Global real estate investing has a world of opportunities for potential investors. Real estate investment brings a long-term income and earning capacity. Among the most popular destinations are the UK and Dubai. The two countries are very different for many reasons, with advantages and disadvantages to both.

Read on to find out more about real estate investing in the UK and Dubai. By comparing and contrasting the two, we’ll help you decide which would work best for you.

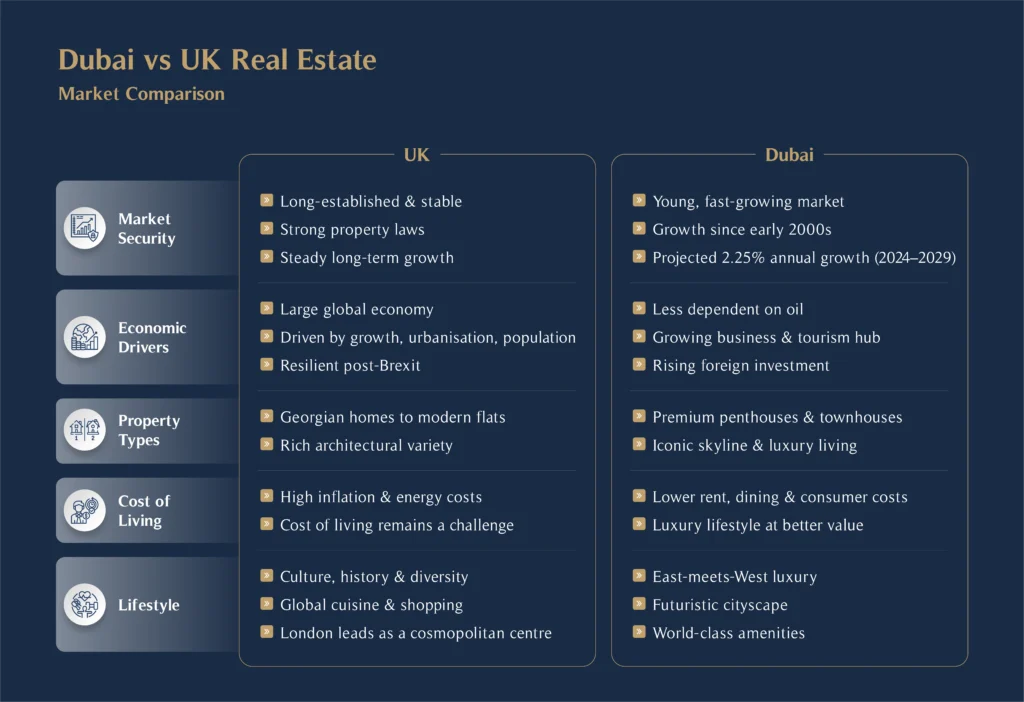

Dubai vs UK Real Estate Market Overview and Comparison

Let’s see how Dubai real estate investment compares to real estate investing in the UK.

Market security

The UK real estate market has long been considered as reliable. Invest in the UK and you have usually been able to expect a consistent, if unspectacular, rise in house value. Despite recent dips in the market, demand still outstrips supply.

Established property laws further bolster the reputation of the UK as a safe bet. But make sure you’re prepared to be in it for the long haul.

By comparison, Dubai real investment is a youthful, buoyant market. Growth has been exponential since the early 2000s thanks to increased foreign investment and infrastructure development. Growth is predicted to continue steadily at an estimated 2.25% between 2024 and 2029.

Economic factors

The UK has one of the world’s largest economies, and the UK real estate market is driven largely by:

- Economic growth

- Population increase

- Urbanisation

Even with the potential volatility of Brexit, the market has demonstrated surprising resilience.

Dubai’s economy has been strengthened by diversification in recent years, with the city relying less on oil revenues and increasingly on its growing reputation as a global business hub.

Property types

The UK has a very diverse selection of properties, ranging from historic Georgian homes to super-stylish luxury apartments in London alone.

Meanwhile, Downtown Dubai wows with premium penthouses and townhouses.

Cost of living in the market

The cost of living has soared in the UK in recent years due to inflation, food prices and high energy bills. Even though inflation is finally slowing down, it’s still a considerable issue.

Dubai may have a reputation as a rich person’s paradise, but living there is more affordable than London, thanks to lower rent, restaurant and consumer prices.

Lifestyle

Many cities in the UK – especially London – are cosmopolitan, culturally diverse and full of history. Great restaurants, shops, global chains and entertainment are easy to find.

Dubai is also a melting pot of cultures, where East meets West for a truly luxury lifestyle of high-end shops and futuristic buildings.

Key Differences Between Dubai and UK Real Estate

Here are the most important differences to consider between real estate investing in Dubai and the UK.

Legal and regulatory differences

Real estate investment in the UK is heavily regulated, which ensures high levels of security for buyers. Conveyancing is meticulous, and energy efficiency is rated.

Dubai is comparatively new to the game but catching up. There used to be concern over the city’s keenness to accept money from unknown sources, but the Real Estate Regulatory Agency (RERA) is trying to improve transparency and protect investors.

Tax implications for expats

This is understandably one of the main reasons why people invest in Dubai real estate. There is no income tax or capital gains tax, and property tax is only 5% of the annual rental value. Read more about this topic in our guide to taxes for expats in the UAE.

In the UK, capital gains tax alone ranges from 10% to 18%. Then there are council tax and rental income tax, as well as the progressive income tax rates. Dubai is the clear winner here.

Financing options and mortgage availability

In the UK, there are many fixed-rate and variable-rate mortgage deals at competitive prices. Lenders conduct thorough financial assessments, including credit checks.

In Dubai, there are conventional mortgages, Islamic mortgages (Sharia compliant), home finance companies, developer financing and rent-to-own.

Investment returns

Rental yields are one of the most crucial considerations in real estate investing for those looking for a regular income.

As of 2024, the average UK rental yield is between 5% and 8%, with the highest performing areas located in the North East, Scotland and the North West.

Dubai has similarly consistent returns, with figures ranging from 5% to 9% in some of the better markets.

So, which is best – property investment in Dubai, or the UK? There’s no easy answer, because it depends on your personal situation and risk tolerance.

Investment Challenges in the UK

Investing in the UK’s real estate market, particularly in London, comes with its own set of rewards and hurdles. While it remains a highly sought-after destination for property investors, navigating the political, economic, and regulatory challenges is essential for long-term success.

Political and Economic Challenges in London

London, the beating heart of the UK property market, is deeply influenced by its political and economic landscape. Recent political uncertainty, such as Brexit and ongoing discussions about potential tax changes, has caused fluctuations in market confidence. These uncertainties, coupled with concerns over economic stability, often make investors cautious about entering the market.

Additionally, London’s competitive market sees high property prices, particularly in the prime property market. These rising prices can squeeze potential returns, especially in a city where demand for affordable housing is overshadowed by a focus on luxury developments.

Impact of Market Stability on Investment Decisions

Historically, the UK real estate market has been synonymous with market stability. However, recent economic shifts have introduced volatility, particularly in high-end developments where oversupply of luxury properties has impacted sales and capital appreciation. This has made it increasingly important for investors to conduct in-depth market analysis to identify the best opportunities and mitigate risks.

For those reliant on rental income streams, the current economic climate has also introduced challenges. Factors such as inflation and changing tenant preferences have affected rental yields, requiring landlords to adopt flexible strategies to maintain steady returns.

Regulatory Complexities in London’s Market

The UK is renowned for its strong property rights and comprehensive legal safeguards for investors. However, these protections come with layers of complexity. For instance, property taxes like Stamp Duty Land Tax (SDLT), coupled with transaction costs, can significantly increase the initial outlay for investors.

Additionally, navigating regulations around energy efficiency, tenant protections, and property maintenance can be daunting for those unfamiliar with the market. While these rules provide long-term stability, they often require additional resources and expertise to ensure compliance.

Read our guide on how to invest in property UK

Dubai’s Real Estate Market

Dubai has emerged as one of the fastest-growing real estate markets globally, offering a unique blend of opportunities for investors seeking high returns. With its strategic location, visionary leadership, and investor-friendly policies, Dubai’s property market continues to attract attention.

Recent Market Data and Growth Projections

Dubai’s real estate market has demonstrated remarkable resilience, with steady growth even during global economic downturns. According to the Dubai Land Department, the market has seen a surge in transactions, driven by both local and international buyers. Projections indicate a steady ROI of 5% to 9% in key areas, making Dubai a competitive choice for property investors.

The city’s ambitious plans, such as the Dubai 2040 Urban Master Plan, aim to enhance infrastructure, create sustainable communities, and further boost property values. For example, areas around Expo City have seen significant growth due to the success of Expo 2020 and the subsequent development of world-class amenities.

Key Infrastructure and Strategic Plans

Dubai’s government has prioritised infrastructure development, with strategic infrastructure projects that include state-of-the-art transport systems, luxury residential developments, and vibrant commercial hubs. This investment has solidified Dubai’s reputation as a global city with modern amenities and a vibrant lifestyle.

Additionally, visionary leadership, including the efforts of Sultan Butti Bin Mejren, has played a pivotal role in enhancing investor confidence. Policies that simplify property transactions and ensure market transparency have made Dubai an increasingly attractive destination.

Market Stability and Economic Fundamentals

Unlike many other rapidly growing markets, Dubai has focused on building a foundation of economic fundamentals to ensure long-term growth. Its economy is no longer solely reliant on oil revenues but has diversified into tourism, finance, and technology. This diversification, combined with strong governance, has created a stable environment for property investments.

Furthermore, Dubai’s prime property market offers high yields and opportunities for capital growth in a market where demand for ultra-luxurious homes continues to rise.

It’s important you know how to invest money in the UAE.

Investing in Dubai vs UK real estate market – Conclusion

So, which is best – property investment in Dubai, or the UK? There’s no easy answer, because it depends on your personal situation and risk tolerance. While the UK is attractive if you want a dependable, heavily regulated, low-risk choice, Dubai is perfect if you’re looking for high returns and can cope with some relative volatility.

Need more guidance? Our wealth management in Dubai services provide solutions to help you grow, manage, and protect your wealth while living abroad. Wherever you live, get in touch with one of our property investment advisors today.

FAQs

Is Dubai a good country to invest in real estate?

Absolutely. Dubai offers a stable and transparent property market, attractive yields, and no income or capital gains taxes, making it a haven for international investors.

Is the UK a good place to invest in real estate?

Yes, the UK provides strong legal protections and a stable market for long-term investments. However, challenges such as high transaction costs and political uncertainty should be carefully considered.

What is the rental yield in Dubai compared to the UK?

Dubai’s rental yields range from 5% to 9%, while the UK offers 5% to 8% on average. Both markets can provide consistent income, but Dubai’s tax-free environment often makes it more lucrative.

Is it worth owning a property in Dubai?

Owning a property in Dubai can be highly beneficial, especially with its tax-free status, high rental yields, and opportunities for capital appreciation in a rapidly growing market.