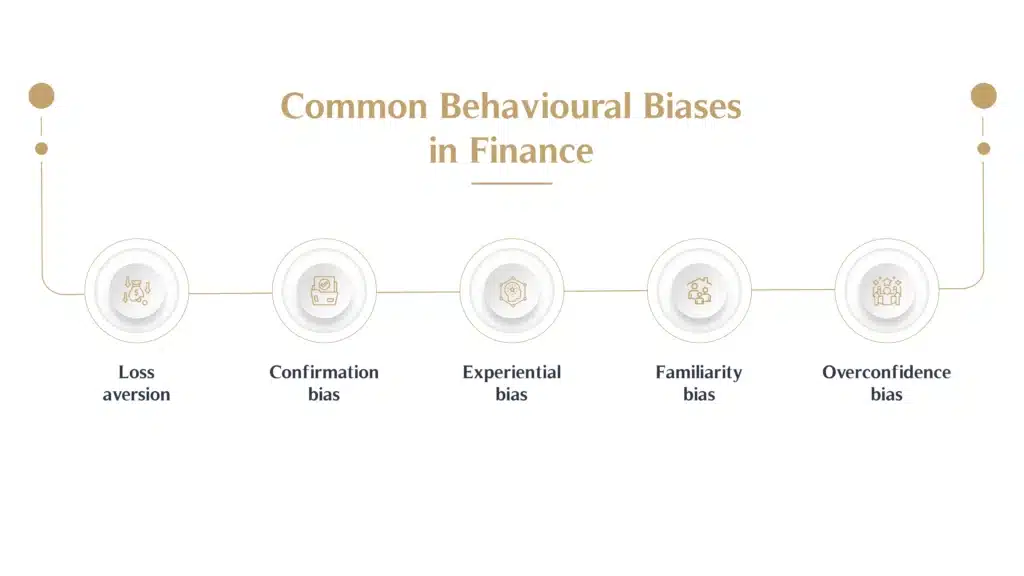

Many biases have been recognised in behavioural finance analysis, including:

- Loss aversion – This can happen if you place greater weighting on worry over potential losses than any pleasure you might get from possible gains. Because of this, you may expect a higher payout to compensate for any losses, and you might be tempted to avoid losses completely if the payout doesn’t reach your expectations.

- Confirmation bias – You’re predisposed to be biased towards accepting information that confirms an already held investment belief. Even if flawed information surfaces, you’d be in danger of accepting it anyway.

- Experiential bias – Your memory of recent events leads to bias, because you worry it could happen again. For example, the financial crisis of 2008 and 2009 caused many investors to leave the stock market.

- Familiarity bias – You tend to invest only in what you know, avoiding diversification across different sectors and over-reliance on the familiar.

- Overconfidence bias – You may overestimate your understanding of the markets, or specific investments. This could lead to you timing the market incorrectly, or concentrate too much on investing riskily, because you consider it a dead cert.

How to mitigate behavioural finance biases

To build a sound investment portfolio, you need to minimise these biases. Here’s how.

- Developing a structured plan – Work with financial advisers to build a plan that encompasses a risk tolerance assessment, a strategy for asset allocation and some clear goals to aim for.

- Embrace diversification – Lessen familiarity bias by spreading your investments wider.

- Education – A deeper understanding of market fundamentals can make you more rational when it comes to investing.

- Acknowledging biases – As with any issue, recognising your biases is half the battle won.

- Regular review and adjustment of portfolio – work with your financial advisers to identify and correct biases this way.

The impact of behavioural finance on our investment decisions cannot be underestimated. We’re all only human, and even the smartest investors may be subject to internal biases, without even realising.

The more you can understand the effect of psychological factors on your finances, the more rational you can be in the future.

If you have expert financial advisers on board to help you take a step back and look at financial decisions from a distance, behavioural finance will be less of an issue. Get in touch with MHG Wealth today to see how we can help.