In today’s dynamic financial landscape, investors are increasingly looking beyond traditional stocks and bonds to diversify their portfolios and enhance returns.

Alternative investment strategies offer access to unique asset classes such as private equity, hedge funds, real estate, commodities, and cryptocurrencies, each presenting distinct opportunities and risks. These investments often have lower correlation with public markets, making them valuable tools for hedging against volatility and achieving long-term wealth growth.

In this guide, we’ll explore various alternative investment strategies, their benefits, and how they can help you build a more resilient and profitable investment portfolio.

What are alternatives?

Alternative investments refer to asset classes beyond traditional stocks, bonds, and cash. These investments often provide diversification, higher return potential, and a hedge against market volatility. Examples include private equity, where investors fund private companies for long-term growth, and hedge funds, which use advanced strategies like short-selling and leverage.

Real estate offers tangible assets with rental income and appreciation, while commodities like gold and oil protect against inflation. Additionally, cryptocurrencies provide digital investment opportunities with high volatility. Alternative investments can be valuable for high-net-worth investors seeking portfolio diversification and long-term wealth accumulation.

What are alternative investment funds?

Alternative Investment Funds (AIFs) are pooled investment vehicles that invest in non-traditional assets such as private equity, hedge funds, real estate, venture capital, commodities, and structured products. Unlike mutual funds or ETFs, AIFs typically cater to high-net-worth individuals (HNWIs) and institutional investors, offering sophisticated strategies with potentially higher returns. They are often less regulated, allowing for greater flexibility in asset selection and risk management.

Examples include hedge funds using complex trading strategies, real estate investment trusts (REITs) for property investments, and private equity funds focusing on unlisted companies. AIFs help investors diversify portfolios beyond conventional stock and bond markets.Read our blog to learn the key differences between private equity and hedge funds

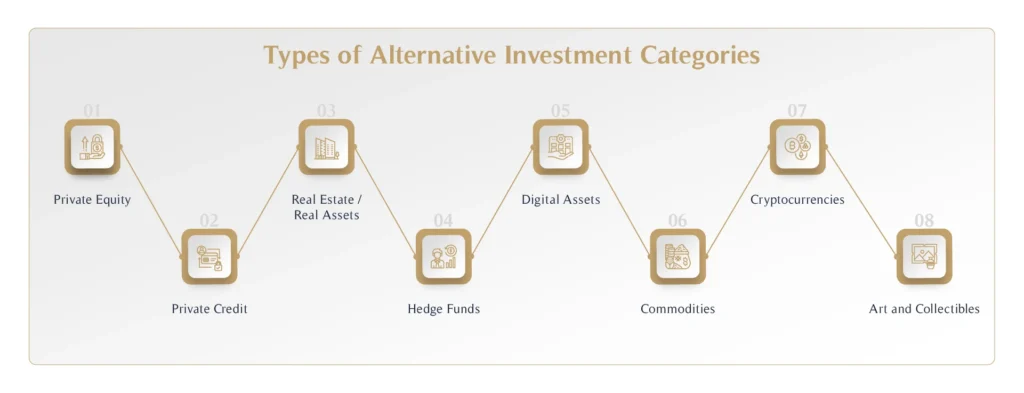

Alternative Investment Categories

Alternative investments encompass a broad range of asset classes that fall outside traditional stocks, bonds, and cash-based investments. These investments are often used by investors to diversify their portfolios, reduce risk, and potentially achieve higher returns than those offered by conventional financial markets.

By exploring categories such as private equity, real estate, commodities, and digital assets, investors can tap into opportunities that are less correlated with the performance of traditional markets. As such, alternative investments offer a valuable strategy for those seeking to navigate market volatility and enhance long-term financial growth.

-

Private Equity: Investments in private companies (non-publicly traded), which may include venture capital, buyouts, or growth equity investments.

-

Private Credit: Lending directly to private companies, often through private debt instruments like loans or bonds. This includes strategies like direct lending, distressed debt, or mezzanine financing.

-

Real Estate / Real Assets: Investments in physical properties or tangible assets (e.g., land, infrastructure). This can also include real assets like timberland or farmland.

-

Hedge Funds: Pooled funds that use various strategies to generate returns for their investors, such as long/short equity, arbitrage, and global macro investing.

-

Digital Assets: A broad category that includes blockchain-based assets such as cryptocurrencies, NFTs (non-fungible tokens), and digital securities.

-

Commodities: Physical goods or raw materials like gold, oil, agricultural products, and industrial metals. Investments can be in futures contracts or direct ownership.

-

Cryptocurrencies: Digital or virtual currencies using cryptography for security, including Bitcoin, Ethereum, and altcoins.

-

Art and Collectibles: Tangible items like fine art, rare wine, antiques, rare coins, or luxury collectibles. These are often valued for their scarcity and unique characteristics.

Alternative Investment Strategies vs. Categories

Alternative investments refer to a broad range of assets that exist outside of traditional stocks, bonds, and cash. These alternative investment categories are defined by the type of asset being invested in and the nature of the investment. Investors often explore these categories to diversify their portfolios and manage risk outside traditional financial markets. Common alternative investment categories include Private Equity, real estate , commodities, cryptocurrencies , art and collectables , private debt , hedge funds etc.

These categories represent non-traditional investments that differ from the typical public market investments, offering diversification opportunities with varying risk and return profiles.

On the other hand, alternative investment strategies refer to the specific methods or approaches used within these categories to generate returns, manage risk, or achieve investment goals. These strategies dictate how investors approach these assets and may include methods like long/short equity or value-add strategies in real estate. For instance:

- Hedge Fund Strategies: Long/short equity, global macro, or event-driven approaches.

- Private Equity Strategies: Venture capital for startups or buyouts of established companies.

- Real Estate Strategies: Value-add or income-focused investing (renovating properties or generating rental income).

- Commodities Strategies: Futures contracts or direct ownership.

- Cryptocurrency Strategies: Long-term holding (HODLing), trading, or staking.

In summary, categories define the broad asset class you are investing in, such as real estate or cryptocurrencies, while strategies define the specific methods you use to manage or invest in those assets, such as value investing in real estate or using a trend-following strategy for commodities. Categories are about the “what,” and strategies are about the “how” of investing.

Alternative Investment Categories & Alternative Investment Strategies

| Investment Categories | Alternative Investment Strategies |

| Private Equity | Venture Capital (investing in startups) |

| Leveraged Buyouts (LBOs) (acquiring established companies) | |

| Real Estate | Value-Add (renovating and selling properties) |

| Core/Core-Plus Investing (buying properties for rental income) | |

| Commodities | Futures Contracts (betting on future prices) |

| Direct Ownership (physical commodities like gold or oil) | |

| Cryptocurrencies | Long-Term Holding (HODLing) |

| Trading (buying and selling for short-term profit) | |

| Staking (participating in network validation for rewards) | |

| Art & Collectibles | Buy and Hold (holding items for long-term appreciation) |

| Speculative Resale (buying low, selling at auction for a profit) | |

| Private Debt | Direct Lending (lending to companies or individuals) |

| Mezzanine Debt (hybrid of debt and equity) | |

| Hedge Funds | Long/Short Equity (buying undervalued and shorting overvalued stocks) |

| Arbitrage (exploiting price differences in markets) | |

| Event-Driven (investing based on corporate events like mergers or bankruptcies) |

The MHG Wealth Approach to Alternative Investments

At MHG Wealth, we offer exclusive access to premier alternative investments with a personalised approach tailored to each investor’s goals. Our commitment to rigorous due diligence and strategic partnerships ensures high-quality investment opportunities across private markets. We provide direct investment access to private companies, allowing investors to capitalise on unique growth potential. Additionally, we emphasise values-based investing, aligning portfolios with ethical and sustainable principles.

Key Pillars of Our Approach:

-

Exclusive Access & Personalised Guidance – Tailored investment solutions with access to top-tier alternative investment opportunities.

-

Strategic Partnerships – Collaborating with leading alternative investment managers to deliver high-quality opportunities.

-

Rigorous Due Diligence – Conducting comprehensive investment and operational evaluations to mitigate risks.

-

Direct Private Market Investments – Offering direct access to private companies with strong growth potential.

-

Values-Based Investing – Aligning investments with ethical, sustainable, and impact-driven strategies.

How Can Someone Get Started with Alternative Investments?

To get started with alternative investments, individuals should first assess their financial goals, risk tolerance, and investment horizon. Consulting with a wealth management firm like MHG Wealth can provide personalised advice and guidance. MHG Wealth specialises in helping high-net-worth individuals navigate alternative investment opportunities, from private equity to real estate, ensuring tailored strategies that align with your objectives. With expert insights and a clear plan, you can make informed decisions and diversify your portfolio effectively. To explore how these top alternative investment strategies can align with your financial goals, visit our Alternative Investments page for more details

FAQ’s

Who Can Invest in Alternative Asset Classes?

While some alternative investments are restricted to accredited investors and institutions, others (like REITs, commodity ETFs, and publicly traded private equity funds) are accessible to retail investors.

What is the Minimum Investment Required?

What’s a Typical Time Horizon for Alternative Investments?

Alternative investments often have a longer time horizon, typically ranging from 3 to 10 years, depending on the asset type and strategy. Some may require a lock-up period before returns are realised.

Who Are the Primary Investors in Alternatives?

Primary investors in alternative assets include accredited investors, institutional investors, family offices, and high-net-worth individuals (HNWI), who seek to diversify their portfolios and manage risk outside traditional financial markets.

What Types of Returns Can Be Expected from Alternative Investments?

Alternative investments offer varying returns depending on the asset class, ranging from stable income (real estate) to high-growth potential (private equity). Returns can be higher than traditional assets, but with greater risk.

Are Alternative Investments Liquid?

Liquidity varies by asset class. While many alternative investments, like private equity and venture capital, are illiquid, others, such as publicly traded REITs and certain hedge funds, offer liquidity options

How to Invest in Alternative Investments?

Alternative investments are accessed by identifying suitable opportunities such as private equity, real estate, or hedge funds, often through specialised platforms or financial advisers. The process typically involves due diligence, risk assessment, and aligning the investment with your long-term financial goals. Learn more about how to invest in alternative investment strategies to make informed decisions.