You’ve worked hard, you’ve been putting money aside but now you’re tired of seeing it slowly accumulate, or worse, go down in value as it sits idle in your account. You want to invest but that can mean a million and one things – max out your ISA allowance? Take up an interest in Bitcoin? Look for an entrepreneur with a game changing idea?

Before diving into active vs passive investing, it’s important to know the best ways to earn money from money so you can make informed decisions about your financial future.

When you’re looking for your first investment opportunity and deciding on the next step in your investment strategy, the first thing is to decide between passive investing vs active investing.

Here we look at active vs passive investing, what are the differences and pros and cons of both of each style.

What is active investing?

Active investing is when you invest in funds where portfolio managers select the component investments for you based on an independent assessment of their worth. It essentially means taking time to research your investments and constructing and maintaining your portfolio, either on your own or through a fund manager.

Active investments tend to be based on short-term performance and the aim is to beat average market returns. This approach allows money managers to adjust investors’ portfolios to align with prevailing market conditions. In essence, active investing is as it sounds – it involves proactive involvement rather than putting your money into the investment and letting it do its thing over time.

Types of active investment strategy

There are lots of ways to define investment types, but in the context of equity, shares and funds, active investment can broadly be divided into two categories:

- Fundamental (also known as discretionary): This focuses on human judgement to choose your investments – perhaps you choose them, or your fund manager does.

- Quantitative (also known as rules-based): This is where quantitative models are used to select investments, including risk analytics, and portfolio optimisation.

Within your active investment strategy, you may then take one of the following approaches:

- Bottom-up – based on value and growth.

- Top-down – based on the macroeconomic environment.

- Factor-based – when you look at a set of characteristics because of particular knowledge you may have (price momentum, value, etc).

- Activist – when you take a meaningful stake in a listed company that can influence its value.

Benefits of active investing

- Active investment funds tend to be more flexible than their passive counterparts.

- You can hedge your bets by using short sales, placing options and other strategies.

- Active investment can bring bigger returns than passive investment.

- They can deliver performance that beats the market over time, even after their fees are paid.

- You can manage your risk by selling specific holdings quickly when the stakes get too high or you deem appropriate.

- You can manage your tax with strategies such as offsetting taxes from money-losing investments against winning stocks.

- There’s potential to benefit from mispriced opportunities in the market.

Risks of active investing

- There are often high management fees, especially if you go through a recommended advisor, and investments need to perform well to make that worthwhile.

- Active investment comes with greater risks than passive investment.

- There’s no guarantee an active fund will be able to deliver index-beating performance and many don’t.

- Fund managers are human and they don’t always get things right, which can be expensive.

What is passive investing?

Passive investing or passive funds are often preferred by investors who are looking at a long-term strategy. It’s generally considered to be lower risk, depending on the details of your approach, but that doesn’t mean it’s for beginners. On the contrary, finance oligarch, Warren Buffett, has famously been a proponent of a passive investment strategy, believing in the long-term efficiency and lower costs that they can yield.

The principle is summed up in his quote: “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.” To explain, passive funds track the performance of the market or index that you’re looking at (e.g., the FTSE 100 or the Standard & Poor’s 500). They can be funds that track the broad market or narrow sectors, depending on your appetite for risk, your personal interests and your knowledge.

Types of passive investment strategy

Passive investment funds can include open-ended investment companies (OEICs), stock market listed exchange traded funds (ETFs) and more. However, the common theme is that it’s about buying and holding a portfolio for the long-term with minimal trading. Within that, you can select your investments based on different factors, such as the value of the dividends they pay, sticking to the 100 largest listed firms (I.e., the FTSE 100 in the UK), and you can opt for an established fund or build your own portfolio, usually through a fund manager.

Benefits of passive investing

- It’s a low-cost way of gaining exposure to certain assets/industries.

- It’s less complicated.

- There’s generally less risk, especially if you opt for funds at the top end of the market.

- It’s a solid and established medium- to long-term way of building moderate wealth.

- They generally perform closer to the index.

- Typically more tax-efficient.

Risks of passive investing

- More of a con than a risk, but there’s no opportunity to outperform the market.

- You still participate in the downside of the market.

- You buy and sell based on the index rather than personal research, which gives you less direct control.

Active vs. Passive Investing Overview

When considering investment strategies, the choice often boils down to active vs. passive investing. Both approaches aim to grow your wealth, but their methodologies, risks, and rewards differ significantly.

Active Investing involves a hands-on approach where fund managers or individual investors make strategic decisions to buy or sell investments. The goal? To outperform the market. This requires extensive research, market analysis, and a dynamic strategy tailored to current conditions. For example, actively managed equity funds focus on identifying opportunities with the potential for higher returns, albeit with a higher expense ratio due to management fees.

Passive Investing, on the other hand, takes a long-term buy-and-hold approach, typically involving index funds or ETFs that track a specific benchmark. With lower fees and minimal trading, this strategy emphasises simplicity and cost-effectiveness while mirroring the market’s overall performance.

To better understand these strategies, let’s explore their market trends and fundamental differences.

Market Trends in Active vs. Passive Investing

In recent years, there has been a noticeable shift in investment flows towards passive strategies. Passive equity funds have seen significant net inflows, while actively managed funds face challenges like higher costs and underperformance against benchmarks.

According to the latest market data:

- Passive funds now control over 50% of global equity fund assets.

- Index fund share growth continues to outpace actively managed funds, especially among retail investors seeking cost-effective solutions.

This trend highlights the increasing preference for low-cost index trackers and the growing influence of robo-advisors in shaping investment decisions.

Fundamental Differences Between Active and Passive Investing

Objective: Active investing aims to outperform the market through strategic decisions, while passive investing focuses on replicating market performance.

Management: Active funds rely on the expertise of fund managers to analyse qualitative and quantitative factors, such as market trends and company performance. Passive funds, however, are designed to track an index like the S&P 500 with minimal human intervention.

Cost: The expense ratio for actively managed funds is typically higher due to management fees and frequent trading. Passive funds, with their low operating costs, offer a more budget-friendly option.

Flexibility: Active investors can adapt to market conditions, making contrarian moves during volatility. Passive investors, conversely, adhere to the benchmark’s composition, limiting flexibility.

The Role of Fund Managers in Active and Passive Investing

Fund managers play a pivotal role in active investing. They:

- Analyse market conditions using dynamic strategies.

- Make informed investment decisions to maximise returns.

- Implement tax management strategies to optimise after-tax gains.

In passive investing, fund managers focus on maintaining alignment with the benchmark index, ensuring accurate market performance tracking, and minimising costs.

Blending Active and Passive Strategies

Blending active and passive investment strategies combines the strengths of both approaches, offering investors flexibility and balance. This hybrid strategy leverages the active approach’s potential for market outperformance while maintaining the cost-effectiveness and diversification of passive investing. By incorporating elements of both, investors can aim to achieve their strategic goals while managing risks effectively.

For instance, a portfolio might use passive index funds for long-term stability (buy-and-hold mentality) and active funds to target specific opportunities, such as undervalued stocks or emerging markets. This combination creates a diversified portfolio that adapts to changing market conditions while staying grounded in low-cost, consistent investment options.

Benefits of Combining Strategies

- Diversified Portfolios:

Blending strategies allow for exposure to broad market indices through passive investments while targeting specific sectors or assets through active management. This ensures a balanced and robust portfolio that mitigates risk. - Risk Management:

Passive strategies provide stability, especially in volatile markets, while active strategies enable dynamic adjustments based on qualitative and quantitative factors. Together, they create a risk-optimised investment approach. - Tax Management Strategies:

Active management can help offset capital gains tax by strategically selling underperforming assets, while passive investments often provide tax efficiency due to their lower turnover rates. - Enhanced Performance Potential:

Active investments can capitalise on mispriced opportunities, while passive funds ensure consistent market exposure, balancing returns over time. - Strategic Goals Alignment:

Blending strategies allow investors to align with their specific financial planning objectives, from wealth building to retirement planning, by leveraging both approaches’ strengths.

Practical Examples of Blended Strategies

- Core-Satellite Approach:

This method involves using passive funds as the “core” of the portfolio to provide stability and broad market exposure, such as S&P 500 index funds, and active funds as “satellites” to pursue higher returns in niche markets. - Hedging Techniques:

Use active strategies to hedge against specific risks, such as currency fluctuations, while maintaining passive investments for long-term growth. - Dynamic Asset Allocation:

A blended portfolio can shift allocations between active and passive investments based on market conditions, such as increasing active exposure during volatile periods to capitalise on market inefficiencies. - Factor-Based Investing:

Employ active strategies to focus on specific factors, such as growth or value, while passive investments track broad indices for diversified exposure.

Comparative Analysis: Active vs. Passive

Performance Comparison: Studies such as the SPIVA Scorecard consistently show that most actively managed funds underperform their benchmarks over the long term. However, in certain market conditions, active investors can achieve higher returns by making contrarian moves or exploiting market inefficiencies.

Implementation Complexity: Active investing requires substantial time, expertise, and resources for analysis and decision-making. Passive investing, with its simplicity, suits those seeking a low-maintenance approach.

Adaptability: Active investors’ ability to adjust portfolios dynamically can be advantageous during market downturns or periods of high volatility.

ETFs and Passive Investing

Exchange-traded funds (ETFs) play a crucial role in passive investing. These funds:

- Track specific indices, offering low-cost exposure to diverse asset classes.

- Provide flexibility with intraday trading, unlike mutual funds.

- Appeal to cost-conscious investors with low expense ratios.

Note: Not all ETFs are passive. Actively managed ETFs have gained traction, combining the benefits of ETFs with active strategies. This shift reflects the evolving landscape of investment products.

Market Trends in Passive Investing

The growth of passive investing continues to reshape the financial landscape. Key trends include:

- Index fund share growth: Passive funds account for a growing percentage of global assets.

- Retail investor adoption: Cost-effective investing options like ETFs attract individual investors.

- Limitations: Despite their popularity, passive strategies face criticism for lack of flexibility and inability to outperform benchmarks during market downturns.

Starting with Passive Investing

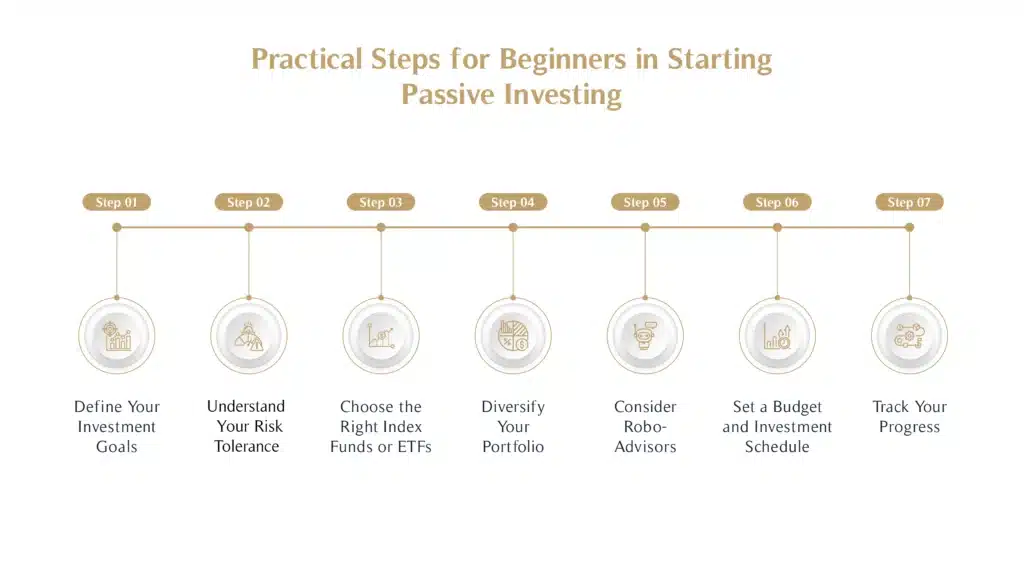

Practical Steps for Beginners in Starting Passive Investing

- Define Your Investment Goals:

Determine why you are investing—be it retirement savings, wealth building, or funding a major purchase. Clear goals will guide your strategy. - Understand Your Risk Tolerance:

Assess your ability and willingness to handle market fluctuations. Passive investing typically suits investors with a long-term horizon and moderate risk appetite. - Choose the Right Index Funds or ETFs:

Research options such as the S&P 500 or Dow Jones Industrial Average index funds for broad exposure, or sector-specific funds for targeted growth. - Diversify Your Portfolio:

Spread your investments across various assets, including equity funds, mutual funds, or real estate crowdfunding, to reduce risk. - Consider Robo-Advisors:

Beginners can use robo-advisors to automate investment decisions. These platforms use algorithms to create diversified portfolios based on your preferences, often at a lower cost than traditional advisors. - Set a Budget and Investment Schedule:

Decide between lump-sum investing or regular contributions. For instance, monthly investments can reduce market timing risks. - Track Your Progress:

Periodically review your investment portfolio to ensure it aligns with your goals and risk tolerance. Passive investments require minimal adjustments but still benefit from occasional oversight.

The Role of Robo-Advisors in Passive Investing

Robo-advisors simplify passive investing by offering automated solutions tailored to individual preferences. These platforms use advanced algorithms to allocate funds, rebalance portfolios, and minimise costs. They are particularly beneficial for cost-effective investing, as fees are typically lower than those of human advisors.

Costs Associated with Passive Investing

- Expense Ratios:

Passive investments, such as index funds and ETFs, often have significantly lower expense ratios than actively managed funds. - Transaction Costs:

While these are minimal for buy-and-hold strategies, they can vary depending on your chosen platform or broker. - Robo-Advisor Fees:

Most platforms charge an annual management fee, usually a fraction of what traditional advisors cost, making them a budget-friendly option for beginners.

Active vs. Passive Investment Strategy: Making the Right Choice for Your Goals

Whether you choose to pursue an active investment strategy or a passive investment strategy, it’s important to first decide what your goals are. A successful investment journey begins with clarity on what you want to achieve. Are you saving for retirement, building up a cash buffer, or paying school fees? Knowing the purpose of your investment will help you determine the right approach.

Active Investment Strategy vs. Passive Investment Strategy

An active investment strategy involves making specific, informed decisions about investments with the aim to outperform the market. This can include frequent buying and selling of assets, focusing on short-term opportunities, and capitalizing on market trends. Active investors typically rely on their research, insights, and market timing to generate returns.

In contrast, a passive investment strategy aims for long-term growth through broad market exposure with minimal trading activity. Passive investors usually focus on low-cost index funds or exchange-traded funds (ETFs) that track market indices, such as the S&P 500, instead of trying to beat the market. Passive investing is often considered a more stable, low-maintenance approach with lower fees.

Choosing Between Active and Passive Investment Strategies

To decide whether an active investment strategy or a passive investment strategy is right for you, consider your risk tolerance and financial goals. Active investing may offer the potential for higher returns, but it also involves more risk and requires time and knowledge of market trends. Passive investing, while often less volatile and easier to manage, might not deliver as high a return in the short term.

Best Passive Investment Strategy

When it comes to finding the best passive investment strategy, choosing low-cost index funds or ETFs is often the ideal approach for long-term growth. These funds give you diversified exposure to entire markets or sectors, allowing you to benefit from broad economic growth without the need to monitor individual companies closely.

Steps to Start Your Investment Journey

-

Set Your Goals – Don’t begin by thinking about the amount of money you want to invest. Focus on what you are investing for, whether that’s retirement, a rainy day fund, or education.

-

Choose Your Investment Style – Based on your risk tolerance and goals, decide whether an active or passive investment strategy aligns best with your preferences.

-

Research – Do thorough research into the market, funds, or companies you’re interested in. If you’re going the active route, this step is crucial as market conditions change frequently.

-

Seek Professional Guidance – Speak with a wealth manager, like MHG Wealth, who can offer expert advice to help you navigate your investment journey.

-

Choose an Investment Service – Find the right investment service for your needs and begin making your investment choices.

-

Decide on Your Investment Method – Whether you prefer investing a lump sum or contributing monthly, define how you’ll invest and if you plan to cap your contributions at any point.

-

Get Investing – Start putting your plan into action.

-

Track Your Investments – Regularly monitor your investments to assess your rate of return. If you’ve chosen an active strategy, staying on top of the news and market trends is key to knowing when to make changes.

Conclusion

Whether you prefer the dynamism of an active investment strategy or the stability of a passive investment strategy, the key lies in aligning your approach with your financial goals. Both strategies have their merits, and with the right research and planning, either can be successful. Remember to keep track of your investments and stay informed to make the most of your strategy, whether you’re actively managing your portfolio or letting your investments grow steadily over time.

If you would like to learn more about the MHG exclusive investment opportunities or speak with an experienced financial advisor, please contact us at MHG Wealth Management today.